Answered step by step

Verified Expert Solution

Question

1 Approved Answer

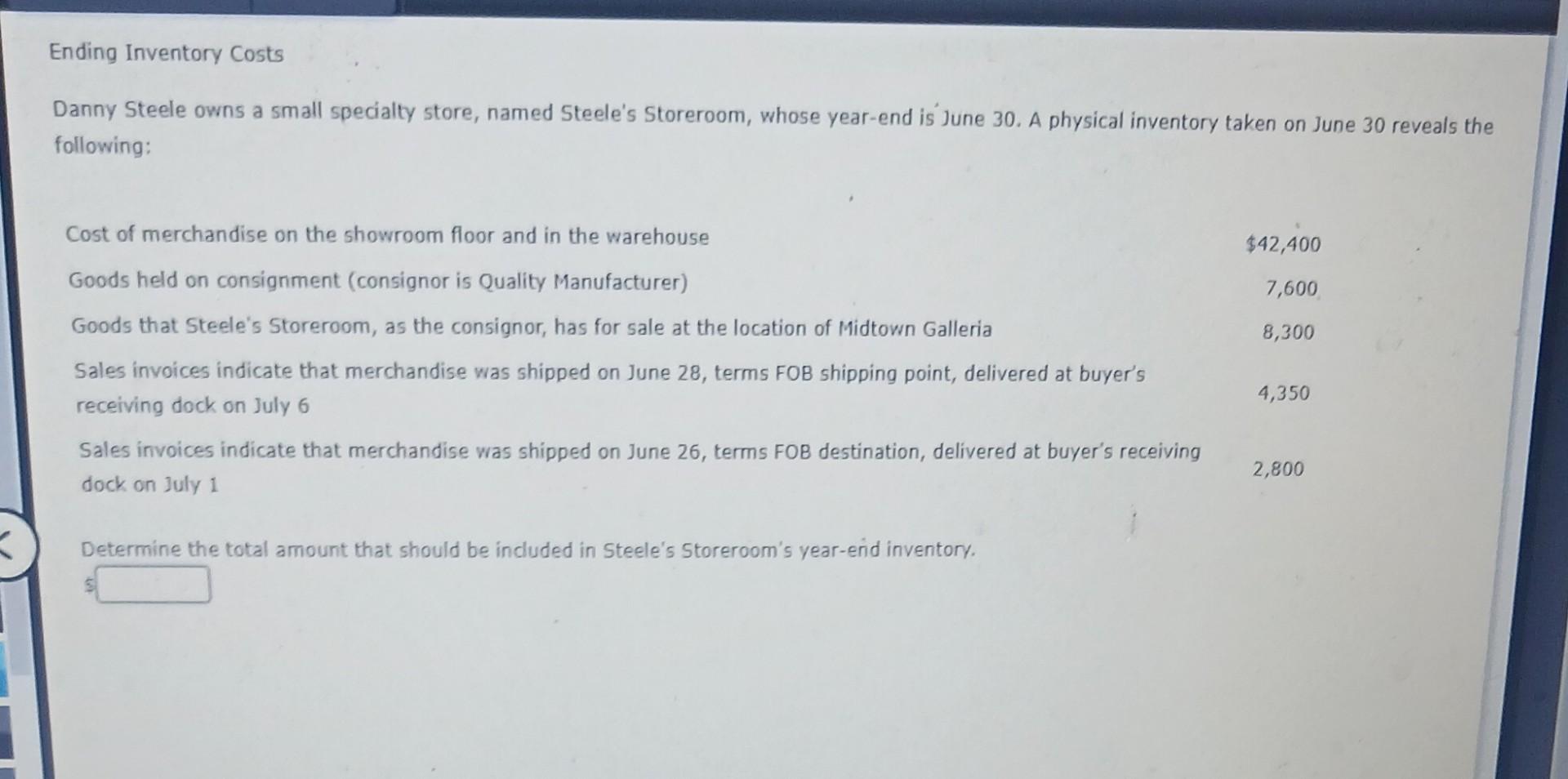

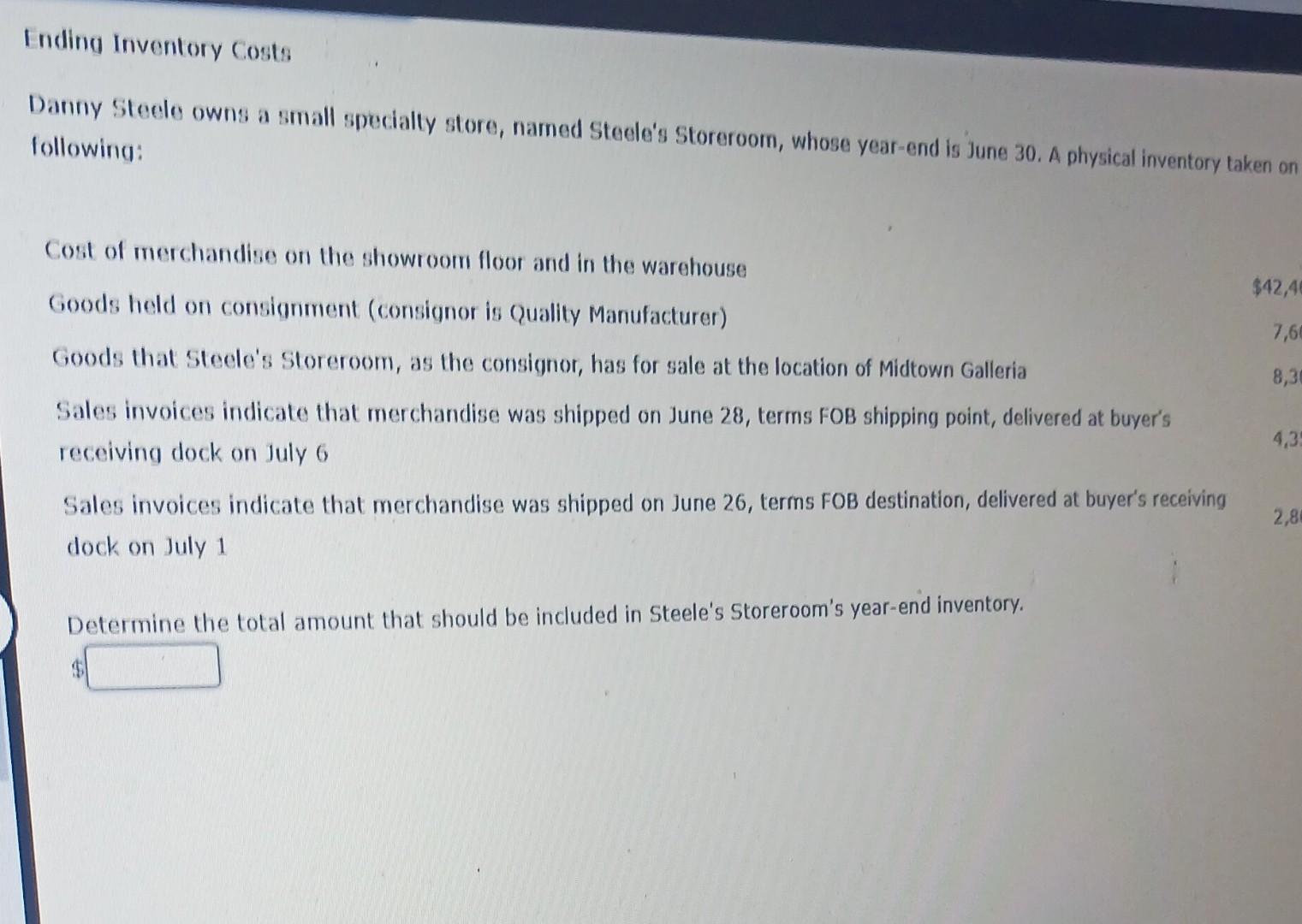

Danny Steele owns a small specialty store, named Steele's Storeroom, whose year-end is June 30 . A physical inventory taken on June 30 reveals the

Danny Steele owns a small specialty store, named Steele's Storeroom, whose year-end is June 30 . A physical inventory taken on June 30 reveals the following: Cost of merchandise on the showroom floor and in the warehouse $42,400 Goods held on consignment (consignor is Quality Manufacturer) 7,600 Goods that Steele's Storeroom, as the consignor, has for sale at the location of Midtown Galleria 8,300 Sales invoices indicate that merchandise was shipped on June 28 , terms FOB shipping point, delivered at buyer's receiving dock on July 6 Sales invoices indicate that merchandise was shipped on June 26, terms FOB destination, delivered at buyer's receiving 2,800 dock on July 1 Determine the total amount that should be induded in Steele's Storeroom's year-enid inventory. Danny Steele owns a small specialty store, named Steele's Storeroom, whose year-end is June 30. A physical inventory taken on following: Cost of merchandise on the showroom floor and in the warehouse Goods held on consignment (consignor is Quality Manufacturer) Goods that Steele's Storeroom, as the consignor, has for sale at the location of Midtown Galleria Sales invoices indicate that merchandise was shipped on June 28, terms FOB shipping point, delivered at buyer's receiving dock on July 6 Sales invoices indicate that merchandise was shipped on June 26, terms FOB destination, delivered at buyer's receiving dock on July 1 Determine the total amount that should be included in Steele's Storeroom's year-end inventory

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started