Answered step by step

Verified Expert Solution

Question

1 Approved Answer

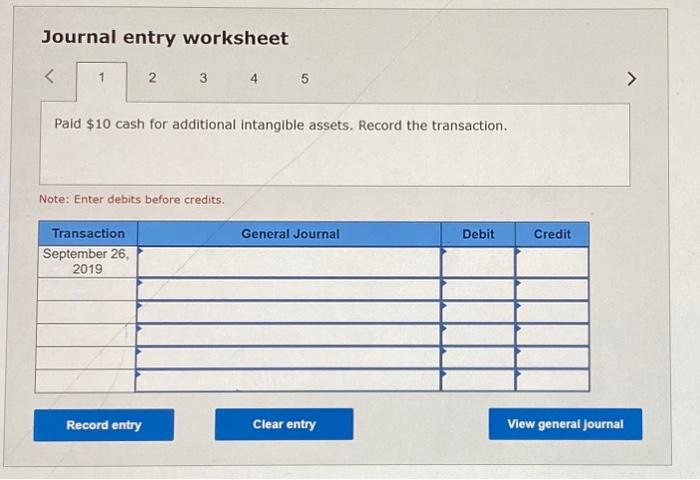

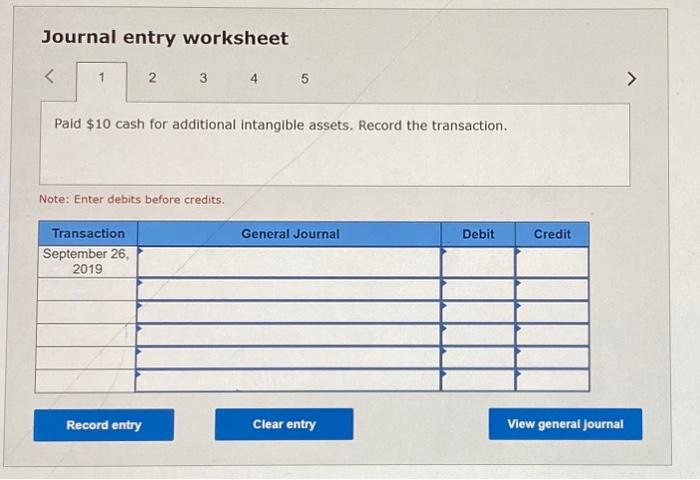

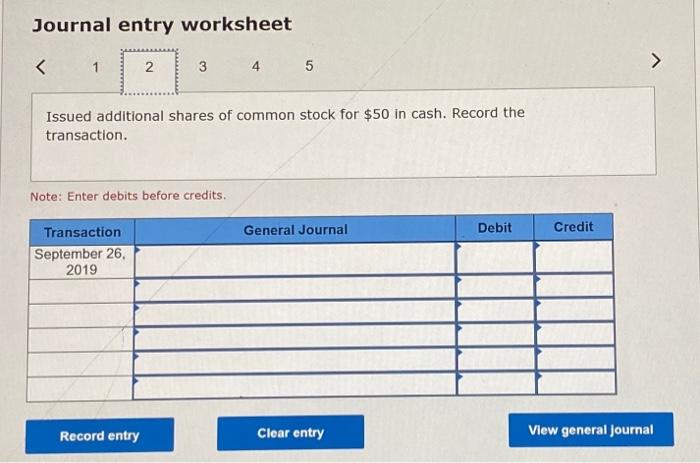

Journal entry worksheet 5 Paid $10 cash for additional intangible assets. Record the transaction. Note: Enter debits before credits. Journal entry worksheet Paid $9 cash

