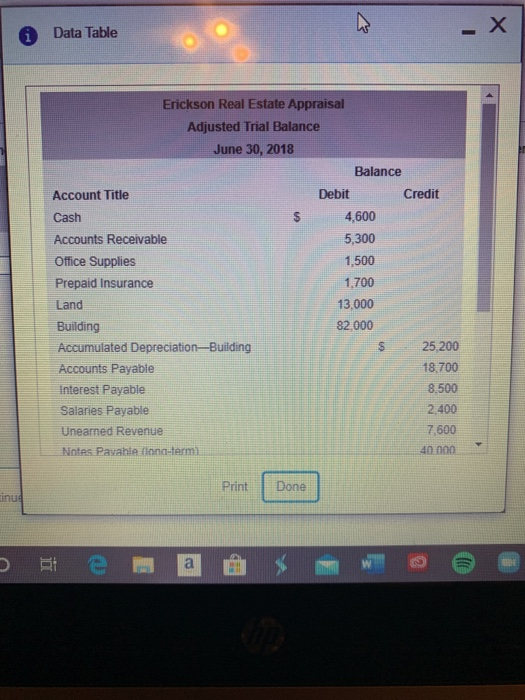

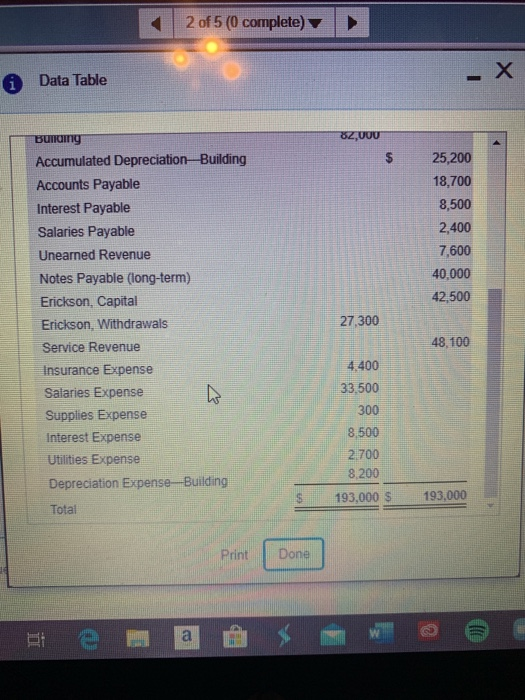

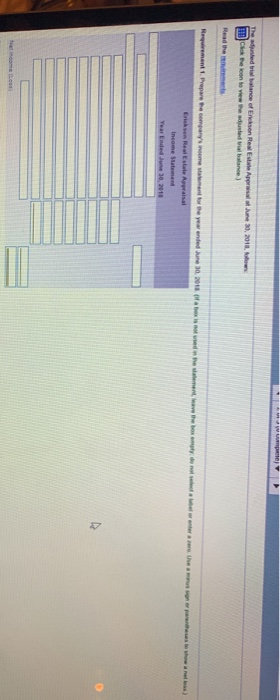

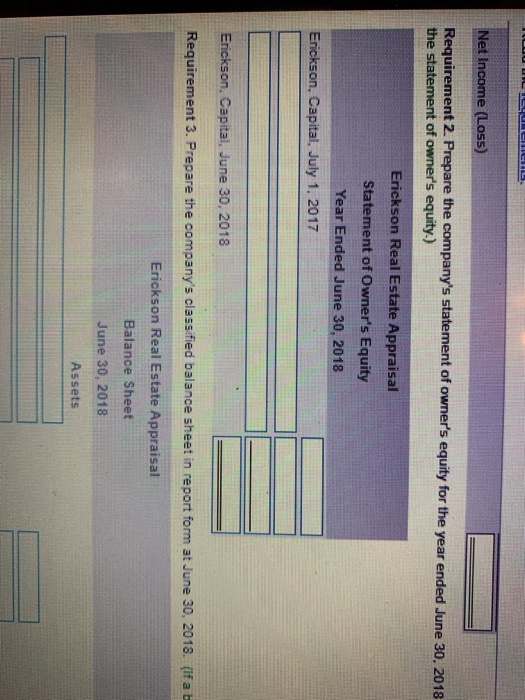

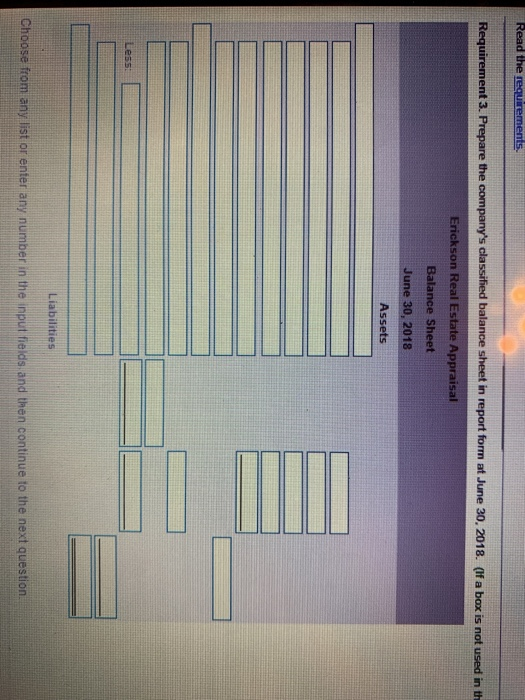

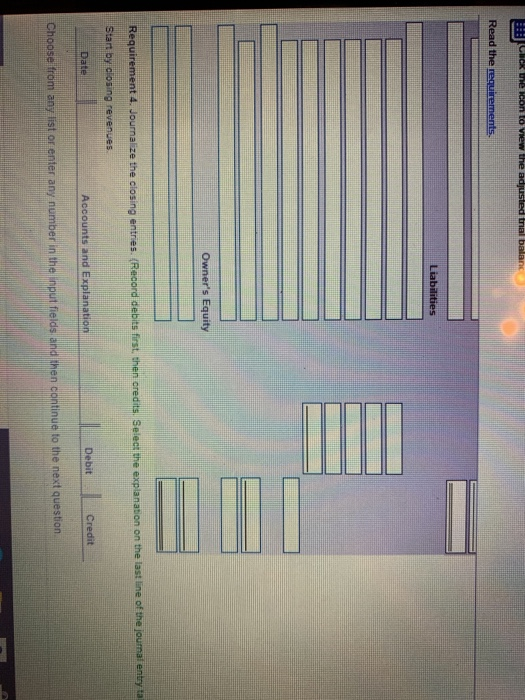

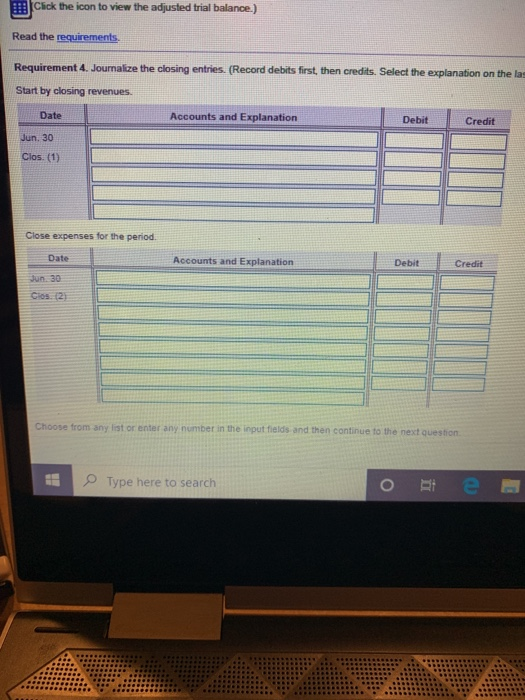

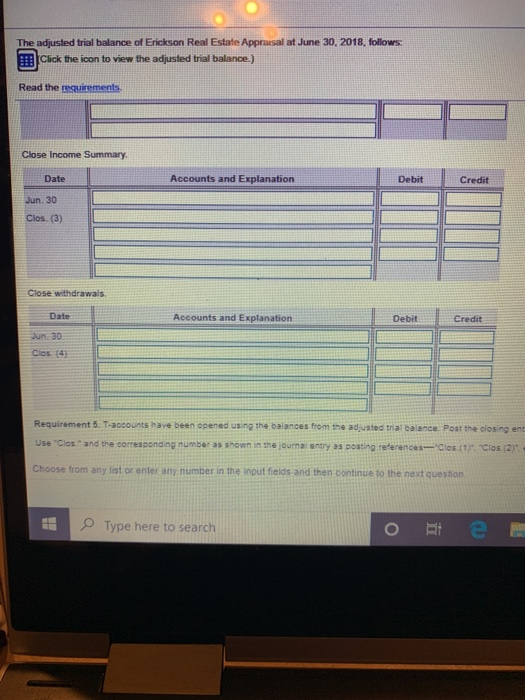

Data Table Erickson Real Estate Appraisal Adjusted Trial Balance June 30, 2018 Balance Account Title Credit Cash Accounts Receivable Office Supplies Prepaid Insurance Land Debit 4,600 5,300 1,500 1,700 13,000 82.000 Building Accumulated Depreciation Building Accounts Payable Interest Payable Salaries Payable Uneamed Revenue Notes Pavable finna-term 25,200 18.700 8,500 2.400 7,600 40.000 Print Done inue x 2 of 5 (0 complete) i Data Table -X 82,000 $ 25,200 18,700 8,500 2,400 7,600 40,000 42,500 Bunung Accumulated Depreciation Building Accounts Payable Interest Payable Salaries Payable Unearned Revenue Notes Payable (long-term) Erickson, Capital Erickson, Withdrawals Service Revenue Insurance Expense Salaries Expense w Supplies Expense Interest Expense Utilities Expense Depreciation Expense-Building 27,300 48, 100 4400 33,500 300 8,500 2.700 8,200 193,000 $ 193,000 Total Print Done prej The used trance of Encon Real Estate Aue 2018 Cheon View