Answered step by step

Verified Expert Solution

Question

1 Approved Answer

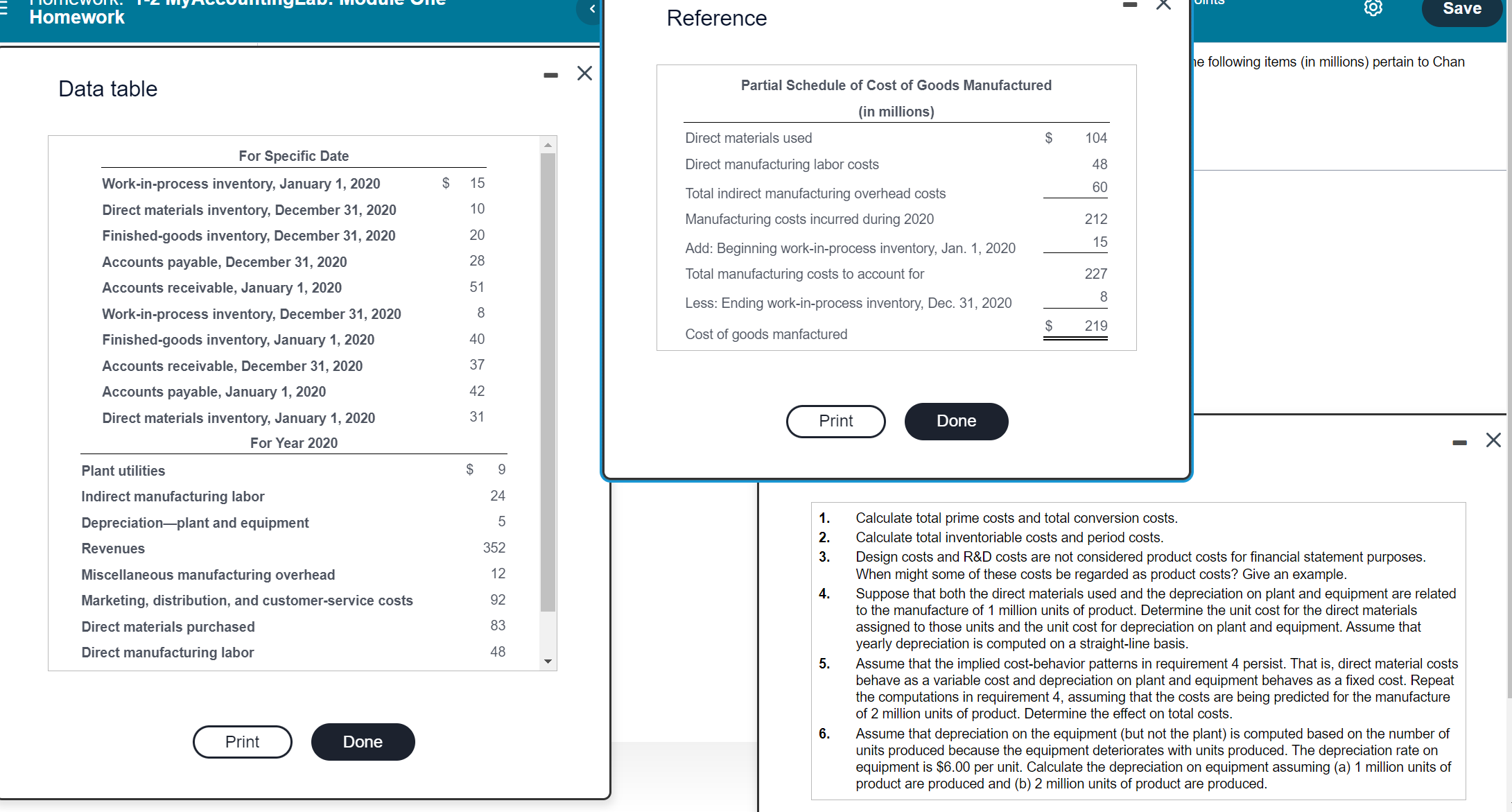

Data table he following items (in millions) pertain to Chan 1. Calculate total prime costs and total conversion costs. 2. Calculate total inventoriable costs and

