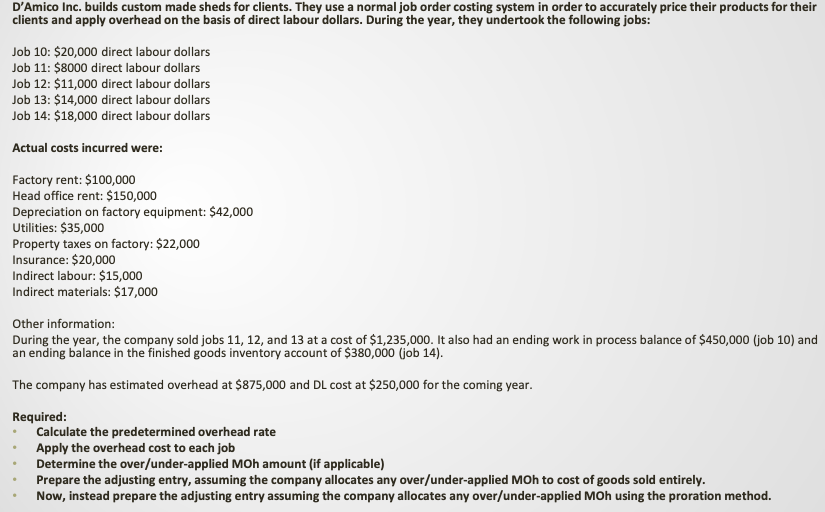

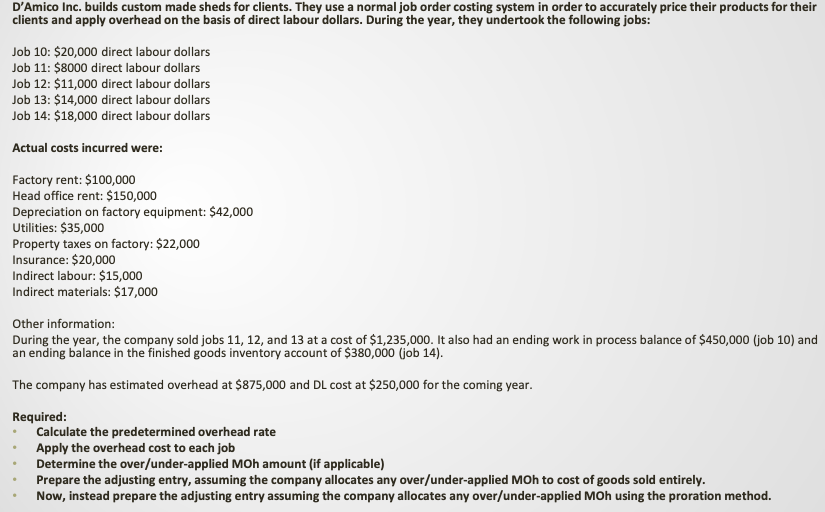

D'Amico Inc. builds custom made sheds for clients. They use a normal job order costing system in order to accurately price their products for their clients and apply overhead on the basis of direct labour dollars. During the year, they undertook the following jobs: Job 10: $20,000 direct labour dollars Job 11: $8000 direct labour dollars Job 12: $11,000 direct labour dollars Job 13: $14,000 direct labour dollars Job 14: $18,000 direct labour dollars Actual costs incurred were: Factory rent: $100,000 Head office rent: $150,000 Depreciation on factory equipment: $42,000 Utilities: $35,000 Property taxes on factory: $22,000 Insurance: $20,000 Indirect labour: $15,000 Indirect materials: $17,000 Other information: During the year, the company sold jobs 11, 12, and 13 at a cost of $1,235,000. It also had an ending work in process balance of $450,000 (job 10) and an ending balance in the finished goods inventory account of $380,000 (job 14). The company has estimated overhead at $875,000 and DL cost at $250,000 for the coming year. Required: Calculate the predetermined overhead rate Apply the overhead cost to each job Determine the over/under-applied MOh amount (if applicable) Prepare the adjusting entry, assuming the company allocates any over/under-applied MOh to cost of goods sold entirely. Now, instead prepare the adjusting entry assuming the company allocates any over/under-applied MOh using the proration method. D'Amico Inc. builds custom made sheds for clients. They use a normal job order costing system in order to accurately price their products for their clients and apply overhead on the basis of direct labour dollars. During the year, they undertook the following jobs: Job 10: $20,000 direct labour dollars Job 11: $8000 direct labour dollars Job 12: $11,000 direct labour dollars Job 13: $14,000 direct labour dollars Job 14: $18,000 direct labour dollars Actual costs incurred were: Factory rent: $100,000 Head office rent: $150,000 Depreciation on factory equipment: $42,000 Utilities: $35,000 Property taxes on factory: $22,000 Insurance: $20,000 Indirect labour: $15,000 Indirect materials: $17,000 Other information: During the year, the company sold jobs 11, 12, and 13 at a cost of $1,235,000. It also had an ending work in process balance of $450,000 (job 10) and an ending balance in the finished goods inventory account of $380,000 (job 14). The company has estimated overhead at $875,000 and DL cost at $250,000 for the coming year. Required: Calculate the predetermined overhead rate Apply the overhead cost to each job Determine the over/under-applied MOh amount (if applicable) Prepare the adjusting entry, assuming the company allocates any over/under-applied MOh to cost of goods sold entirely. Now, instead prepare the adjusting entry assuming the company allocates any over/under-applied MOh using the proration method