Answered step by step

Verified Expert Solution

Question

1 Approved Answer

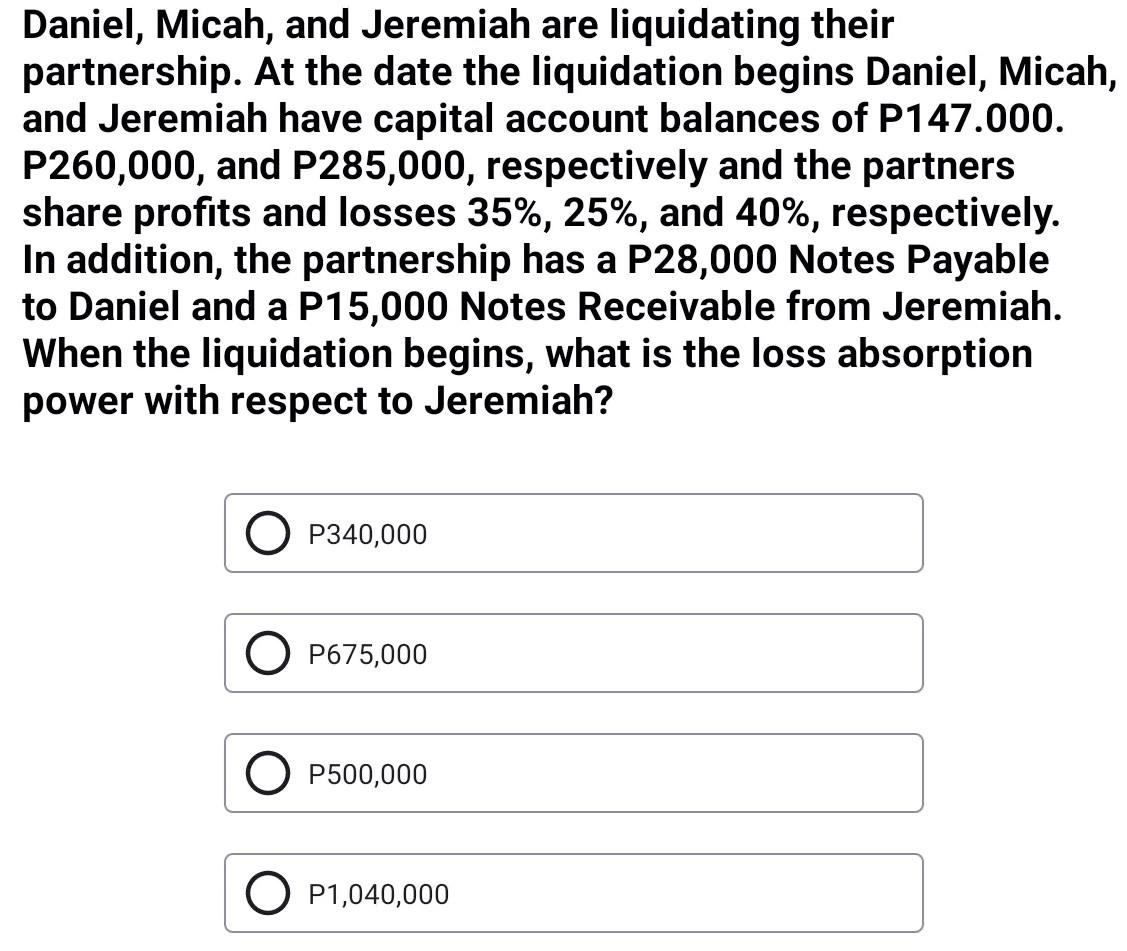

Daniel, Micah, and Jeremiah are liquidating their partnership. At the date the liquidation begins Daniel, Micah, and Jeremiah have capital account balances of P147.000. P260,000,

