Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Data table Beg. Bal. Feb. 6 Feb. 15 Feb. 23 Feb. 28 End. Bal. Beverly Associates 14 W Gadsden St Pensacola, FL 32501 BANK

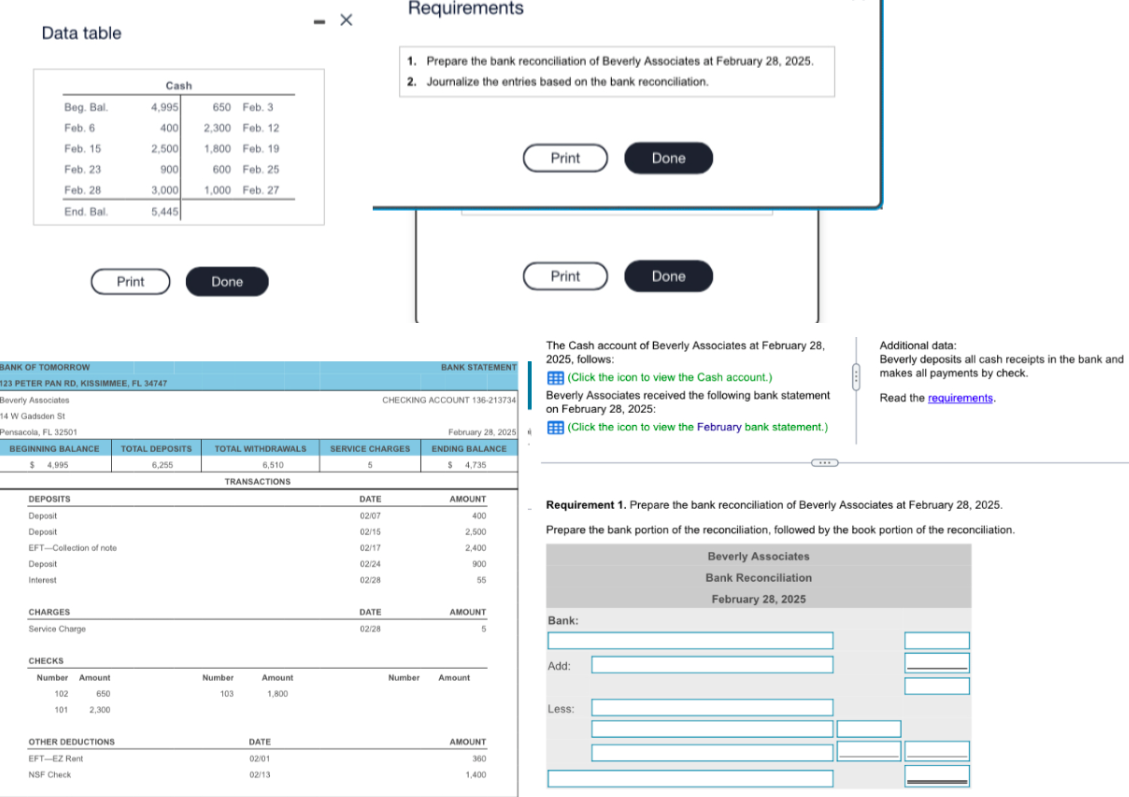

Data table Beg. Bal. Feb. 6 Feb. 15 Feb. 23 Feb. 28 End. Bal. Beverly Associates 14 W Gadsden St Pensacola, FL 32501 BANK OF TOMORROW 123 PETER PAN RD, KISSIMMEE, FL 34747 DEPOSITS Deposit Deposit EFT-Collection of note Deposit Interest BEGINNING BALANCE TOTAL DEPOSITS $ 4,995 6,255 CHARGES Service Charge CHECKS Number Amount 102 101 Print 650 2,300 Cash OTHER DEDUCTIONS EFT-EZ Rent NSF Check 4,995 400 2,500 900 3,000 5,445 650 Feb. 3 2,300 Feb. 12 1,800 Feb. 19 600 Feb. 25 1,000 Feb. 27 Done TOTAL WITHDRAWALS 6.510 TRANSACTIONS Number 103 Amount 1,800 DATE 02/01 02/13 - X 5 DATE 02/07 02/15 SERVICE CHARGES 02/17 02/24 02/28 Requirements DATE 02/28 1. Prepare the bank reconciliation of Beverly Associates at February 28, 2025. 2. Journalize the entries based on the bank reconciliation. BANK STATEMENT CHECKING ACCOUNT 136-213734 AMOUNT 400 2,500 2,400 900 55 AMOUNT Number Amount (Click the icon to view the Cash account.) Beverly Associates received the following bank statement on February 28, 2025: February 28, 2025 (Click the icon to view the February bank statement.) ENDING BALANCE $ 4,735 5 AMOUNT Print 360 1,400 Print The Cash account of Beverly Associates at February 28, 2025, follows: Done Bank: Done Add: Requirement 1. Prepare the bank reconciliation of Beverly Associates at February 28, 2025. Prepare the bank portion of the reconciliation, followed by the book portion of the reconciliation. Less: Additional data: Beverly deposits all cash receipts in the bank and makes all payments by check. Read the requirements. Beverly Associates Bank Reconciliation February 28, 2025

Step by Step Solution

★★★★★

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the bank reconciliation for Beverly Associates as of February 28 2025 we will need to reconcile the differences between the bank statement ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started