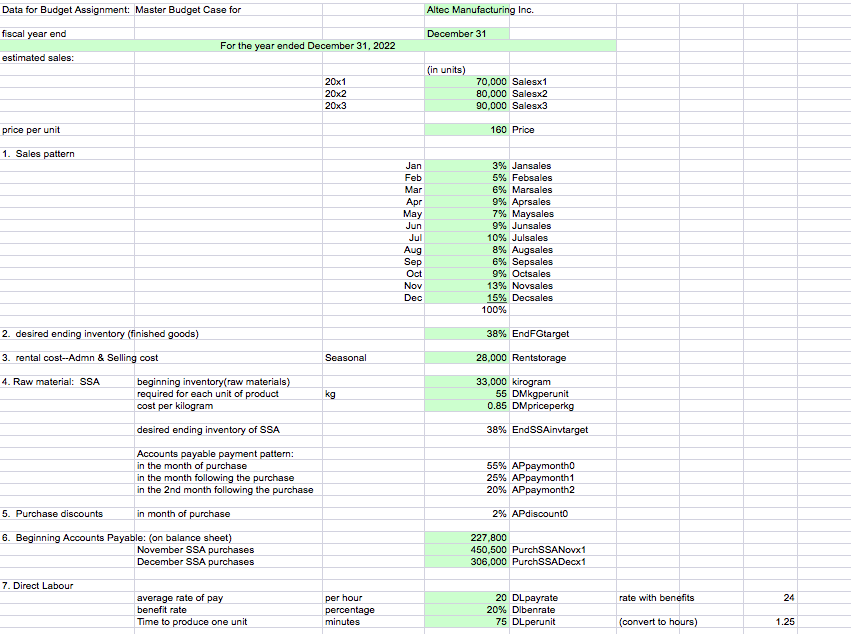

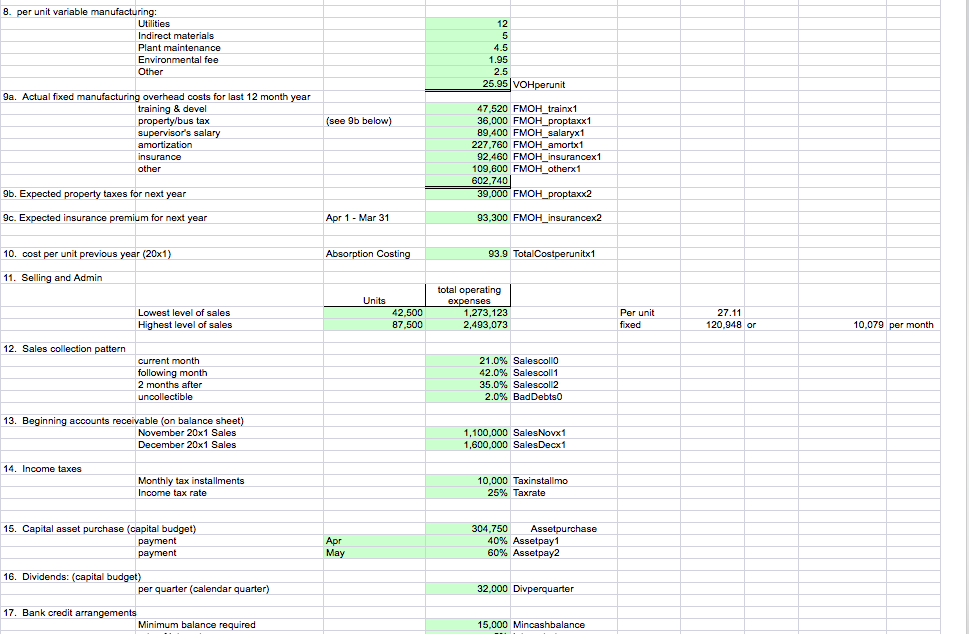

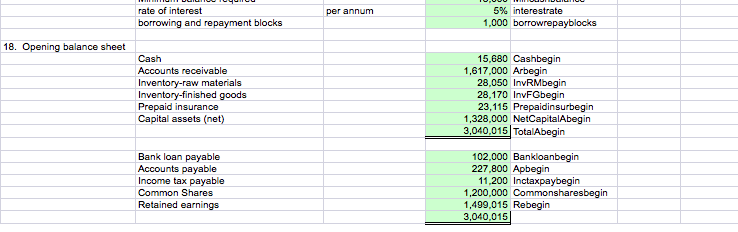

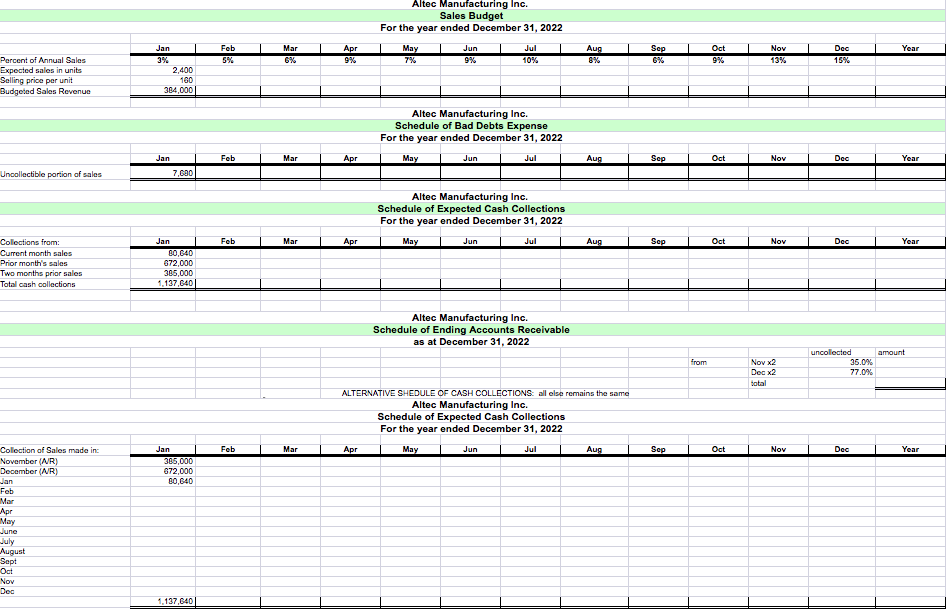

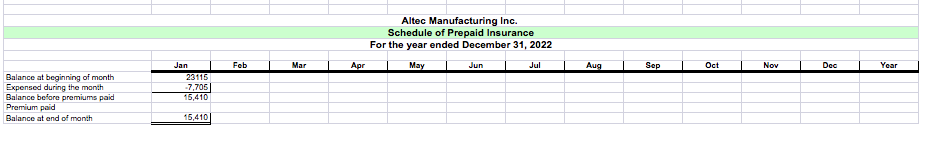

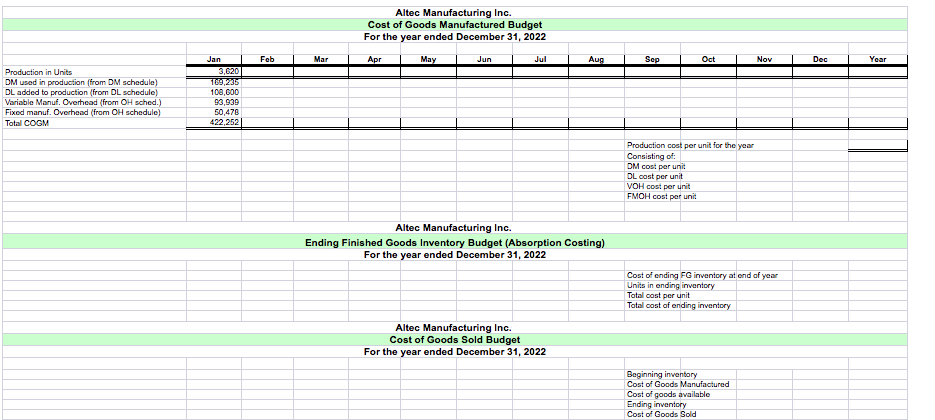

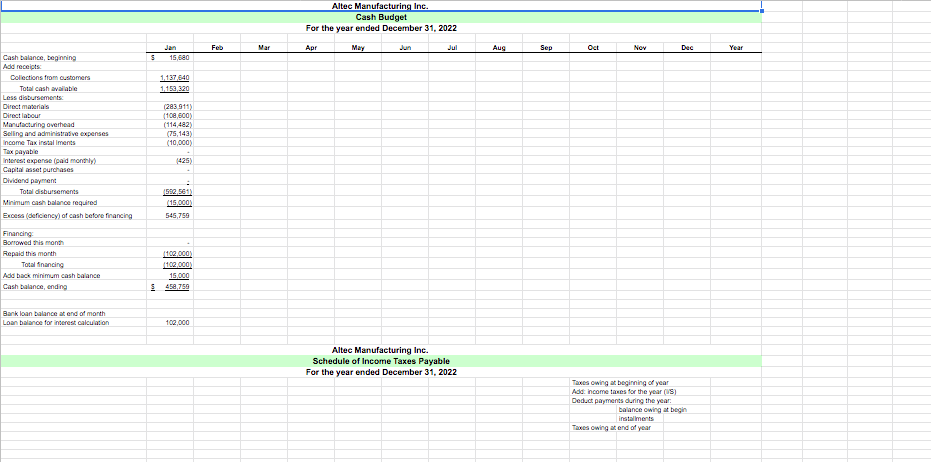

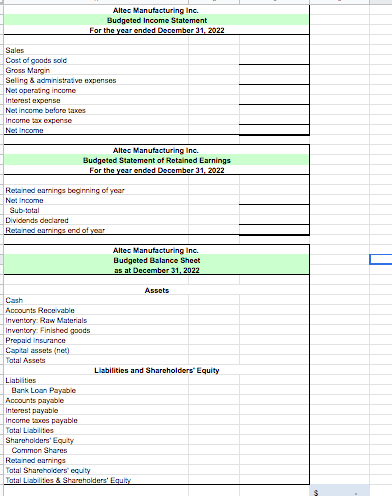

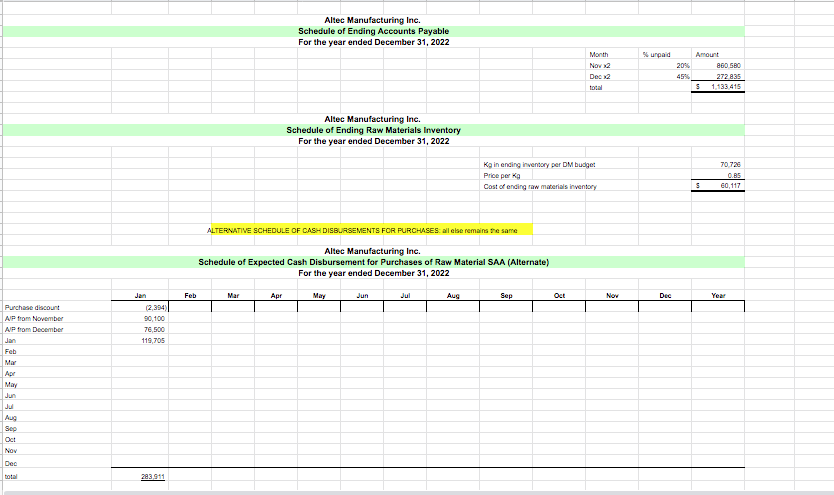

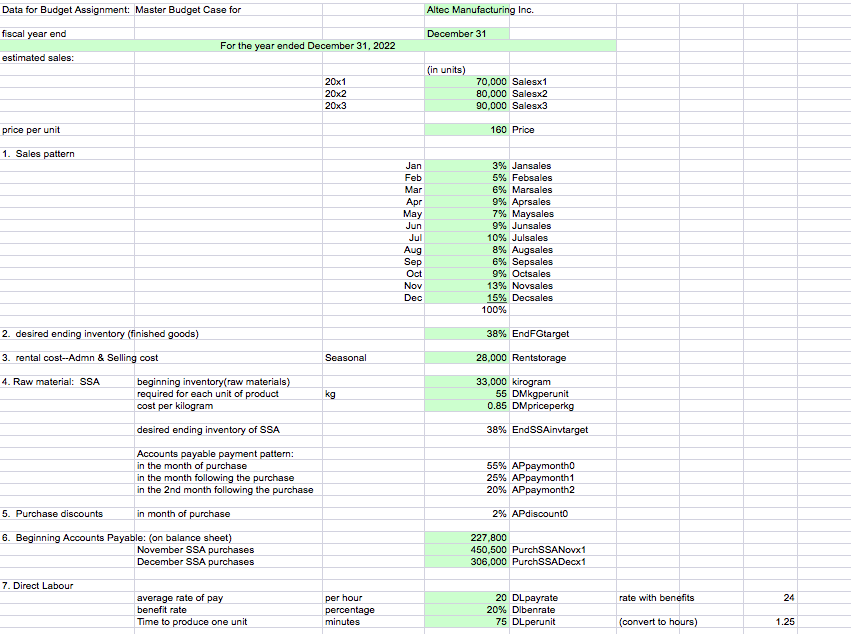

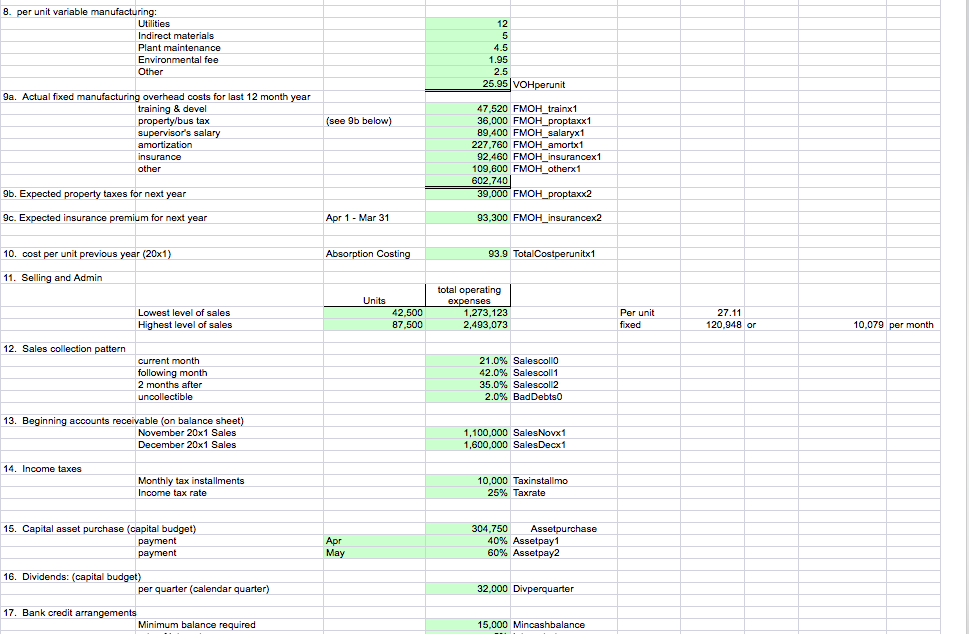

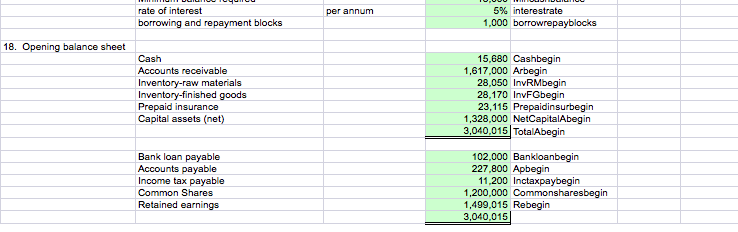

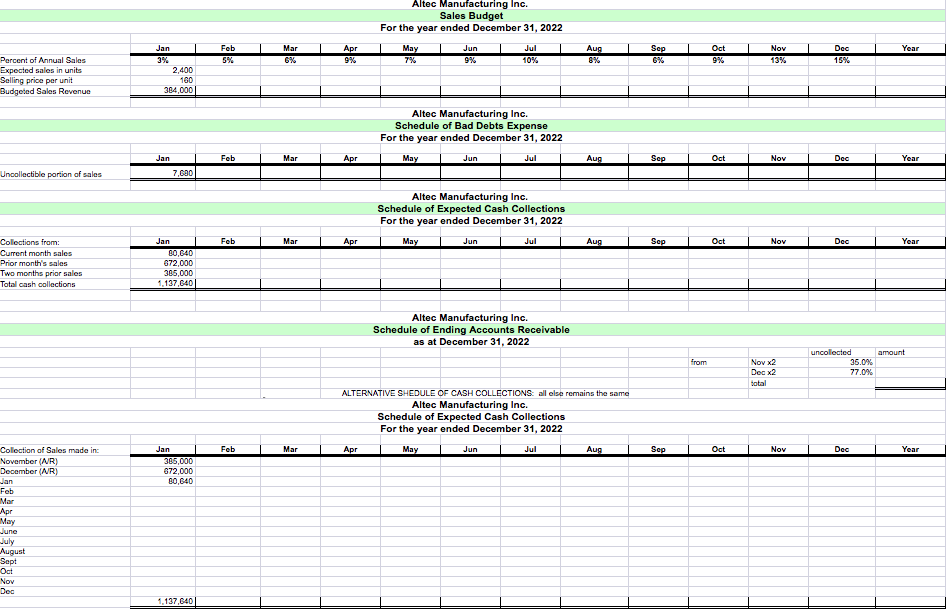

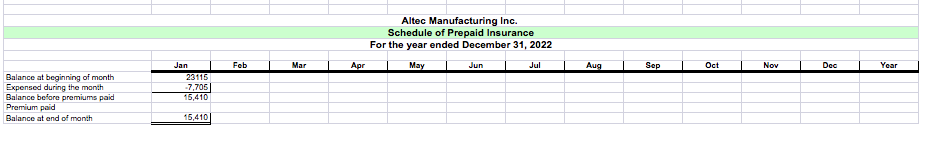

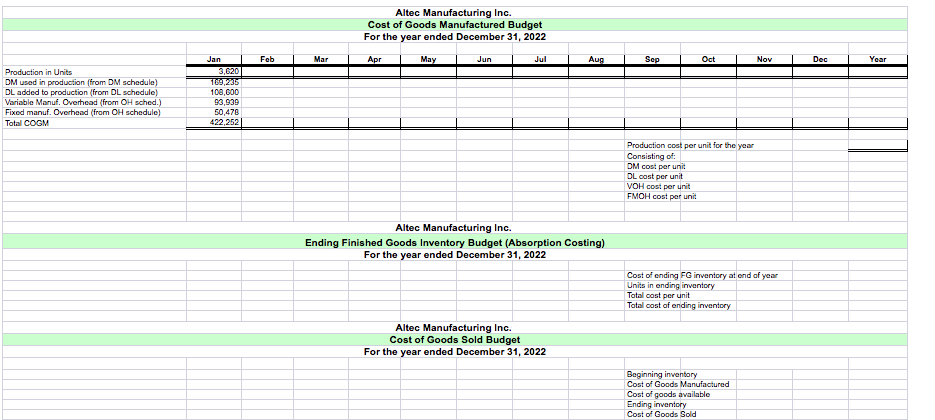

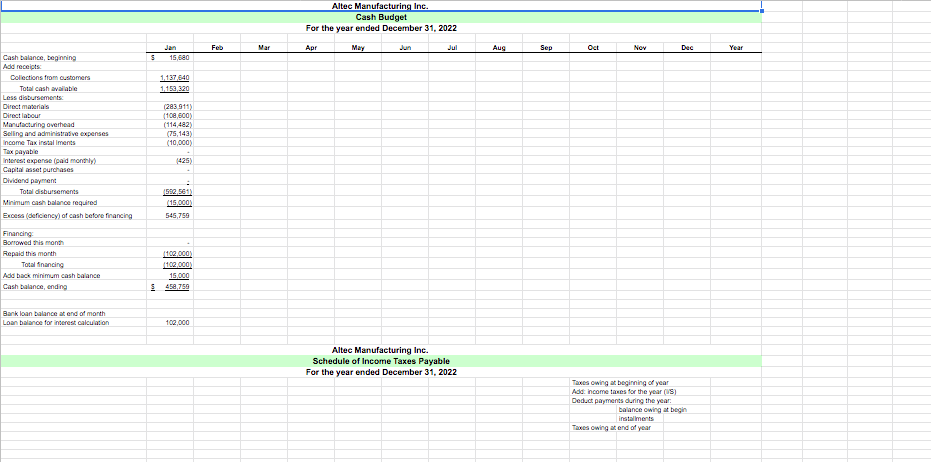

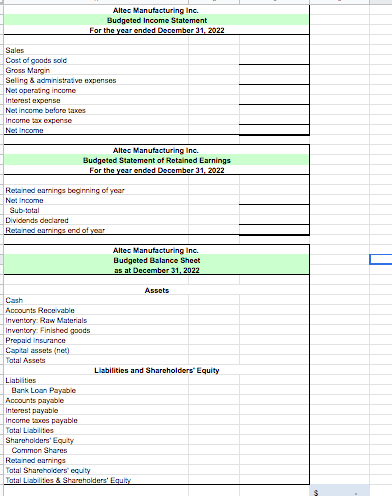

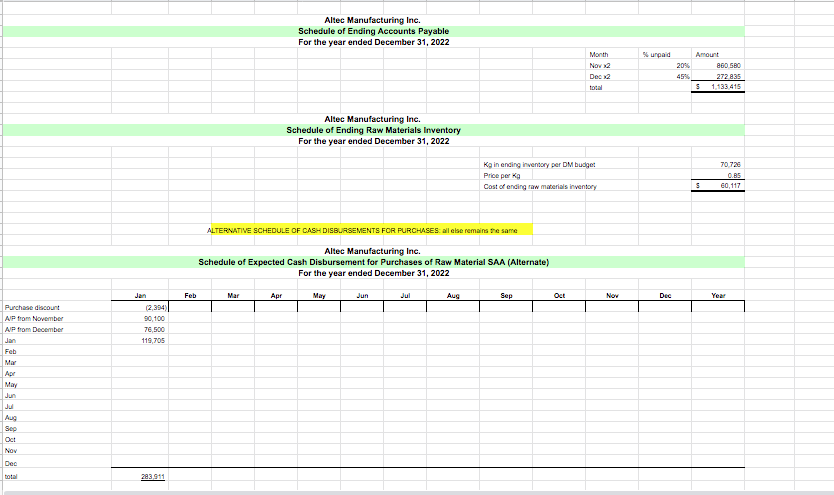

Data for Budget Assignment: Master Budget Case for Altec Manufacturing Inc. fiscal year end December 31 For the year ended December 31, 2022 estimated sales: (in units) 20x1 20x2 20x3 70,000 Salesx1 80.000 Salesx2 90,000 Salesx3 price per unit 160 Price 1. Sales pattern Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 3% Jansales 5% Febsales 6% Marsales 9% Aprsales 7% Maysales 9% Junsales 10% Julsales 8% Augsales 6% Sepsales 9% Octsales 13% Novsales 15% Decsales 100% 2. desired ending inventory (finished goods) 38% EndFGtarget 3. rental cost--Admn & Selling cost Seasonal 28,000 Rentstorage 4. Raw material: SSA kg beginning inventory(raw materials) required for each unit of product cost per kilogram desired ending inventory of SSA 33,000 kirogram 55 DMkgperunit 0.85 DMpriceperkg 38% End SSAinvtarget Accounts payable payment pattern: in the month of purchase in the month following the purchase in the 2nd month following the purchase in month of purchase 55% APpaymontho 25% APpaymonth1 20% APpaymonth2 5. Purchase discounts 2% APdiscount 6. Beginning Accounts Payable: (on balance sheet) November SSA purchases December SSA purchases 227,800 450,500 PurchSSANovx1 306,000 PurchSSADecx1 7. Direct Labour rate with benefits 24 average rate of pay benefit rate Time to produce one unit per hour percentage minutes 20 DL payrate 20% Dibenrate 75 DL perunit (convert to hours) 1.25 8. per unit variable manufacturing: Utilities Indirect materials Plant maintenance Environmental fee Other 12 5 4.5 1.95 2.5 25.95 VOHperunit (see 