Answered step by step

Verified Expert Solution

Question

1 Approved Answer

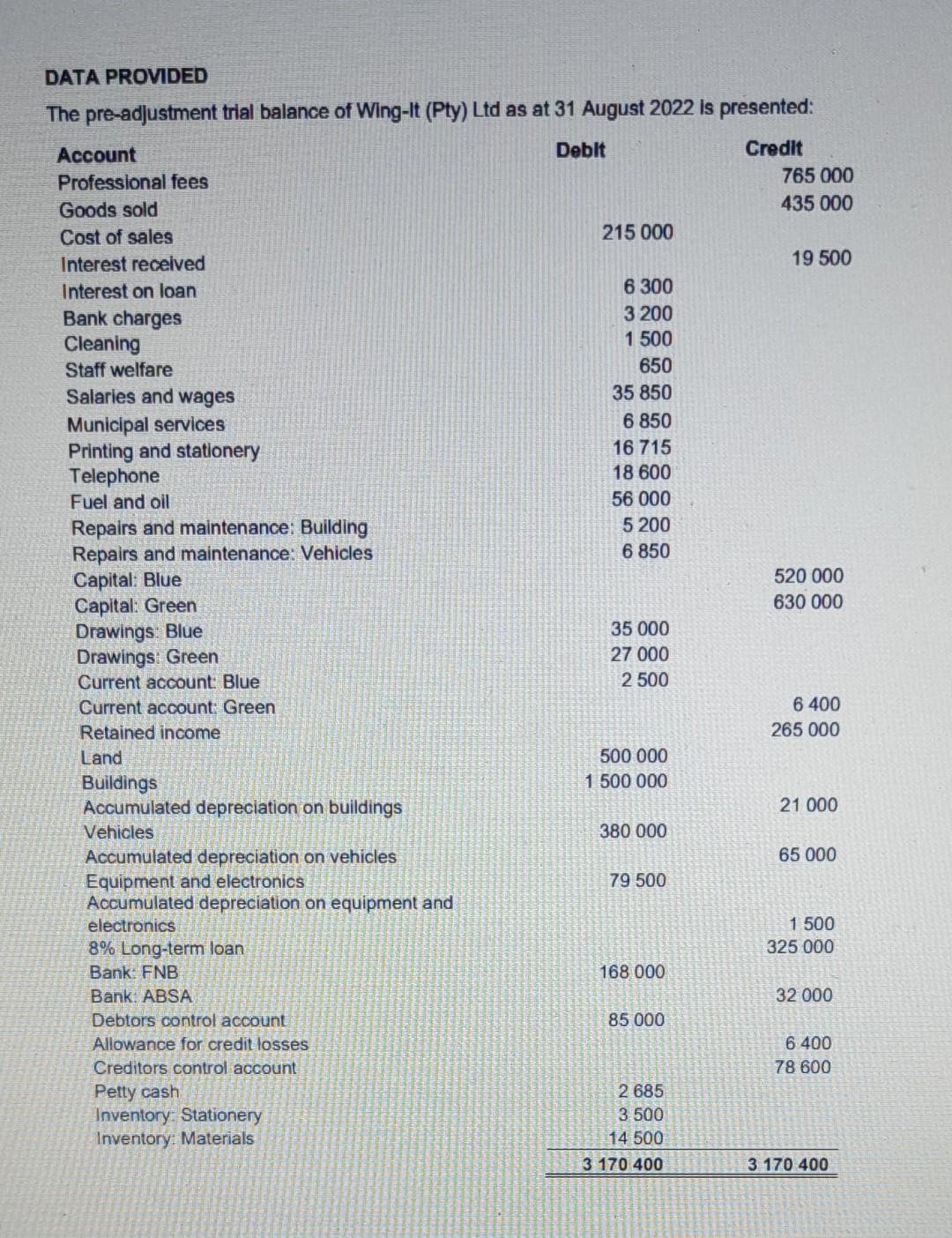

DATA PROVIDED The nreadlustment trial balance of Wina-It (Pty) Ltd as at 31 August 2022 is presented: dditional Information 1. Professional services to the value