the dusted balance the mentave the more than whats) Requirement 1. Prepare the company's homelement for the year andede 30 2018.01 Erich Real Estate Appraisal Income Statemen Year Ended June 10, 2011 Tu LIL UCHUCHL. Net Income (Loss) Requirement 2. Prepare the company's statement of owner's equity for the year ended June 30, 2018 the statement of owner's equity.) Erickson Real Estate Appraisal Statement of Owner's Equity Year Ended June 30, 2018 Erickson, Capital, July 1, 2017 Erickson. Capital, June 30, 2018 Requirement 3. Prepare the company's classified balance sheet in report form at June 30, 2018. (If a b Erickson Real Estate Appraisal Balance Sheet June 30, 2018 Assets Read the requirements Requirement 3. Prepare the company's classified balance sheet in report form at June 30, 2018. (If a box is not used in th Erickson Real Estate Appraisal Balance Sheet June 30, 2018 Assets Less Liabilities Choose from any list or enter any number in the input fields and then continue to the next question Click the icon to view the adjusted trial balanc Read the requirements. Liabilities TITI Owner's Equity Requirement 4. Journalize the closing entries (Record debits first, then credits. Select the explanation on the last line of the journal entry ta Start by closing revenues Debit Accounts and Explanation Credit Date Choose from any list or enter any number in the nput fields and then continue to the next question Click the icon to view the adjusted trial balance.) Read the requirements Requirement 4. Journalize the closing entries. (Record debits first, then credits. Select the explanation on the las Start by closing revenues Date Accounts and Explanation Debit Credit Jun 30 Clos. (1) Close expenses for the period Date Accounts and Explanation Debit Credit Jun 30 Clos (2) Choose from any list or enter any number in the input fields and then continue to the next question Type here to search The adjusted trial balance of Erickson Real Estate Appraisal at June 30, 2018, follows: Click the icon to view the adjusted trial balance.) Read the requirements Close Income Summary Date Accounts and Explanation Debit Credit Jun 30 Clos. (3) Close withdrawals Date Accounts and Explanation Debit Credit Jun 30 Clos 14 Requirement 5. T-accounts have been opened using the balances from the adjusted trial balance Post the closing en Use "Clos" and the corresponding number as shown in the journal entry as posting references-clos (1) Clos2) Choose from any list or enter any number in the input fields and then continue to the next question Type here to search