9b below) 9a. Actual fixed manufacturing overhead costs for last 12 month year training & devel property/bus tax supervisor's salary amortization insurance other 47,520 FMOH_trainx1 36,000 FMOH_proptaxx1 89.400 FMOH_salaryx1 227,760 FMOH_amortx1 92,460 FMOH_insurancex1 109,600 FMOH_otherx1 602.740 39,000 FMOH_proptaxx2 9b. Expected property taxes for next year 9c. Expected insurance premium for next year Apr 1 - Mar 31 93,300 FMOH_insurancex2 10. cost per unit previous year (20x1) Absorption Costing 93.9 TotalCostperunitx 1 11. Selling and Admin Units Lowest level of sales Highest level of sales 42,500 87.500 total operating expenses 1,273,123 2,493,073 Per unit fixed 27.11 120.948 or 10,079 per month 12. Sales collection pattern current month following month 2 months after uncollectible 21.0% Salescollo 42.0% Salescoll1 35.0% Salescoll2 2.0% Bad Debtso 13. Beginning accounts receivable (on balance sheet) November 20x1 Sales December 20x1 Sales 1,100,000 Sales Novx 1 1,600,000 Sales Decx1 14. Income taxes Monthly tax installments Income tax rate 10,000 Taxinstallmo 25% Taxrate 15. Capital asset purchase (capital budget) payment payment Apr May 304,750 Assetpurchase 40% Assetpay1 60% Assetpay2 16. Dividends: (capital budget) per quarter (calendar quarter) 32,000 Divperquarter 17. Bank credit arrangements Minimum balance required 15,000 Mincashbalance per annum rate of interest borrowing and repayment blocks 5% interestrate 1,000 borrowrepayblocks 18. Opening balance sheet Cash Accounts receivable Inventory-raw materials Inventory-finished goods Prepaid insurance Capital assets (net) 15,680 Cashbegin 1,617.000 Arbegin 28,050 InvRMbegin 28,170 InvFGbegin 23,115 Prepaidinsurbegin 1,328,000 NetCapitalAbegin 3,040,015 TotalAbegin Bank loan payable Accounts payable Income tax payable Common Shares Retained earnings 102,000 Bankloanbegin 227,800 Apbegin 11,200 Inctaxpaybegin 1,200,000 Commonsharesbegin 1,499,015 Rebegin 3,040,015 Altec Manufacturing Inc. Sales Budget For the year ended December 31, 2022 Jan Mar Jun Jul Aug Sep Oct Apr 9% Year Feb 5% May 7% Noy 13% Dec 15% 9% 10% Percent of Annual Sales Expected sales in units Selling price per unit Budgeted Sales Revenue 2,400 160 384,000 Altec Manufacturing Inc. Schedule of Bad Debts Expense For the year ended