Question

Dan Branson is a farmer in Abbotsford, British Columbia. A major part of Dans farm is blueberries. Dan is entrepreneurial and ambitious. He is considering

Dan Branson is a farmer in Abbotsford, British Columbia. A major part of Dans farm is blueberries. Dan is entrepreneurial and ambitious. He is considering opening the processing of blueberries into blueberry jams in an abandoned barn nearby. Dan is an experienced and very passionate farmer but has no finance or even business background. He invited you as a consultant to help him evaluate the project. Below is the data he and you have managed to collect so far. Dan is only planning to do it for 7 years before he retires on Salt Spring Island and starts a quiet life there. The processing equipment would cost $465,000, and after Dan retires can be sold for $100,000. With this new product being launched (Dan named it Merry Berry Blue), some time will be required to gain market share in grocery stores. Sales of the first year are planned to be 15,000 jars, growing 50% with market engagement in year 2 and a further increase of 15% every next year. Dan talked to Choices and Whole Foods, and they indicated the price for a jar they are willing to pay: $16. They also mentioned that due to inflation expectations, they are going to increase their retail prices by 5% per year within the two next years and 3% per year in further years. The retailers are comfortable if Dan increases his prices as well. You and Dan estimated that variable costs will be about 25% of the price. Lucrative business! Also, due to inflation, they are expected to be increasing by 5% per year within the two next years and 3% per year in further years. Dan will hire 2 employees for the first year and then one more employee starting year 2 as production increases. Dan is looking at average salaries in Abbotsford and $45,000/year seems reasonable. Also, you expect that the salaries will need to increase by 5% per year within the two next years and 3% per year in further years due to inflation. The abandoned barn is for rent, and the rent is $2,000/month. As the owner of the barn was very excited to make some money on otherwise hopeless asset, the contract assumes that the rent is not going to be increased for all the 7 years it will be signed for. Dan will need to spend $25,000 on marketing meetings with retailers, promotions, testing campaigns, collaboration with influencers. Also, it is expected that inflation will cause these costs to increase by 5% per year within the two next years and 3% per year in further years. The retailers never pay in advance. Based on the tentative agreements, the accounts receivable by the end of every year will be equal to 45% of the revenue. Dan is going to negotiate with suppliers as well so that the accounts payable are equal to 20% of the costs of goods sold. Dan will need an inventory of jars and some blueberries which is an estimated $9,000 before the FNCE 623 2 start and 15% of revenue during the production years. Accounts receivable, accounts payable and inventory will fully recover in year 8 after the project is finished (AR and AP will be paid, and inventory sold back to the suppliers). You defined that an alternative investment of similar risk would bring Dan a return of 16%. The government supports farmers, and Dans income tax is 13%.

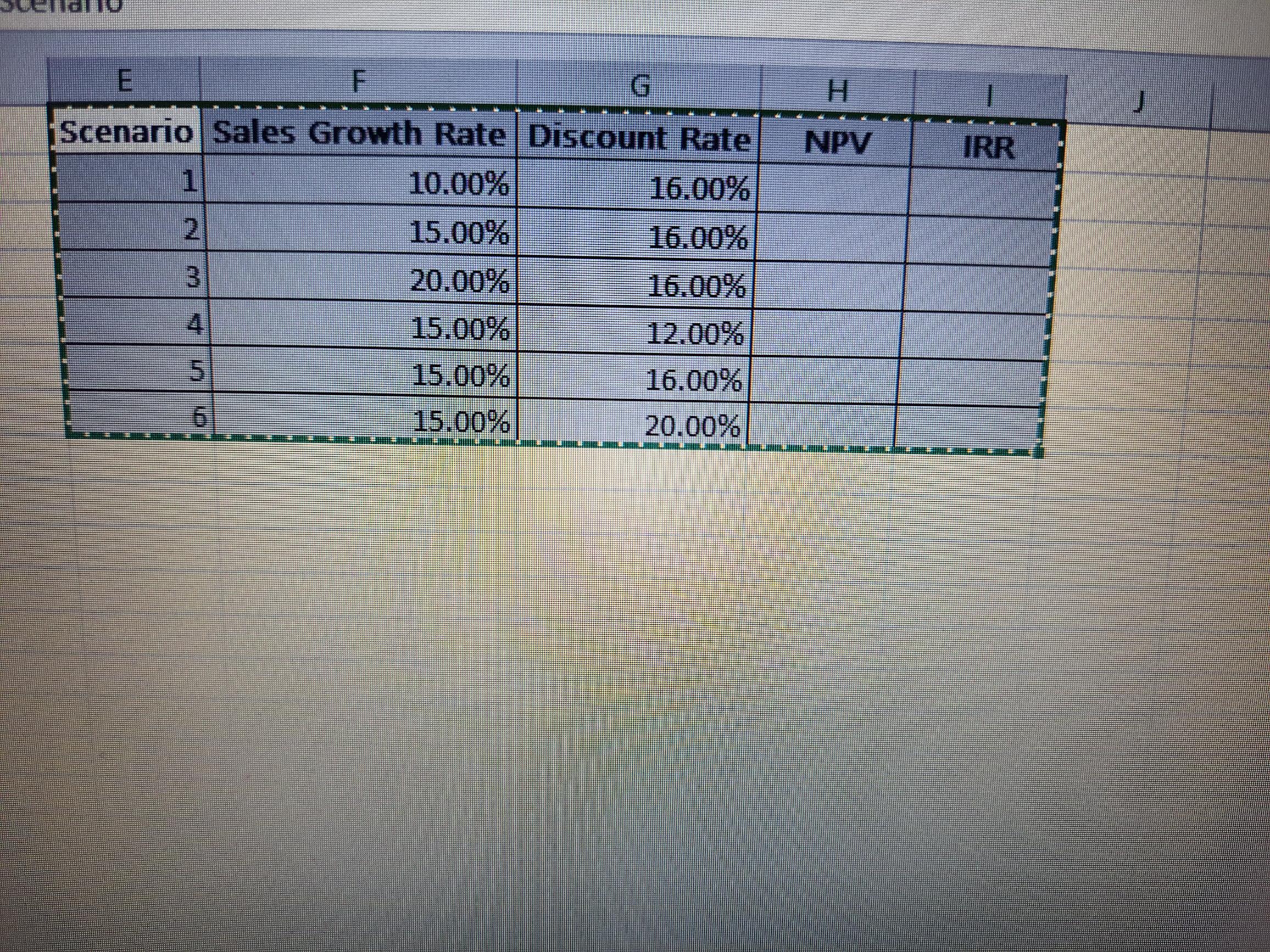

From the above case study and below excel calculate the NPV and the IRR's

\\begin{tabular}{|r|r|r|r|r|} \\hline Ecenario & Sales Growth Rate & Discount Rate & NPV & IRR \\\\ \\hline 1 & \10.00 & \16.00 & & \\\\ \\hline 2 & \15.00 & \16.00 & & \\\\ \\hline 3 & \20.00 & \16.00 & & \\\\ \\hline 4 & \15.00 & \12.00 & & \\\\ \\hline 5 & \15.00 & \16.00 & & \\\\ \\hline 6 & \15.00 & \20.00 & & \\\\ \\hline \\end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started