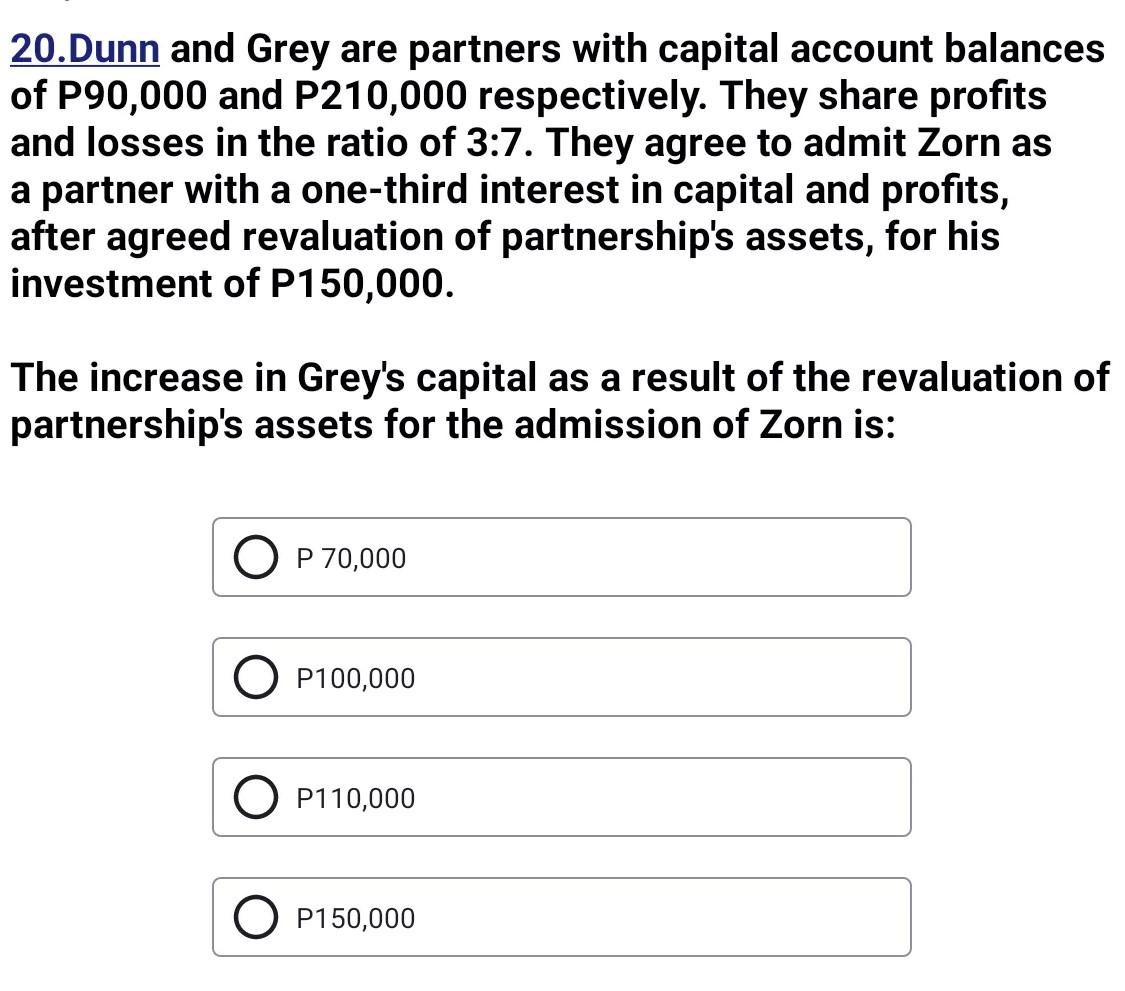

Daniel, Micah, and Jeremiah are liquidating their partnership. At the date the liquidation begins Daniel, Micah, and Jeremiah have capital account balances of P147.000. P260,000, and P285,000, respectively and the partners share profits and losses 35%, 25%, and 40%, respectively. In addition, the partnership has a P28,000 Notes Payable to Daniel and a P15,000 Notes Receivable from Jeremiah. When the liquidation begins, what is the loss absorption power with respect to Jeremiah? P340,000 P675,000 P500,000 O P1,040,000 20.Dunn and Grey are partners with capital account balances of P90,000 and P210,000 respectively. They share profits and losses in the ratio of 3:7. They agree to admit Zorn as a partner with a one-third interest in capital and profits, after agreed revaluation of partnership's assets, for his investment of P150,000. The increase in Grey's capital as a result of the revaluation of partnership's assets for the admission of Zorn is: P 70,000 P100,000 P110,000 O P150,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started