December 31, 2022 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Noy Dec Year Uncollectible portion of sales 7.690 Altec Manufacturing Inc. Schedule of Expected Cash Collections For the year ended December 31, 2022 Feb Mar Apr May Jun Aug Sep Oct Nov Dec Year Collections from: Current month sales Prior month's sales Two months prior sales Total cash collections Jan 80,640 672,000 385,000 1.137.640 Altec Manufacturing Inc. Schedule of Ending Accounts Receivable as at December 31, 2022 amount from Nov x2 Dec x2 total uncollected 35.0% 77.0% ALTERNATIVE SHEDULE OF CASH COLLECTIONS: all else remains the same Altec Manufacturing Inc. Schedule of Expected Cash Collections For the year ended December 31, 2022 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Year Collection of Sales made inc November (NR) December (NR) Jan 385,000 672,000 80,640 Feb Mar Apr May June July August Sept Oct Nov Dec 1.137,640 Altec Manufacturing Inc. Schedule of Prepaid Insurance For the year ended December 31, 2022 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Year Balance at beginning of month Expensed during the month Balance before premiums paid Premium paid Balance at and of month Jan 23115 -7.705 15,410 15,410 Altec Manufacturing Inc. Cost of Goods Manufactured Budget For the year ended December 31, 2022 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Year Production in Units DM used in production (from DM schedule) DL added to production (from DL schedule) Variable Manuf. Overhead (from OH sched.) Fixed manuf. Overhead (from OH schedule) Total COGM Jan 3.620 T80.235 108,600 93,039 50.476 422,252 Production cost per unit for the year Consisting of: DM cost per unit DL cost per unit VOH cost per unit FMOH cost per unit Altec Manufacturing Inc. Ending Finished Goods Inventory Budget (Absorption Costing) For the year ended December 31, 2022 Cost of ending FG inventory at end of year Units in ending inventory Total cost per unit Total cost of ending inventory Altec Manufacturing Inc. Cost of Goods Sold Budget For the year ended December 31, 2022 Beginning inventory Cost of Goods Manufactured Cost of goods available Ending inventory Cost of Goods Sold Altec Manufacturing Inc. Cash Budget For the year ended December 31, 2022 Feb Mar Apr May Jul Aug Sep Oct Ney