Question

Daniel has been working as a secondary school teacher for the whole of the 2020 year.He commenced his Masters in Education in February 2019 (online).

Daniel has been working as a secondary school teacher for the whole of the 2020 year.He commenced his Masters in Education in February 2019 (online). His course fees for the 2020 year were $10,500. He obtained a Fee-HELP Loan to pay these fees.

Daniel has been working as a secondary school teacher for the whole of the 2020 year.He commenced his Masters in Education in February 2019 (online). His course fees for the 2020 year were $10,500. He obtained a Fee-HELP Loan to pay these fees.

In addition, he has incurred the following expenses:

Reference Books $ 195

Stationery $ 148

Travel for exams - 150 km total

Study - 10 hours per week x 40 weeks

Internet paid by house mate - $90 per month. 15% study related usage

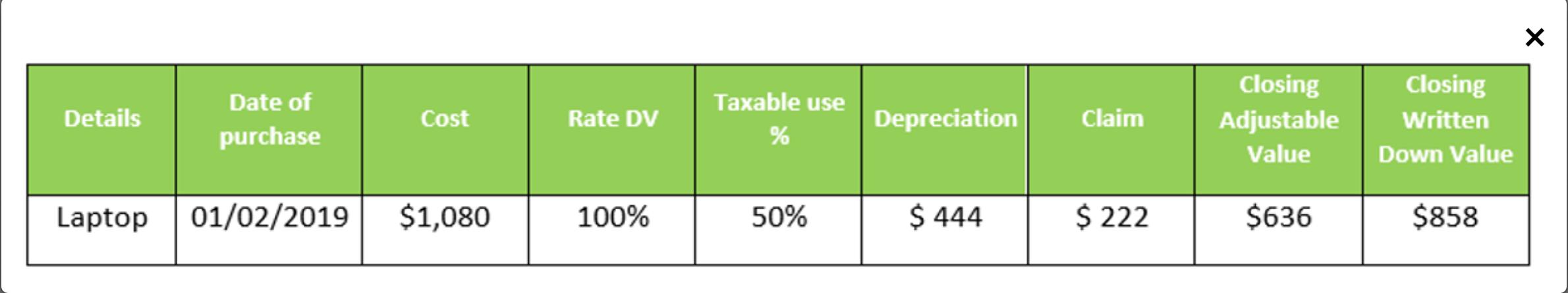

Laptop purchased in previous year used 50% for study. Depreciation schedule for 2019 shown below.

How much can Daniel claim as a deduction at Item D4 in the 2020 year?

$675

$11,175

$823

$11,323

Date of purchase Laptop 01/02/2019 Details Cost $1,080 Rate DV 100% Taxable use % 50% Depreciation $444 Claim $ 222 Closing Adjustable Value $636 Closing Written Down Value $858 X

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Total Help Fees 410500 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started