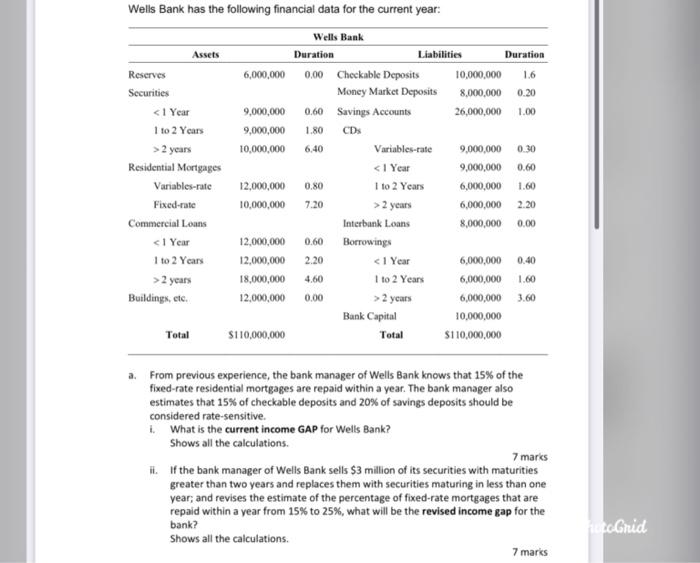

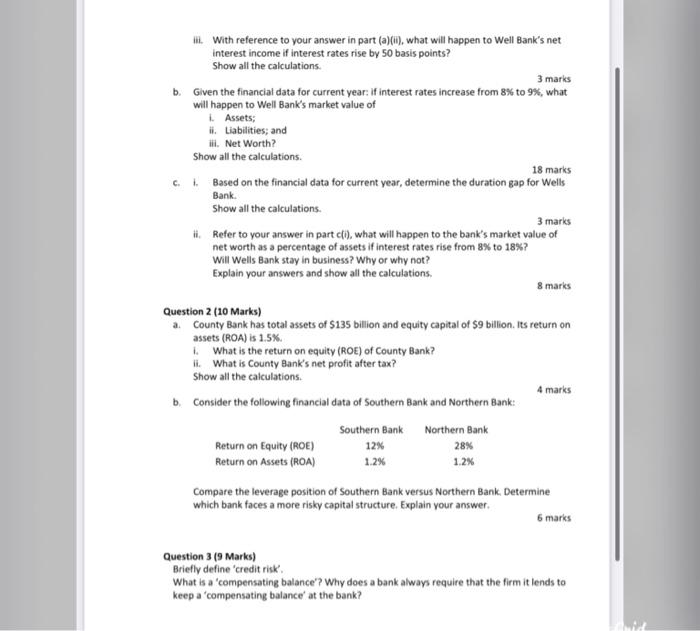

Wells Bank has the following financial data for the current year: Assets Reserves Securities 2 years Residential Mortgages Variables-rate Fixed-rate Commercial Leans 2 years Buildings, etc. Wells Bank Duration Liabilities Duration 6,000,000 0.00 Checkable Deposits 10,000,000 1.6 Money Market Deposits 8,000,000 0.20 9,000,000 0.60 Savings Accounts 26,000,000 1.00 9,000,000 1.80 CDs 10,000,000 6.40 Variables-tate 9,000,000 0.30 2 years 6,000,000 2.20 Interbank Loans 8,000,000 0.00 12,000,000 0.60 Borrowings 12,000,000 2.20 2 years 6,000,000 3.60 Bank Capital 10,000,000 $110,000,000 S110,000,000 Total Total a. From previous experience, the bank manager of Wells Bank knows that 15% of the fixed-rate residential mortgages are repaid within a year. The bank manager also estimates that 15% of checkable deposits and 20% of savings deposits should be considered rate-sensitive What is the current income GAP for Wells Bank? Shows all the calculations 7 marks ii. If the bank manager of Wells Bank sells $3 million of its securities with maturities greater than two years and replaces them with securities maturing in less than one year, and revises the estimate of the percentage of fixed-rate mortgages that are repaid within a year from 15% to 25%, what will be the revised income gap for the bank? Shows all the calculations 7 maris fucGrid it. With reference to your answer in part (a)(w), what will happen to Well Bank's net interest income if interest rates rise by 50 basis points? Show all the calculations 3 marks b. Given the financial data for current year: If interest rates increase from 8% to 9%, what will happen to Well Bank's market value of Assets; ii. Liabilities, and lil. Net Worth? Show all the calculations. 18 marks C. Based on the financial data for current year, determine the duration gap for Wells Bank. Show all the calculations 3 marks Refer to your answer in part c), what will happen to the bank's market value of net worth as a percentage of assets if interest rates rise from 8% to 18%? Will Wells Bank stay in business? Why or why not? Explain your answers and show all the calculations 8 marks Question 2 (10 Marks) a County Bank has total assets of $135 billion and equity capital of $9 billion. Its return on assets (ROA) is 1.5% What is the return on equity (ROE) of County Bank? ll. What is County Bank's net profit after tax? Show all the calculations 4 marks b. Consider the following financial data of Southern Bank and Northern Bank: Southern Bank Northern Bank Return on Equity (ROE) 12% 28% Return on Assets (ROA) 1.2% 1.2% Compare the leverage position of Southern Bank versus Northern Bank. Determine which bank faces a more risky capital structure. Explain your answer. 6 marks Question 3 (9 Marks) Briefly define 'credit risk What is a compensating balance? Why does a bank always require that the firm it lends keep a compensating balance at the bank? to