Dec Year 15,600 1,137 640 1.159,320 Cash balance beginning Addrocolos Collections from somers Total cash available Less disbursements: Direct materials Direct labour Manufacturing overhead Selling and administrative expenses Income Tax in aliments Tax payable Interest expense paid monthly Capital asset purchases Dividend payment Total disbursements Minimum cash balance required Excesa (deficiency of cash before financing (283 911) 1100,600) (114,482) (75,143) (10,000) 59050 (15.000! 546,750 Financing Borrowed is month Repaid this month Total financing Add back minimum cash balance Cash balance, ending 110.000 112 000 15,000 459,759 S. Bank loan balance at end of month Loan balance for interest calculation 102,000 Altec Manufacturing Inc. Schedule of Income Taxes Payable For the year ended December 31, 2022 Taxes owing at beginning of year Add income taxes for the year (WS Deduct payments during the year: balance owing at begin installments Taxes owing and of year Altec Manufacturing Inc. Budgeted Income Statement For the year onded December 31, 2022 Sales Cost of goods sold Gross Margin Seling & administrative expenses Net Operating income Interest expone Net income before taxes Income tax expense Nenoom Altec Manufacturing Inc. Budgeted Statement of Retained Earnings For the year ended December 31, 2022 Retared earnings beginning of year Ne income Sub total Dividends declared Retared earnings erd of year Altec Manufacturing Inc. Budgeted Balance Sheet as at December 31, 2022 Assets Cash Accounts Receivable Inventory Raw Materials Inventory: Finished goods Prepad insurance Captal assets (net) Total Assets Liabilities and Shareholders' Equity Liabilities Bark Loon Payable Accounts payable Interest payable Income taxes payable Total Liabilities Shareholders' Equity Common Shares Retared amings Total Shareholders' equity Total Liabilities & Shareholders' Equity Altec Manufacturing Inc. Schedule of Ending Accounts Payable For the year ended December 31, 2022 unpaid Month Nov 2 2096 4596 Amount 860 580 272 835 1,133 415 Dec 2 Altec Manufacturing Inc. Schedule of Ending Raw Materials Inventory For the year ended December 31, 2022 Kain ending inventory per DM budget Price per kg Cost of ending raw materials inventory 70.720 0.85 60117 s ALTERNATIVE SCHEDULE