Answered step by step

Verified Expert Solution

Question

1 Approved Answer

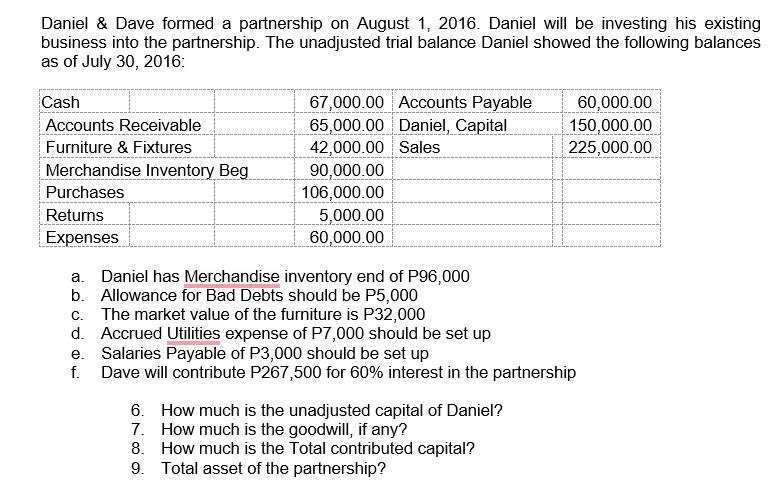

Daniel & Dave formed a partnership on August 1 , 2 0 1 6 . Daniel will be investing his existing business into the partnership.

Daniel & Dave formed a partnership on August Daniel will be investing his existing

business into the partnership. The unadjusted trial balance Daniel showed the following balances

as of July :

a Daniel has Merchandise inventory end of

b Allowance for Bad Debts should be P

c The market value of the furniture is

d Accrued Utilities expense of should be set up

e Salaries Payable of should be set up

f Dave will contribute for interest in the partnership

How much is the unadjusted capital of Daniel?

How much is the goodwill, if any?

How much is the Total contributed capital?

Total asset of the partnership?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started