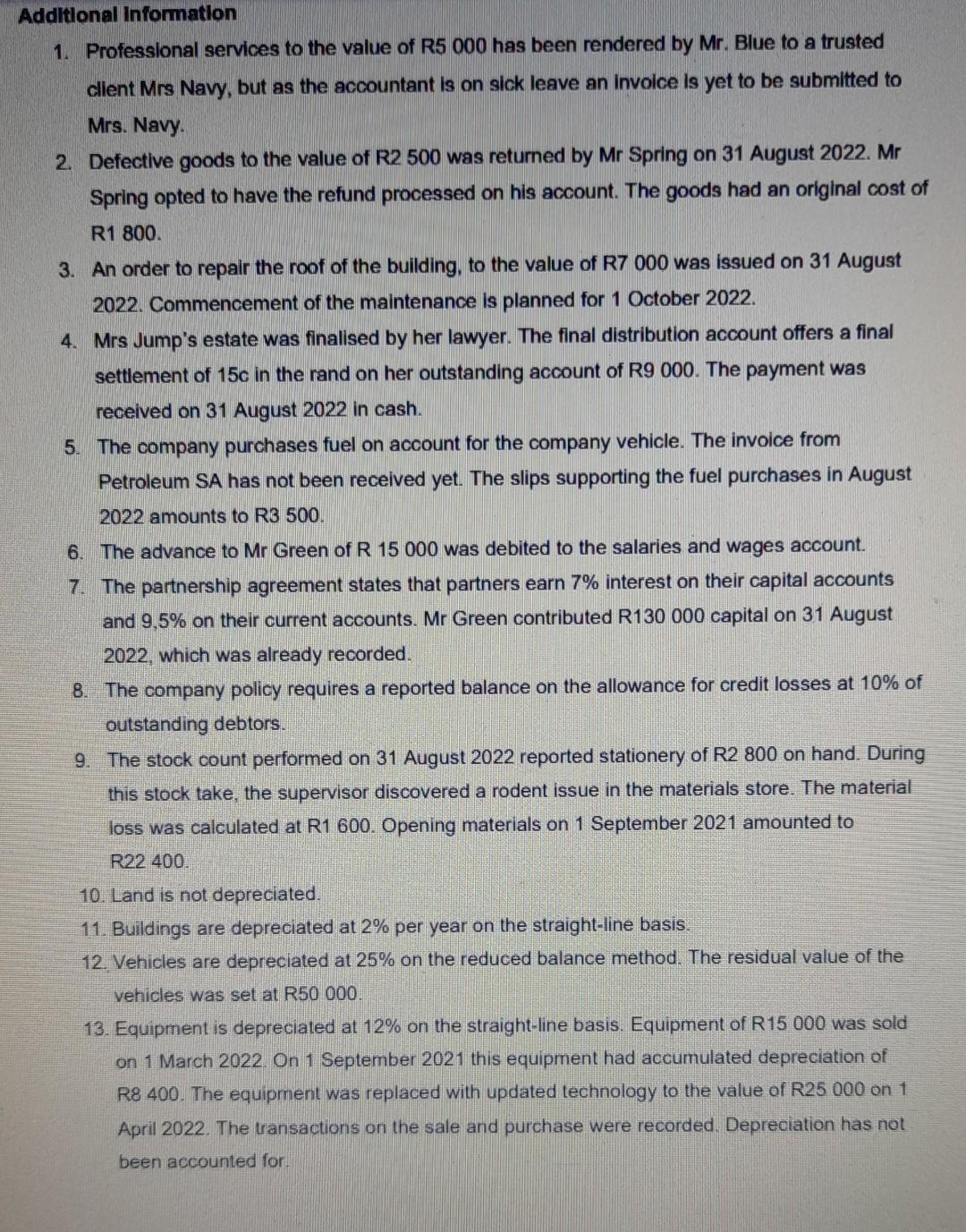

DATA PROVIDED The nreadlustment trial balance of Wina-It (Pty) Ltd as at 31 August 2022 is presented: dditional Information 1. Professional services to the value of R5000 has been rendered by Mr. Blue to a trusted cllent Mrs Navy, but as the accountant is on sick leave an invoice is yet to be submitted to Mrs. Navy. 2. Defective goods to the value of R2 500 was returned by Mr Spring on 31 August 2022. Mr Spring opted to have the refund processed on his account. The goods had an original cost of R1 800. 3. An order to repair the roof of the building, to the value of R7000 was issued on 31 August 2022. Commencement of the maintenance is planned for 1 October 2022. 4. Mrs Jump's estate was finalised by her lawyer. The final distribution account offers a final settlement of 15c in the rand on her outstanding account of R9 000 . The payment was received on 31 August 2022 in cash. 5. The company purchases fuel on account for the company vehicle. The invoice from Petroleum SA has not been received yet. The slips supporting the fuel purchases in August 2022 amounts to R3 500. 6. The advance to Mr Green of R15000 was debited to the salaries and wages account. 7. The partnership agreement states that partners earn 7% interest on their capital accounts and 9,5% on their current accounts. Mr Green contributed R130 000 capital on 31 August 2022 , which was already recorded. 8. The company policy requires a reported balance on the allowance for credit losses at 10% of outstanding debtors. 9. The stock count performed on 31 August 2022 reported stationery of R2800 on hand. During this stock take, the supervisor discovered a rodent issue in the materials store. The material loss was calculated at R1 600 . Opening materials on 1 September 2021 amounted to R22 400. 10. Land is not depreciated. 11. Buildings are depreciated at 2% per year on the straight-line basis. 12. Vehicles are depreciated at 25% on the reduced balance method. The residual value of the vehicles was set at R50000. 13. Equipment is depreciated at 12% on the straight-line basis. Equipment of R15 000 was sold on 1 March 2022. On 1 September 2021 this equipment had accumulated depreciation of R8 400. The equipment was replaced with updated technology to the value of R25000 on 1 April 2022. The transactions on the sale and purchase were recorded. Depreciation has not been accounted for. QUESTION ONE Process the general journals on the additional transactions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started