OF CASH DISBURSEMENTS FOR PURCHASES. all else remains the same Altec Manufacturing Inc. Schedule of Expected Cash Disbursement for Purchases of Raw Material SAA (Alternate) For the year ended December 31, 2022 Feb Mar Apr Mary Jun Jul Aug Sep Oct Nov Dec Year Purchase discount AP from November AP from December Jan Jan (2394) 90,100 76,500 119,705 Feb Apr Aug Sep OC! Nov 223911 Data for Budget Assignment: Master Budget Case for Altec Manufacturing Inc. fiscal year end December 31 For the year ended December 31, 2022 estimated sales: (in units) 20x1 20x2 20x3 70,000 Salesx1 80.000 Salesx2 90,000 Salesx3 price per unit 160 Price 1. Sales pattern Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 3% Jansales 5% Febsales 6% Marsales 9% Aprsales 7% Maysales 9% Junsales 10% Julsales 8% Augsales 6% Sepsales 9% Octsales 13% Novsales 15% Decsales 100% 2. desired ending inventory (finished goods) 38% EndFGtarget 3. rental cost--Admn & Selling cost Seasonal 28,000 Rentstorage 4. Raw material: SSA kg beginning inventory(raw materials) required for each unit of product cost per kilogram desired ending inventory of SSA 33,000 kirogram 55 DMkgperunit 0.85 DMpriceperkg 38% End SSAinvtarget Accounts payable payment pattern: in the month of purchase in the month following the purchase in the 2nd month following the purchase in month of purchase 55% APpaymontho 25% APpaymonth1 20% APpaymonth2 5. Purchase discounts 2% APdiscount 6. Beginning Accounts Payable: (on balance sheet) November SSA purchases December SSA purchases 227,800 450,500 PurchSSANovx1 306,000 PurchSSADecx1 7. Direct Labour rate with benefits 24 average rate of pay benefit rate Time to produce one unit per hour percentage minutes 20 DL payrate 20% Dibenrate 75 DL perunit (convert to hours) 1.25 8. per unit variable manufacturing: Utilities Indirect materials Plant maintenance Environmental fee Other 12 5 4.5 1.95 2.5 25.95 VOHperunit (see 9b below) 9a. Actual fixed manufacturing overhead costs for last 12 month year training & devel property/bus tax supervisor's salary amortization insurance other 47,520 FMOH_trainx1 36,000 FMOH_proptaxx1 89.400 FMOH_salaryx1 227,760 FMOH_amortx1 92,460 FMOH_insurancex1 109,600 FMOH_otherx1 602.740 39,000 FMOH_proptaxx2 9b. Expected property taxes for next year 9c. Expected