Answered step by step

Verified Expert Solution

Question

1 Approved Answer

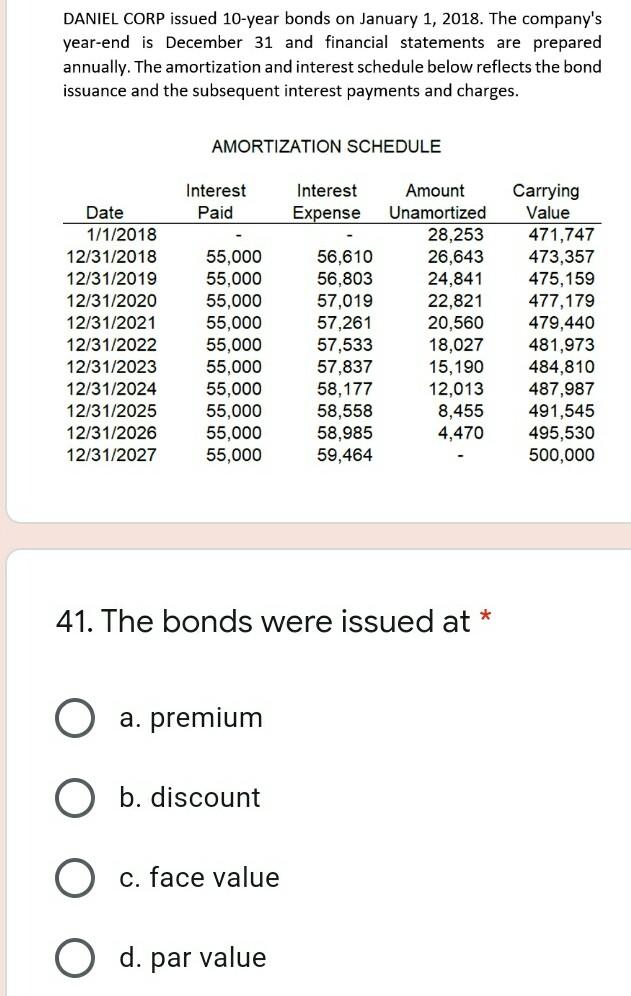

DANIEL CORP issued 10-year bonds on January 1, 2018. The company's year-end is December 31 and financial statements are prepared annually. The amortization and interest

DANIEL CORP issued 10-year bonds on January 1, 2018. The company's year-end is December 31 and financial statements are prepared annually. The amortization and interest schedule below reflects the bond issuance and the subsequent interest payments and charges. AMORTIZATION SCHEDULE Interest Paid Interest Expense Date 1/1/2018 12/31/2018 12/31/2019 12/31/2020 12/31/2021 12/31/2022 12/31/2023 12/31/2024 12/31/2025 12/31/2026 12/31/2027 55,000 55,000 55,000 55,000 55,000 55,000 55,000 55,000 55,000 55,000 56,610 56,803 57,019 57,261 57,533 57,837 58,177 58,558 58,985 59,464 Amount Unamortized 28,253 26,643 24,841 22,821 20,560 18,027 15,190 12,013 8,455 4,470 Carrying Value 471,747 473,357 475,159 477,179 479,440 481,973 484,810 487,987 491,545 495,530 500,000 41. The bonds were issued at * a. premium b. discount O c. face value O d. par value 42. What is the nominal (stated) interest rate of the bonds issued on January 1, 2018? (answer should be in this format, ex. 10% or 10.50%) * Your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started