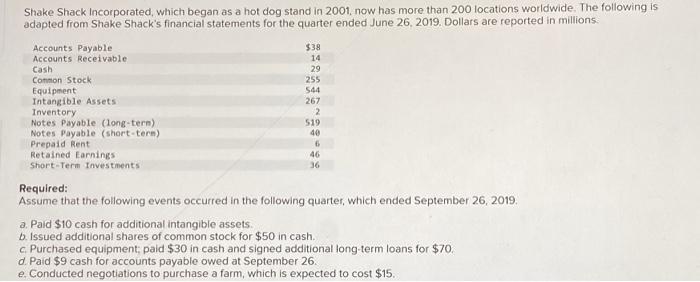

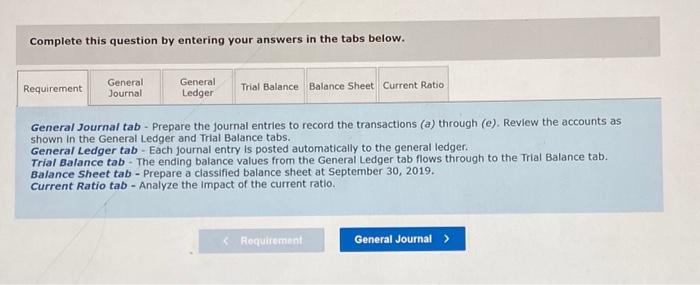

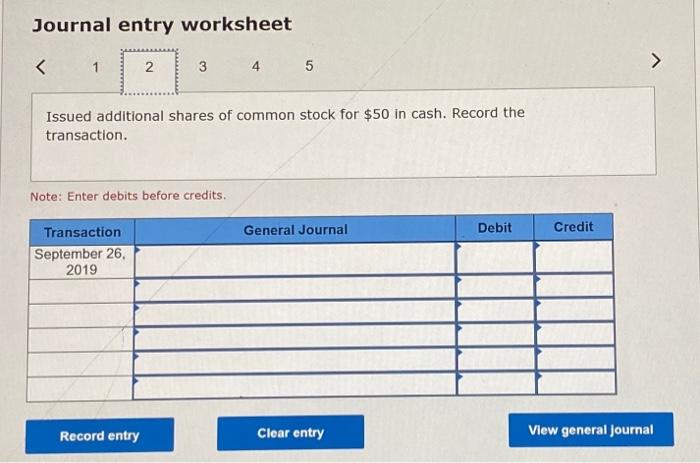

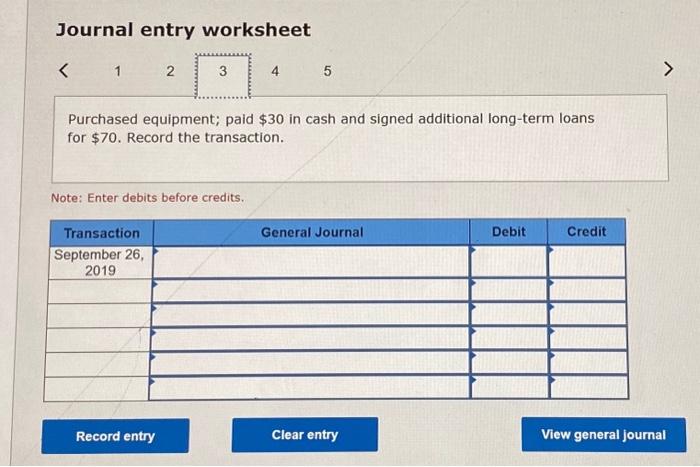

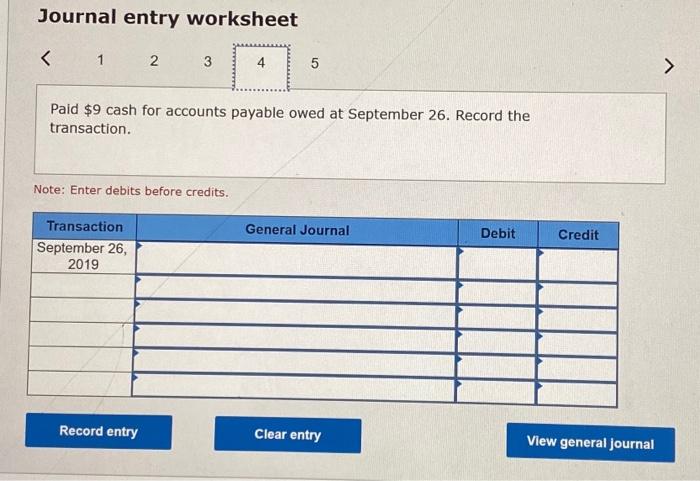

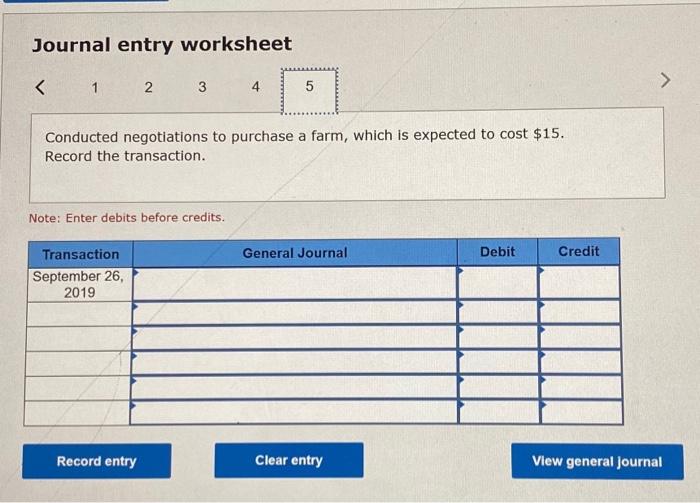

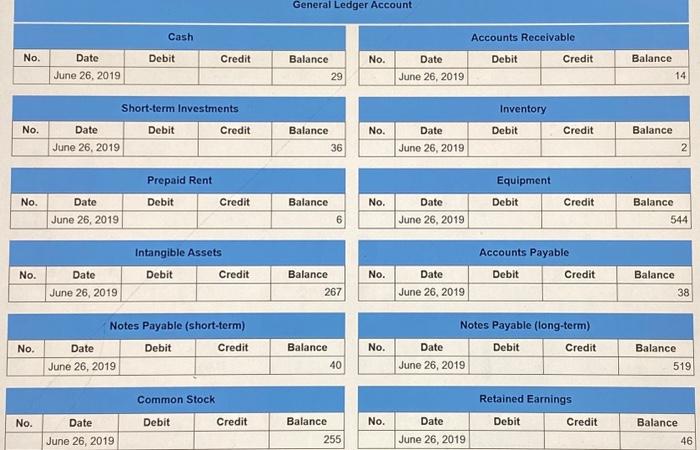

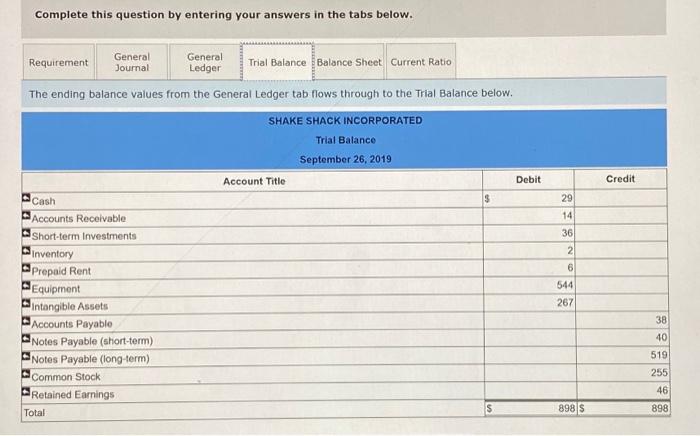

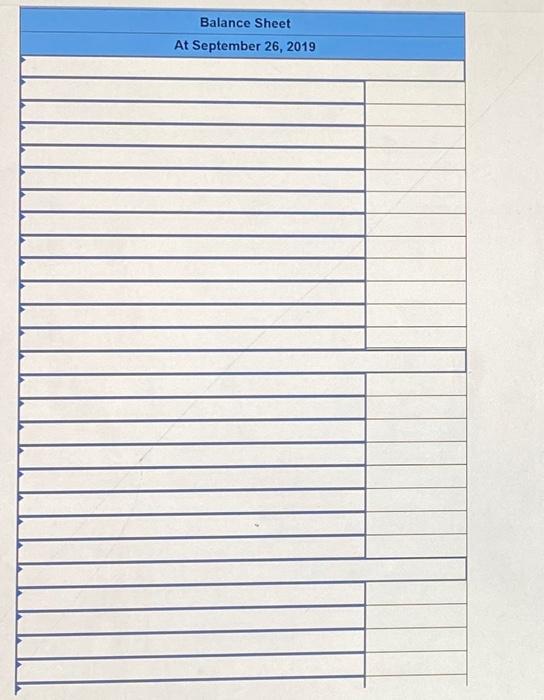

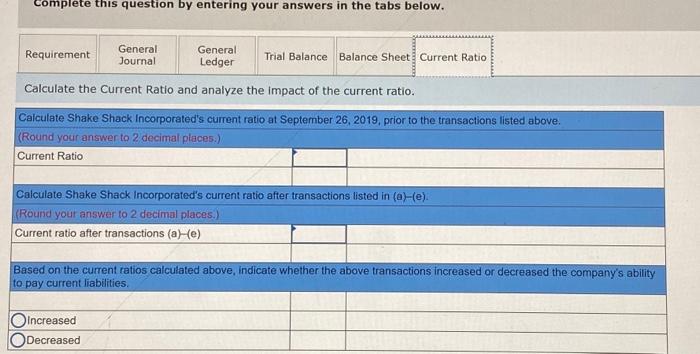

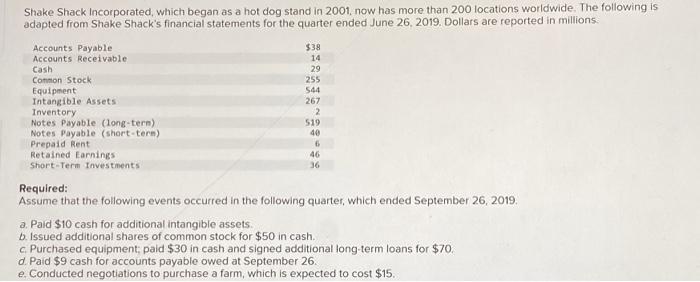

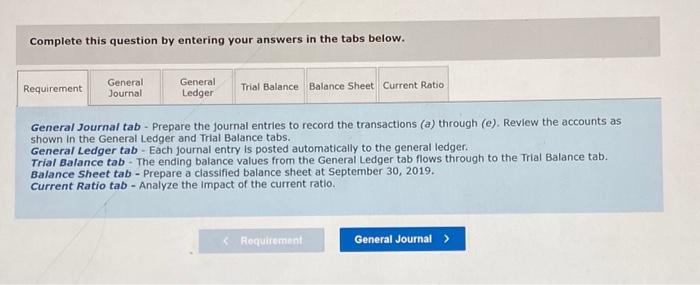

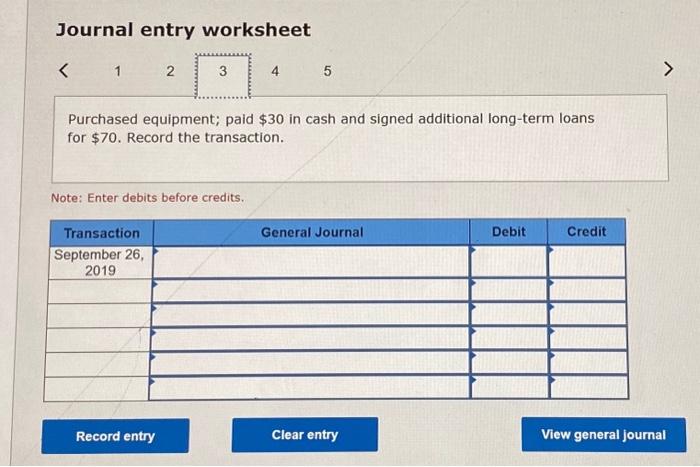

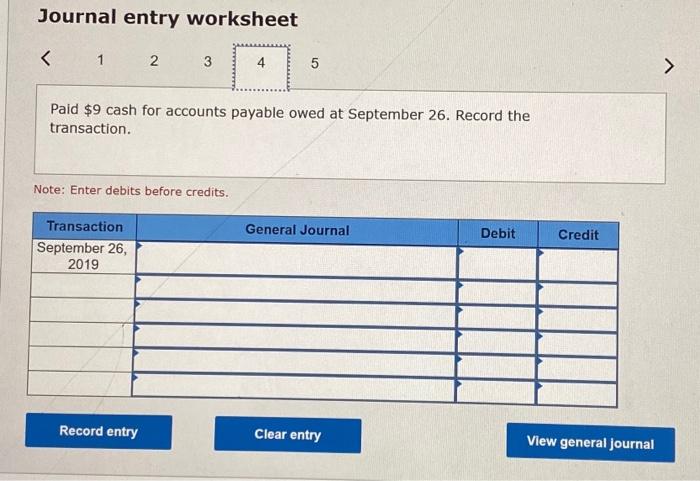

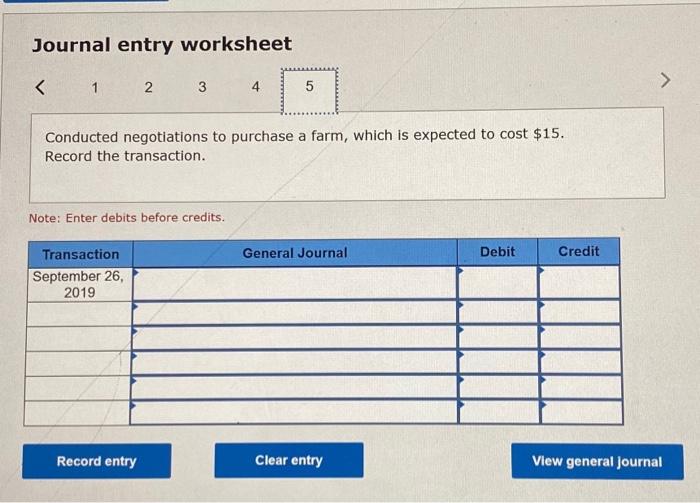

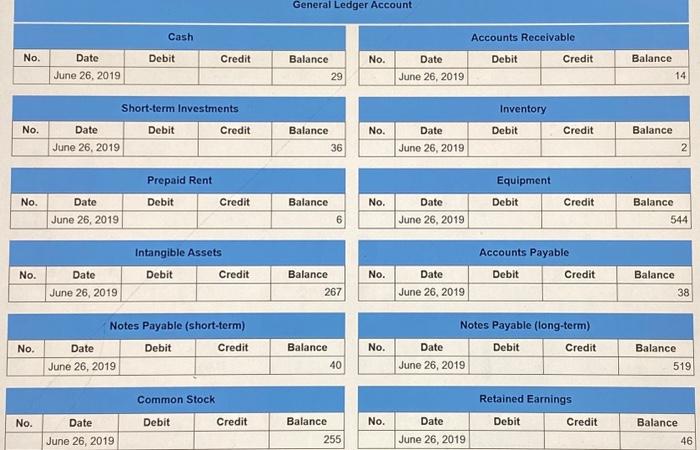

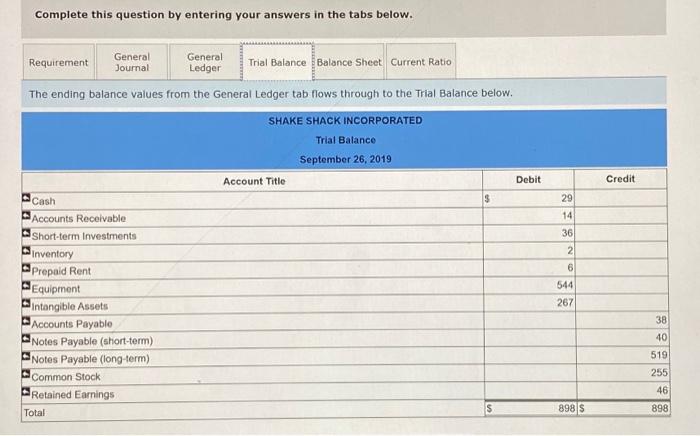

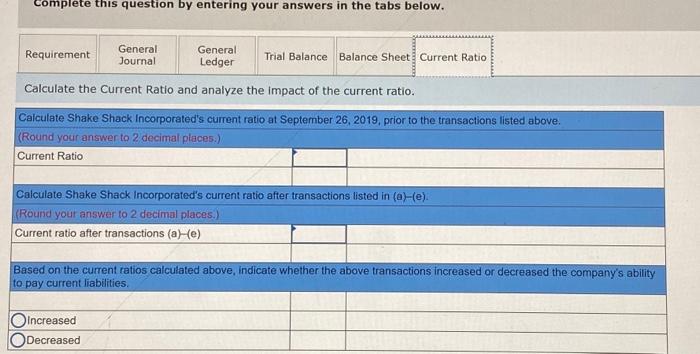

Journal entry worksheet 5 Paid $10 cash for additional intangible assets. Record the transaction. Note: Enter debits before credits. Journal entry worksheet Paid $9 cash for accounts payable owed at September 26 . Record the transaction. Note: Enter debits before credits. Journal entry worksheet Issued additional shares of common stock for $50 in cash. Record the transaction. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. General Journal tab - Prepare the journal entries to record the transactions (a) through (e). Review the accounts as shown in the General Ledger and Trlal Balance tabs. General Ledger tab - Each journal entry is posted automatically to the general ledger. Trial Balance tab - The ending balance values from the General Ledger tab flows through to the Trial Balance tab. Balance Sheet tab - Prepare a classified balance sheet at September 30, 2019. Current Ratio tab - Analyze the impact of the current ratio. Complete this question by entering your answers in the tabs below. The ending balance values from the General Ledger tab flows through to the Trial Balance below. Journal entry worksheet Purchased equipment; paid $30 in cash and signed additional long-term loans for $70. Record the transaction. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Calculate the Current Ratio and analyze the impact of the current ratio. Journal entry worksheet Conducted negotiations to purchase a farm, which is expected to cost $15. Record the transaction. Note: Enter debits before credits. General Ledger Account Balance Sheet At September 26, 2019 Shake Shack Incorporated, which began as a hot dog stand in 2001, now has more than 200 locations worldwide. The following is adapted from Shake Shack's financial statements for the quarter ended June 26, 2019. Dollars are reported in millions. Required: Assume that the following events occurred in the following quarter, which ended September 26, 2019. a. Paid $10 cash for additional intangible assets. b. Issued additional shares of common stock for $50 in cash. c. Purchased equipment; paid $30 in cash and signed additional long-term loans for $70. d. Paid $9 cash for accounts payable owed at September 26 . e. Conducted negotiations to purchase a farm, which is expected to cost $15

Journal entry worksheet 5 Paid $10 cash for additional intangible assets. Record the transaction. Note: Enter debits before credits. Journal entry worksheet Paid $9 cash for accounts payable