insurance premium for next year Apr 1 - Mar 31 93,300 FMOH_insurancex2 10. cost per unit previous year (20x1) Absorption Costing 93.9 TotalCostperunitx 1 11. Selling and Admin Units Lowest level of sales Highest level of sales 42,500 87.500 total operating expenses 1,273,123 2,493,073 Per unit fixed 27.11 120.948 or 10,079 per month 12. Sales collection pattern current month following month 2 months after uncollectible 21.0% Salescollo 42.0% Salescoll1 35.0% Salescoll2 2.0% Bad Debtso 13. Beginning accounts receivable (on balance sheet) November 20x1 Sales December 20x1 Sales 1,100,000 Sales Novx 1 1,600,000 Sales Decx1 14. Income taxes Monthly tax installments Income tax rate 10,000 Taxinstallmo 25% Taxrate 15. Capital asset purchase (capital budget) payment payment Apr May 304,750 Assetpurchase 40% Assetpay1 60% Assetpay2 16. Dividends: (capital budget) per quarter (calendar quarter) 32,000 Divperquarter 17. Bank credit arrangements Minimum balance required 15,000 Mincashbalance per annum rate of interest borrowing and repayment blocks 5% interestrate 1,000 borrowrepayblocks 18. Opening balance sheet Cash Accounts receivable Inventory-raw materials Inventory-finished goods Prepaid insurance Capital assets (net) 15,680 Cashbegin 1,617.000 Arbegin 28,050 InvRMbegin 28,170 InvFGbegin 23,115 Prepaidinsurbegin 1,328,000 NetCapitalAbegin 3,040,015 TotalAbegin Bank loan payable Accounts payable Income tax payable Common Shares Retained earnings 102,000 Bankloanbegin 227,800 Apbegin 11,200 Inctaxpaybegin 1,200,000 Commonsharesbegin 1,499,015 Rebegin 3,040,015 Altec Manufacturing Inc. Sales Budget For the year ended December 31, 2022 Jan Mar Jun Jul Aug Sep Oct Apr 9% Year Feb 5% May 7% Noy 13% Dec 15% 9% 10% Percent of Annual Sales Expected sales in units Selling price per unit Budgeted Sales Revenue 2,400 160 384,000 Altec Manufacturing Inc. Schedule of Bad Debts Expense For the year ended December 31, 2022 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Noy Dec Year Uncollectible portion of sales 7.690 Altec Manufacturing Inc. Schedule of Expected Cash Collections For the year ended December 31, 2022 Feb Mar Apr May Jun Aug Sep Oct Nov Dec Year Collections from: Current month sales Prior month's sales Two months prior sales Total cash collections Jan 