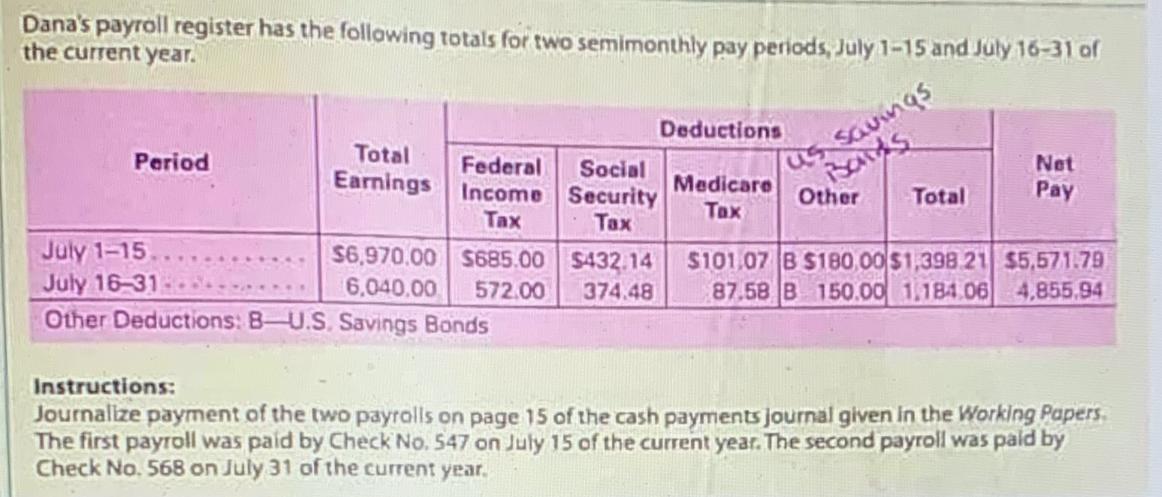

Question: Dana's payroll register has the following totals for two semimonthly pay periods, July 1-15 and July 16-31 of the current year. Period Total Federal

Dana's payroll register has the following totals for two semimonthly pay periods, July 1-15 and July 16-31 of the current year. Period Total Federal Social Earnings Income Security Tax Tax July 1-15 July 16-31 Other Deductions: B-U.S. Savings Bonds $6,970.00 $685.00 $432.14 6,040,00 572.00 374.48 Deductions us savings Bands Other Medicare Tax Total Net Pay $101.07 B $180,00 $1,398.21 $5,571.79 87.58 B 150.00 1.184.06 4,855.94 Instructions: Journalize payment of the two payrolls on page 15 of the cash payments journal given in the Working Papers. The first payroll was paid by Check No. 547 on July 15 of the current year. The second payroll was paid by Check No. 568 on July 31 of the current year.

Step by Step Solution

There are 3 Steps involved in it

To journalize the payment of the two payrolls we need to record the cash payments in the cash paymen... View full answer

Get step-by-step solutions from verified subject matter experts