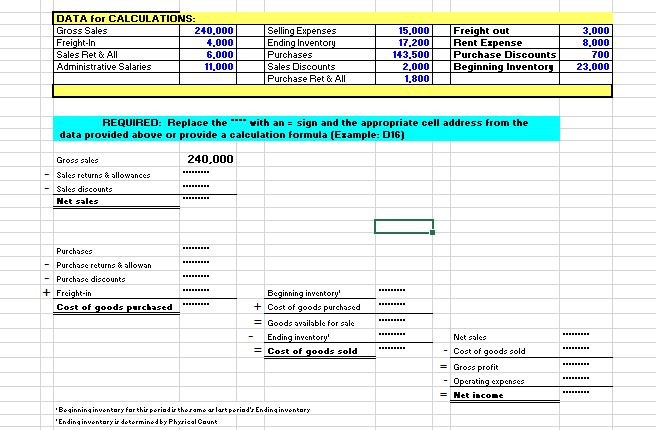

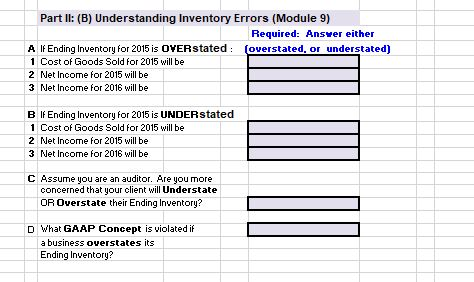

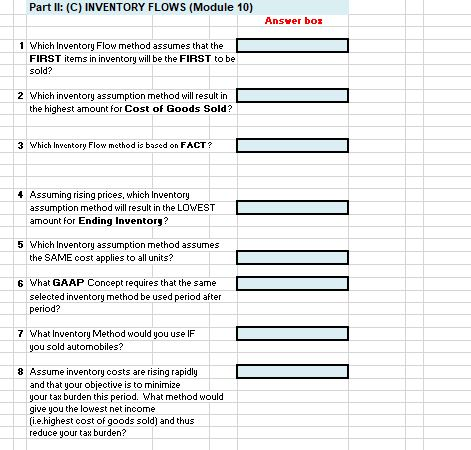

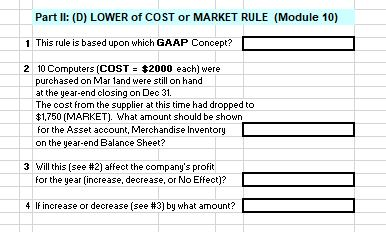

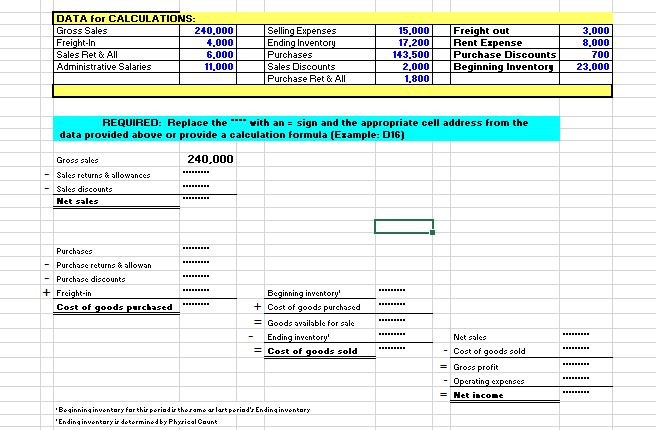

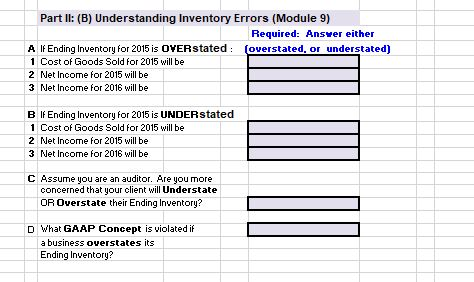

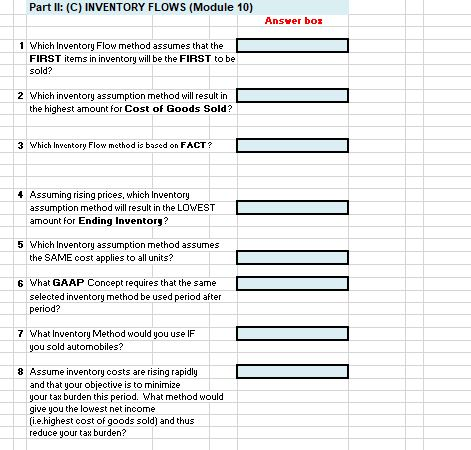

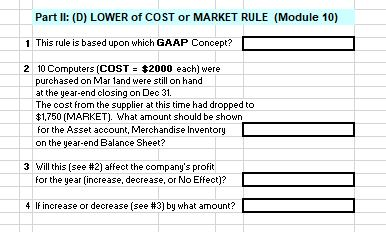

DATA for CALCULATIONS: 3,000 Selling Expenses Ending Inventory Freight out Rent Ezpense Purchase Discounts Beginning Inventory 240,000 Gross Sales 15,000 17,200 143,500 2,000 1,800 Freight-In 4,000 6.000 8,000 Sales Ret & All Purchases Sales Discounts 700 Administrative Salaries 11,000 23,000 Purchase Ret & All REQUIRED: Replace the with an siqn and the appropriate cell address from the data provided above or provide a calculation formula (Example: D16) 240,000 Gross sales Sales returne & allowance Sales discounts Het sales Purchases Purchase returns & allowan Purchase discounts Beginning inventory Cost of goods purchased Freight-in www Cost of goods purchased =Goods available for sale Ending inventory Net sales Cost of goods sold Cost of gooda pold Gross profit Operating expenses www = Net income Beginninginvontory for thir perind ir the rame ar lart porind'r Ending inventory 'Ending inventary ir determinedby Phyrieal Caunt Part Il: (B) Understanding Inventory Errors (Module 9) Required: Answer either (overstated, or understated] A IF Ending Inventory for 2015 is OVERstated 1 Cost of Goods Sold for 2015 will be 2 Net Income for 2015 will be 3 Net Income for 2016 will be B If Ending Inventory for 2015 is UNDERstated 1 Cost of Goods Sold for 2015 will be 2 Net Income for 2015 will be 3 