owed at September 26 . Record the transaction. Note: Enter debits before credits. Journal entry worksheet Issued additional shares of common stock for $50 in cash. Record the transaction. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. General Journal tab - Prepare the journal entries to record the transactions (a) through (e). Review the accounts as shown in the General Ledger and Trlal Balance tabs. General Ledger tab - Each journal entry is posted automatically to the general ledger. Trial Balance tab - The ending balance values from the General Ledger tab flows through to the Trial Balance tab. Balance Sheet tab - Prepare a classified balance sheet at September 30, 2019. Current Ratio tab - Analyze the impact of the current ratio. Complete this question by entering your answers in the tabs below. The ending balance values from the General Ledger tab flows through to the Trial Balance below. Journal entry worksheet Purchased equipment; paid $30 in cash and signed additional long-term loans for $70. Record the transaction. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Calculate the Current Ratio and analyze the impact of the current ratio. Journal entry worksheet Conducted negotiations to purchase a farm, which is expected to cost $15. Record the transaction. Note: Enter debits before credits. General Ledger Account Balance Sheet At September 26, 2019 Shake Shack Incorporated, which began as a hot dog stand in 2001, now has more than 200 locations worldwide. The following is adapted from Shake Shack's financial statements for the quarter ended June 26, 2019. Dollars are reported in millions. Required: Assume that the following events occurred in the following quarter, which ended September 26, 2019. a. Paid $10 cash for additional intangible assets. b. Issued additional shares of common stock for $50 in cash. c. Purchased equipment; paid $30 in cash and signed additional long-term loans for $70. d. Paid $9 cash for accounts payable owed at September 26 . e. Conducted negotiations to purchase a farm, which is expected to cost $15

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started