Answered step by step

Verified Expert Solution

Question

1 Approved Answer

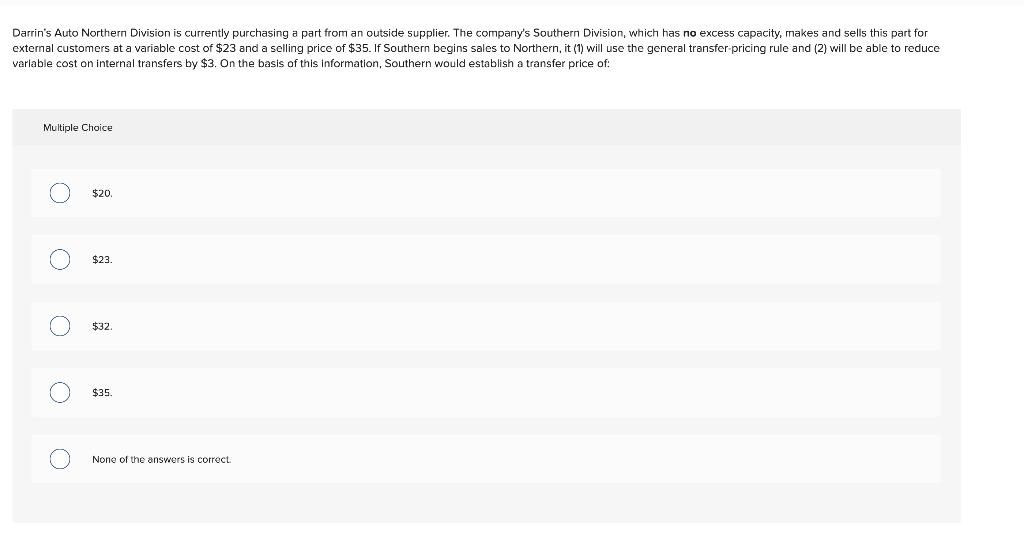

Darrin's Auto Northern Division is currently purchasing a part from an outside supplier. The company's Southern Division, which has no excess capacity, makes and