80,640 672,000 385,000 1.137.640 Altec Manufacturing Inc. Schedule of Ending Accounts Receivable as at December 31, 2022 amount from Nov x2 Dec x2 total uncollected 35.0% 77.0% ALTERNATIVE SHEDULE OF CASH COLLECTIONS: all else remains the same Altec Manufacturing Inc. Schedule of Expected Cash Collections For the year ended December 31, 2022 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Year Collection of Sales made inc November (NR) December (NR) Jan 385,000 672,000 80,640 Feb Mar Apr May June July August Sept Oct Nov Dec 1.137,640 Altec Manufacturing Inc. Schedule of Prepaid Insurance For the year ended December 31, 2022 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Year Balance at beginning of month Expensed during the month Balance before premiums paid Premium paid Balance at and of month Jan 23115 -7.705 15,410 15,410 Altec Manufacturing Inc. Cost of Goods Manufactured Budget For the year ended December 31, 2022 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Year Production in Units DM used in production (from DM schedule) DL added to production (from DL schedule) Variable Manuf. Overhead (from OH sched.) Fixed manuf. Overhead (from OH schedule) Total COGM Jan 3.620 T80.235 108,600 93,039 50.476 422,252 Production cost per unit for the year Consisting of: DM cost per unit DL cost per unit VOH cost per unit FMOH cost per unit Altec Manufacturing Inc. Ending Finished Goods Inventory Budget (Absorption Costing) For the year ended December 31, 2022 Cost of ending FG inventory at end of year Units in ending inventory Total cost per unit Total cost of ending inventory Altec Manufacturing Inc. Cost of Goods Sold Budget For the year ended December 31, 2022 Beginning inventory Cost of Goods Manufactured Cost of goods available Ending inventory Cost of Goods Sold Altec Manufacturing Inc. Cash Budget For the year ended December 31, 2022 Feb Mar Apr May Jul Aug Sep Oct Ney Dec Year 15,600 1,137 640 1.159,320 Cash balance beginning Addrocolos Collections from somers Total cash available Less disbursements: Direct materials Direct labour Manufacturing overhead Selling and administrative expenses Income Tax in aliments Tax payable Interest expense paid monthly Capital asset purchases Dividend payment Total disbursements Minimum cash balance required Excesa (deficiency of cash before financing (283 911) 1100,600) (114,482) (75,143) (10,000) 59050 (15.000! 