Answered step by step

Verified Expert Solution

Question

1 Approved Answer

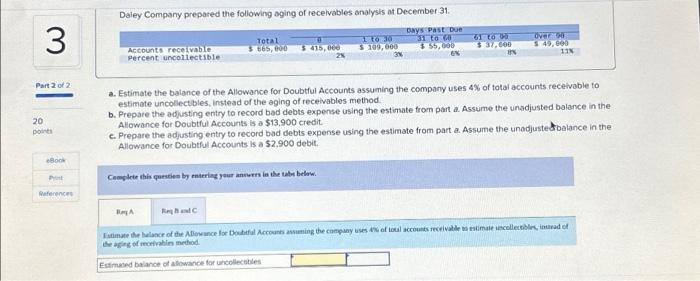

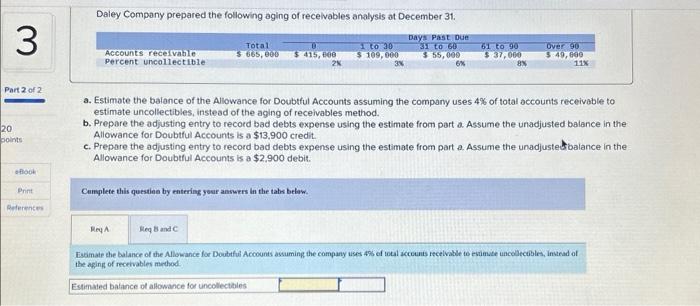

Daley Company prepared the following aging of receivables analysis at December 31. Days Past Due 31 to 60 $ 55,000 Accounts receivable Percent uncollectible Total

Daley Company prepared the following aging of receivables analysis at December 31. Days Past Due 31 to 60 $ 55,000 Accounts receivable Percent uncollectible Total 0 $ 665,000 $ 415,000 Complete this question by entering your answers in the tabs below. Req A 2% Req B and C 1 to 30 $ 109,000 3% 6% a. Estimate the balance of the Allowance for Doubtful Accounts assuming the company uses 4% of total accounts receivable to estimate uncollectibles, instead of the aging of receivables method. Estimated balance of allowance for uncollectibles 61 to 90 $ 37,000 b. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $13,900 credit. 8% c. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $2,900 debit. Over 90 $ 49,000 11% Estimate the balance of the Allowance for Doubtful Accounts assuming the company uses 4% of total accounts receivable to estimate uncollectibles, instead of the aging of receivables method.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started