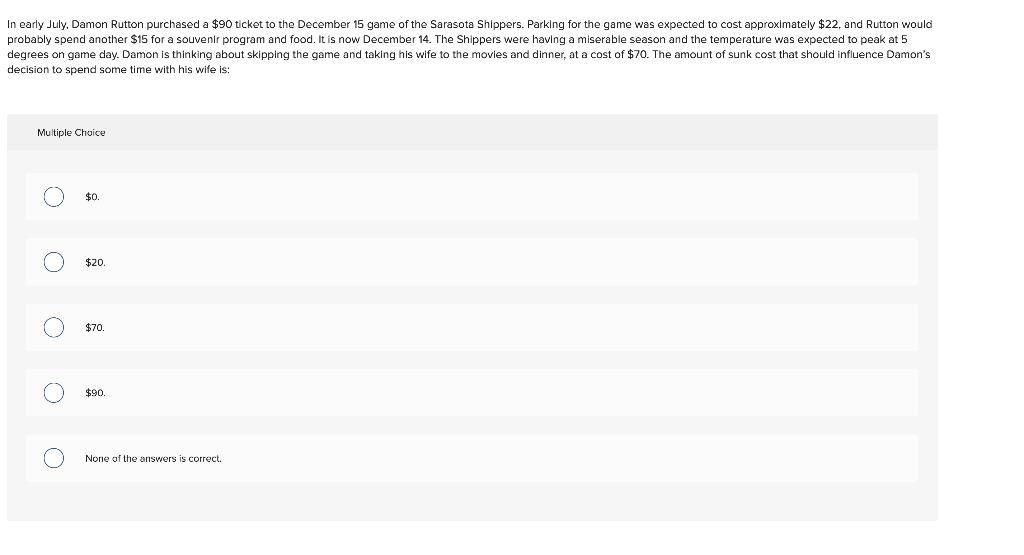

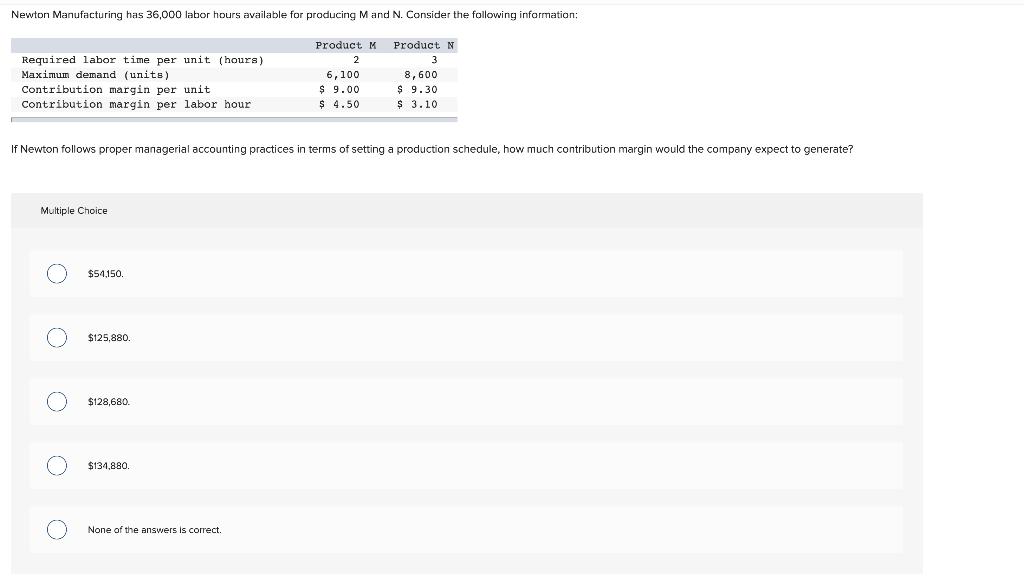

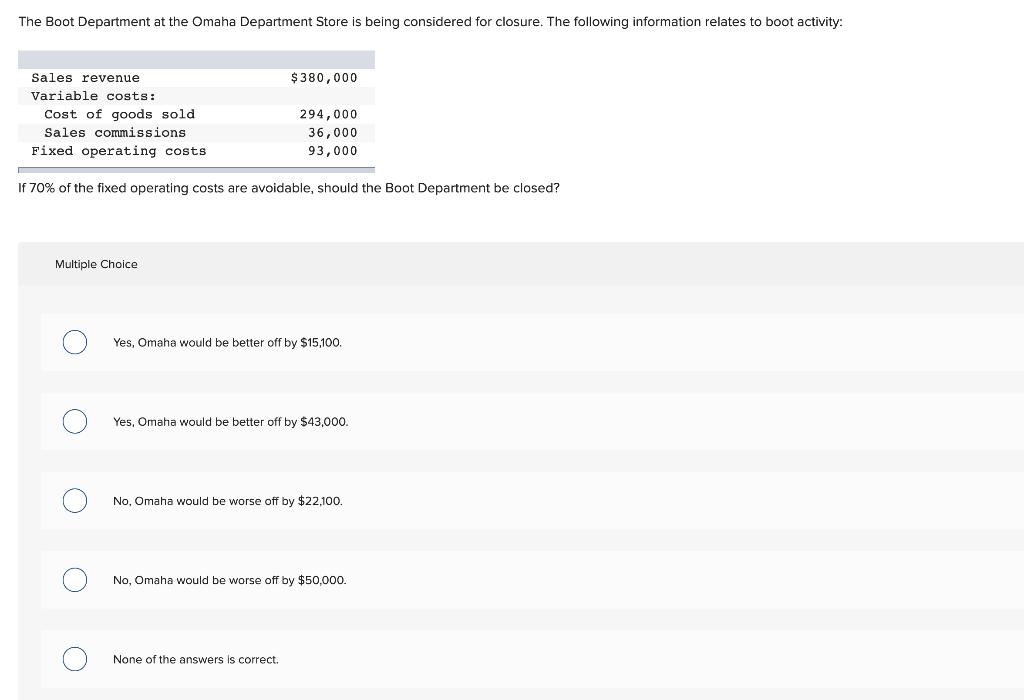

Darrin's Auto Northern Division is currently purchasing a part from an outside supplier. The company's Southern Division, which has no excess capacity, makes and sells this part for external customers at a variable cost of $23 and a selling price of $35. If Southern begins sales to Northern, it (1) will use the general transfer-pricing rule and (2) will be able to reduce varlable cost on internal transfers by $3. On the basis of this information, Southern would establish a transfer price of: Multiple Choice $20. $23. $32. $35 None of the answers is correct. In early July. Damon Rutton purchased a $90 ticket to the December 15 game of the Sarasota Shippers. Parking for the game was expected to cost approximately $22, and Rutton would probably spend another $15 for a souvenir program and food. It is now December 14. The Shippers were having a miserable season and the temperature was expected to peak at 5 degrees on game day. Damon is thinking about skipping the game and taking his wife to the movies and dinner, at a cost of $70. The amount of sunk cost that should influence Damon's decision spend some time with his wife is: Multiple Choice $0. $20. $70. $90. None of the answers is correct. Newton Manufacturing has 36,000 labor hours available for producing M and N. Consider the following information: Product M Product N Required labor time per unit (hours) Maximum demand (units) Contribution margin per unit 2 3 6,100 $ 9.00 $ 4.50 8,600 $ 9.30 $ 3.10 Contribution margin per labor hour If Newton follows proper managerial accounting practices in terms of setting a production schedule, how much contribution margin would the company expect to generate? Multiple Choice $54,150. $125,880. $128,680. $134,880. None of the answers is correct. The Boot Department at the Omaha Department Store is being considered for closure. The following information relates to boot activity: Sales revenue $380,000 Variable costs: Cost of goods sold 294,000 Sales commissions 36,000 Fixed operating costs 93,000 If 70% of the fixed operating costs are avoidable, should the Boot Department be closed? Multiple Choice Yes, Omaha would be better off by $15,100. Yes, Omaha would be better off by $43,00. No, Omaha would be worse off by $22,100. No, Omaha would be worse off by $50,000. None of the answers is correct.

Step by Step Solution

★★★★★

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Solution 1 The correct answer is 32 Explanation Selling price variable cost 353 32 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started