546,750 Financing Borrowed is month Repaid this month Total financing Add back minimum cash balance Cash balance, ending 110.000 112 000 15,000 459,759 S. Bank loan balance at end of month Loan balance for interest calculation 102,000 Altec Manufacturing Inc. Schedule of Income Taxes Payable For the year ended December 31, 2022 Taxes owing at beginning of year Add income taxes for the year (WS Deduct payments during the year: balance owing at begin installments Taxes owing and of year Altec Manufacturing Inc. Budgeted Income Statement For the year onded December 31, 2022 Sales Cost of goods sold Gross Margin Seling & administrative expenses Net Operating income Interest expone Net income before taxes Income tax expense Nenoom Altec Manufacturing Inc. Budgeted Statement of Retained Earnings For the year ended December 31, 2022 Retared earnings beginning of year Ne income Sub total Dividends declared Retared earnings erd of year Altec Manufacturing Inc. Budgeted Balance Sheet as at December 31, 2022 Assets Cash Accounts Receivable Inventory Raw Materials Inventory: Finished goods Prepad insurance Captal assets (net) Total Assets Liabilities and Shareholders' Equity Liabilities Bark Loon Payable Accounts payable Interest payable Income taxes payable Total Liabilities Shareholders' Equity Common Shares Retared amings Total Shareholders' equity Total Liabilities & Shareholders' Equity Altec Manufacturing Inc. Schedule of Ending Accounts Payable For the year ended December 31, 2022 unpaid Month Nov 2 2096 4596 Amount 860 580 272 835 1,133 415 Dec 2 Altec Manufacturing Inc. Schedule of Ending Raw Materials Inventory For the year ended December 31, 2022 Kain ending inventory per DM budget Price per kg Cost of ending raw materials inventory 70.720 0.85 60117 s ALTERNATIVE SCHEDULE OF CASH DISBURSEMENTS FOR PURCHASES. all else remains the same Altec Manufacturing Inc. Schedule of Expected Cash Disbursement for Purchases of Raw Material SAA (Alternate) For the year ended December 31, 2022 Feb Mar Apr Mary Jun Jul Aug Sep Oct Nov Dec Year Purchase discount AP from November AP from December Jan Jan (2394) 90,100 76,500 119,705 Feb Apr Aug Sep OC! Nov 223911