Answered step by step

Verified Expert Solution

Question

1 Approved Answer

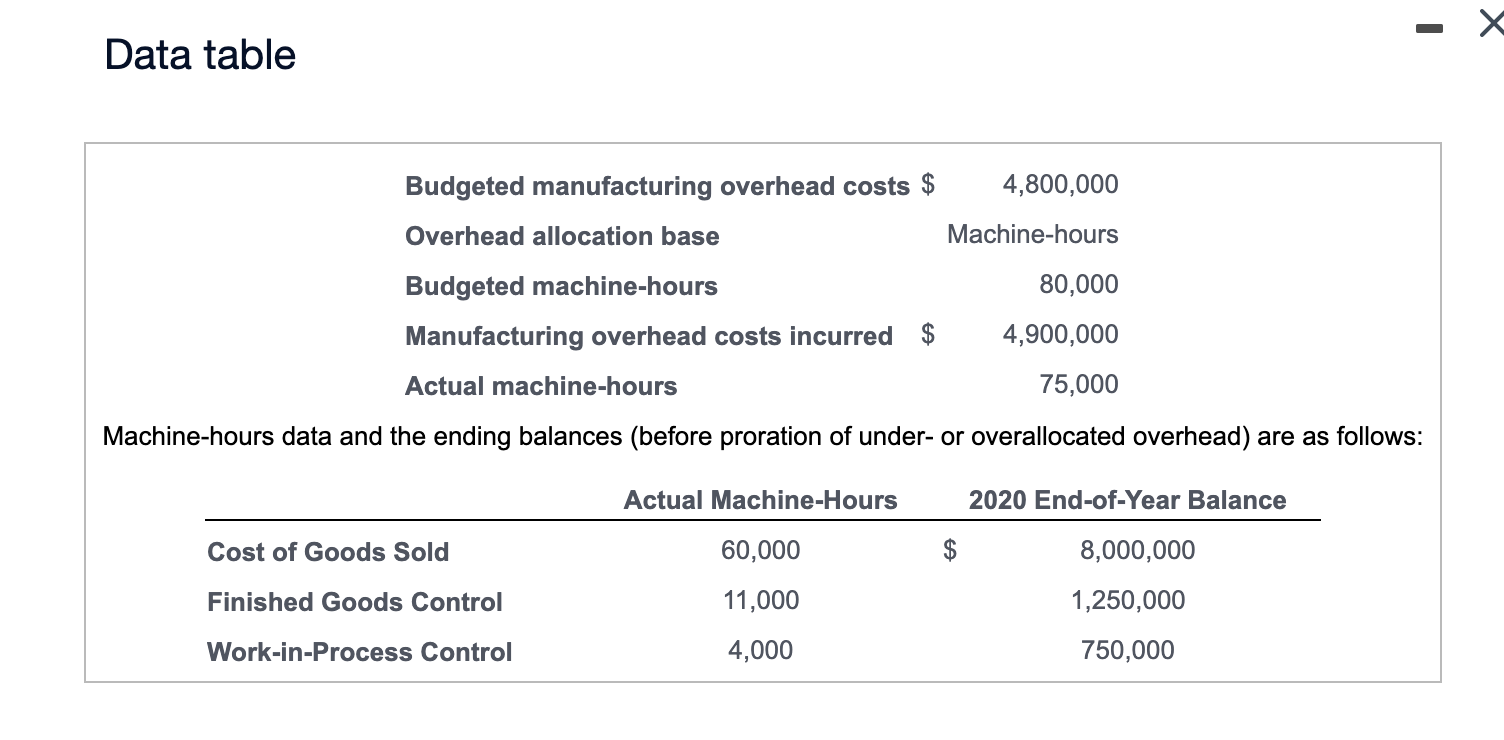

Data table Budgeted manufacturing overhead costs $ 4,800,000 Overhead allocation base Machine-hours Budgeted machine-hours 80,000 Manufacturing overhead costs incurred $ 4,900,000 Actual machine-hours 75,000