Data table he following items (in millions) pertain to Chan 1. Calculate total prime costs and total conversion costs. 2. Calculate total inventoriable costs and period costs. 3. Design costs and R\&D costs are not considered product costs for financial statement purposes. When might some of these costs be regarded as product costs? Give an example. 4. Suppose that both the direct materials used and the depreciation on plant and equipment are related to the manufacture of 1 million units of product. Determine the unit cost for the direct materials assigned to those units and the unit cost for depreciation on plant and equipment. Assume that yearly depreciation is computed on a straight-line basis. 5. Assume that the implied cost-behavior patterns in requirement 4 persist. That is, direct material costs behave as a variable cost and depreciation on plant and equipment behaves as a fixed cost. Repeat the computations in requirement 4 , assuming that the costs are being predicted for the manufacture of 2 million units of product. Determine the effect on total costs. 6. Assume that depreciation on the equipment (but not the plant) is computed based on the number of units produced because the equipment deteriorates with units produced. The depreciation rate on equipment is $6.00 per unit. Calculate the depreciation on equipment assuming (a) 1 million units of product are produced and (b) 2 million units of product are produced. Data table he following items (in millions) pertain to Chan 1. Calculate total prime costs and total conversion costs. 2. Calculate total inventoriable costs and period costs. 3. Design costs and R\&D costs are not considered product costs for financial statement purposes. When might some of these costs be regarded as product costs? Give an example. 4. Suppose that both the direct materials used and the depreciation on plant and equipment are related to the manufacture of 1 million units of product. Determine the unit cost for the direct materials assigned to those units and the unit cost for depreciation on plant and equipment. Assume that yearly depreciation is computed on a straight-line basis. 5. Assume that the implied cost-behavior patterns in requirement 4 persist. That is, direct material costs behave as a variable cost and depreciation on plant and equipment behaves as a fixed cost. Repeat the computations in requirement 4 , assuming that the costs are being predicted for the manufacture of 2 million units of product. Determine the effect on total costs. 6. Assume that depreciation on the equipment (but not the plant) is computed based on the number of units produced because the equipment deteriorates with units produced. The depreciation rate on equipment is $6.00 per unit. Calculate the depreciation on equipment assuming (a) 1 million units of product are produced and (b) 2 million units of product are produced

Data table he following items (in millions) pertain to Chan 1. Calculate total prime costs and total conversion costs. 2. Calculate total inventoriable costs and period costs. 3. Design costs and R\&D costs are not considered product costs for financial statement purposes. When might some of these costs be regarded as product costs? Give an example. 4. Suppose that both the direct materials used and the depreciation on plant and equipment are related to the manufacture of 1 million units of product. Determine the unit cost for the direct materials assigned to those units and the unit cost for depreciation on plant and equipment. Assume that yearly depreciation is computed on a straight-line basis. 5. Assume that the implied cost-behavior patterns in requirement 4 persist. That is, direct material costs behave as a variable cost and depreciation on plant and equipment behaves as a fixed cost. Repeat the computations in requirement 4 , assuming that the costs are being predicted for the manufacture of 2 million units of product. Determine the effect on total costs. 6. Assume that depreciation on the equipment (but not the plant) is computed based on the number of units produced because the equipment deteriorates with units produced. The depreciation rate on equipment is $6.00 per unit. Calculate the depreciation on equipment assuming (a) 1 million units of product are produced and (b) 2 million units of product are produced. Data table he following items (in millions) pertain to Chan 1. Calculate total prime costs and total conversion costs. 2. Calculate total inventoriable costs and period costs. 3. Design costs and R\&D costs are not considered product costs for financial statement purposes. When might some of these costs be regarded as product costs? Give an example. 4. Suppose that both the direct materials used and the depreciation on plant and equipment are related to the manufacture of 1 million units of product. Determine the unit cost for the direct materials assigned to those units and the unit cost for depreciation on plant and equipment. Assume that yearly depreciation is computed on a straight-line basis. 5. Assume that the implied cost-behavior patterns in requirement 4 persist. That is, direct material costs behave as a variable cost and depreciation on plant and equipment behaves as a fixed cost. Repeat the computations in requirement 4 , assuming that the costs are being predicted for the manufacture of 2 million units of product. Determine the effect on total costs. 6. Assume that depreciation on the equipment (but not the plant) is computed based on the number of units produced because the equipment deteriorates with units produced. The depreciation rate on equipment is $6.00 per unit. Calculate the depreciation on equipment assuming (a) 1 million units of product are produced and (b) 2 million units of product are produced Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started