Net Income for 2016 will be C Assume you are an auditor. Are you more concerned that your client will Understate OR Overstate their Ending Inventory? DWhat GAAP Concept is violated if a business overstates its Ending Inventory? Part ll: (C) INVENTORY FLOWS (Module 10) Answer boz 1 which Inventory Flow method assumes that the FIRST items in inventory will be the FIRST to be sold? 2 Which inventory assumption method will result in the highest amount for Cost of Goods Sold? 3 which Inventory Flow method is based on FACT? 4 Assuming rising prices, which Inventory assumption method will result in the LOWEST amount for Ending Inventorg? 5 which Inventory assumption method assumes the SAME cost applies to all units? 6 what GAAP Concept requires that the same selected inventory method be used period after period? 7 What Inventory Method would you use IF you sold automobiles? 8 Assume inventory costs are rising rapidly and that your objective is to minimize your tax burden this period. What method would give you the lowest net income (i.e.highest cost of goods sold) and thus reduce your tas burden? Part ll: (D) LOWER of COST or MARKET RULE (Module 10) 1 This rule is based upon which GAAP Concept? 2 10 Computers (COST $2000 each) were purchased on Mar 1and were still on hand at the year-end closing on Dec 31. The cost from the supplier at this time had dropped to $1,750 (MARKET). What amount should be shown for the Asset account, Merchandise Inventory on the year-end Balance Sheet? 3 Will this (see #2) affect the company's profit for the year (increase, decrease, or No Effect)? 4 If increase or decrease (see #3) by what amount