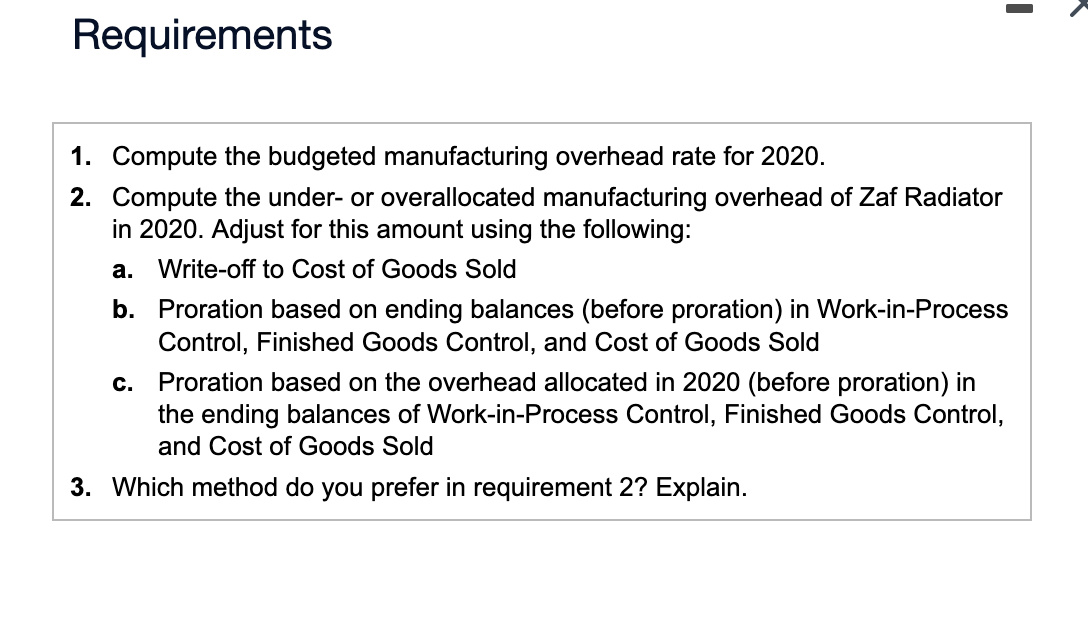

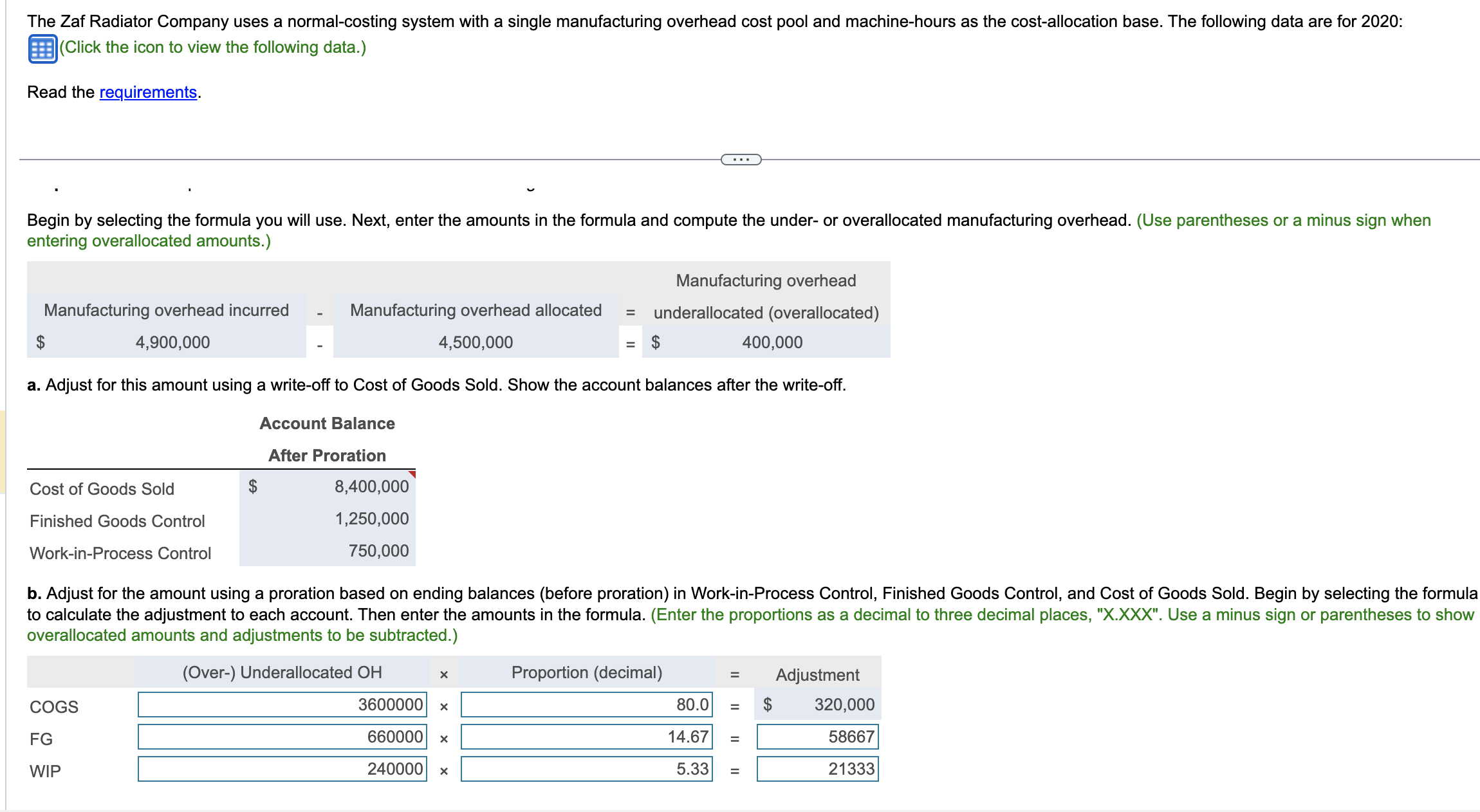

Data table Budgeted manufacturing overhead costs $ 4,800,000 Overhead allocation base Machine-hours Budgeted machine-hours 80,000 Manufacturing overhead costs incurred $ 4,900,000 Actual machine-hours 75,000 Machine-hours data and the ending balances (before proration of under- or overallocated overhead) are as follows: Actual Machine-Hours Cost of Goods Sold Finished Goods Control 60,000 11,000 Work-in-Process Control 4,000 EA 2020 End-of-Year Balance 8,000,000 1,250,000 750,000 Requirements I 1. Compute the budgeted manufacturing overhead rate for 2020. 2. Compute the under- or overallocated manufacturing overhead of Zaf Radiator in 2020. Adjust for this amount using the following: a. Write-off to Cost of Goods Sold b. Proration based on ending balances (before proration) in Work-in-Process Control, Finished Goods Control, and Cost of Goods Sold C. Proration based on the overhead allocated in 2020 (before proration) in the ending balances of Work-in-Process Control, Finished Goods Control, and Cost of Goods Sold 3. Which method do you prefer in requirement 2? Explain. The Zaf Radiator Company uses a normal-costing system with a single manufacturing overhead cost pool and machine-hours as the cost-allocation base. The following data are for 2020: (Click the icon to view the following data.) Read the requirements. Begin by selecting the formula you will use. Next, enter the amounts in the formula and compute the under- or overallocated manufacturing overhead. (Use parentheses or a minus sign when entering overallocated amounts.) Manufacturing overhead underallocated (overallocated) Manufacturing overhead incurred 4,900,000 Manufacturing overhead allocated 4,500,000 = = $ 400,000 a. Adjust for this amount using a write-off to Cost of Goods Sold. Show the account balances after the write-off. Cost of Goods Sold Account Balance After Proration 8,400,000 Finished Goods Control Work-in-Process Control 1,250,000 750,000 b. Adjust for the amount using a proration based on ending balances (before proration) in Work-in-Process Control, Finished Goods Control, and Cost of Goods Sold. Begin by selecting the formula to calculate the adjustment to each account. Then enter the amounts in the formula. (Enter the proportions as a decimal to three decimal places, "X.XXX". Use a minus sign or parentheses to show overallocated amounts and adjustments to be subtracted.) COGS FG WIP (Over-) Underallocated OH Proportion (decimal) = Adjustment 3600000 80.0 = 320,000 660000 14.67 = 58667 240000 5.33 = 21333

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started