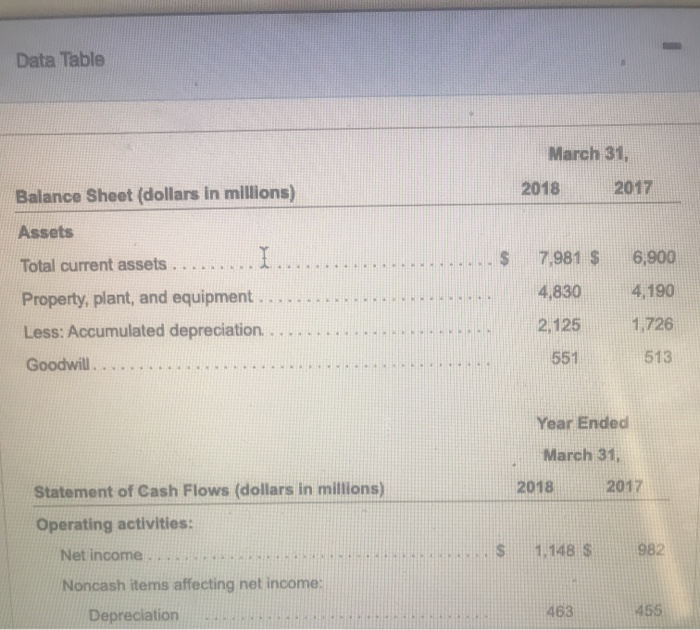

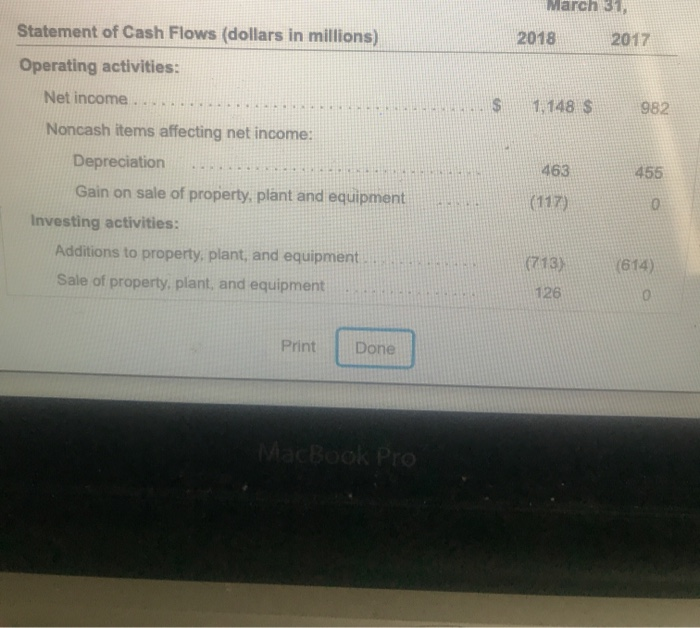

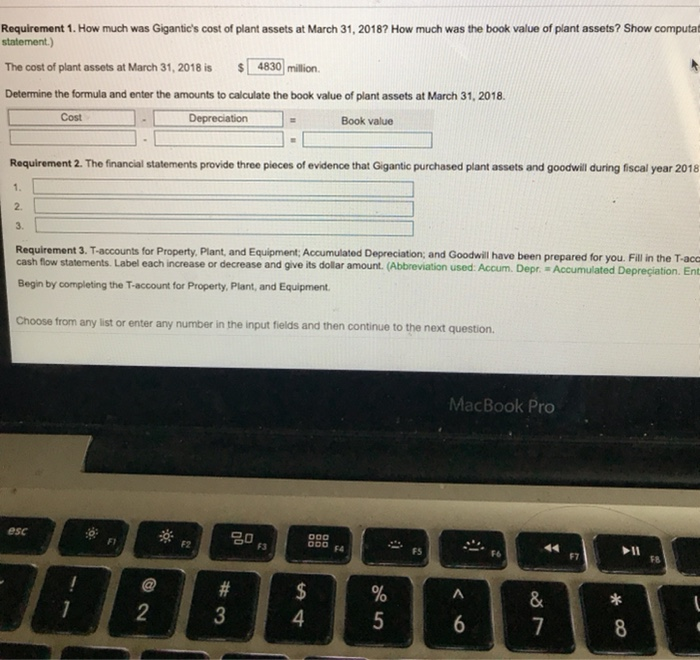

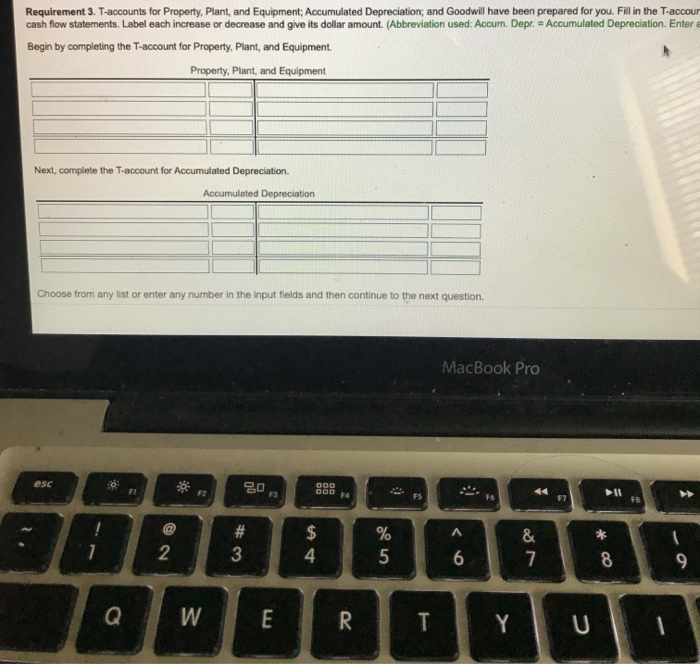

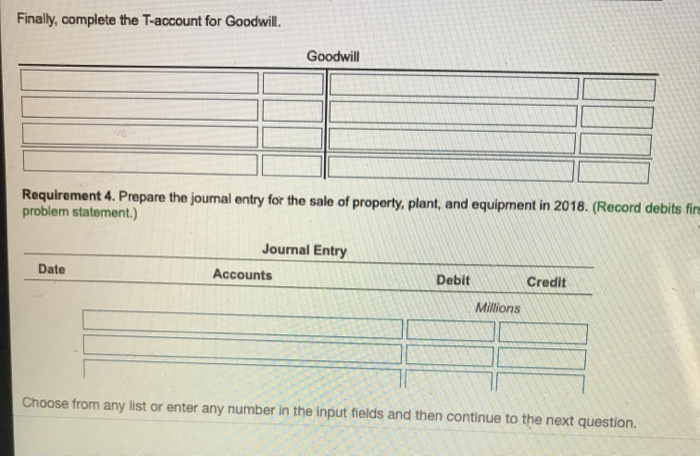

Data Table March 31, 2018 2017 Balance Sheet (dollars in millions) Assets Total current assets. 7,981 $ 6,900 --- 4,830 4,190 . Property, plant, and equipment Less: Accumulated depreciation, 2,125 1,726 Goodwill... 551 513 Year Ended March 31, Statement of Cash Flows (dollars in millions) 2018 2017 Operating activities: Net income 1.148 $ 982 . Noncash items affecting net income: Depreciation 463 455 March 31, 2018 Statement of Cash Flows (dollars in millions) Operating activities: 2017 Net income 1,148 $ 982 - 463 455 Noncash items affecting net income: Depreciation Gain on sale of property, plant and equipment Investing activities: Additions to property, plant, and equipment Sale of property, plant, and equipment (117 0 (713) 126 Print Done MacBook Pro Requirement 1. How much was Gigantic's cost of plant assets at March 31, 2018? How much was the book value of plant assets? Show computat statement.) The cost of plant assets at March 31, 2018 is 4830 milion Determine the formula and enter the amounts to calculate the book value of plant assets at March 31, 2018. Cost Depreciation Book value Requirement 2. The financial statements provide three pieces of evidence that Gigantic purchased plant assets and goodwill during fiscal year 2018 1. 2 3. Requirement 3. T-accounts for Property, Plant, and Equipment, Accumulated Depreciation; and Goodwill have been prepared for you. Fill in the T-acc cash flow statements. Label each increase or decrease and give its dollar amount. (Abbreviation used. Accum. Depr. = Accumulated Depreciation. Ent Begin by completing the T-account for Property, Plant, and Equipment. Choose from any list or enter any number in the input fields and then continue to the next question MacBook Pro esc 80 000 F2 73 ODD 4 58 A E N # 3 $ 4 % 5 & 7 6 8 Requirement 3. T-accounts for Property, Plant, and Equipment; Accumulated Depreciation; and Goodwill have been prepared for you. Fill in the T-accour cash flow statements. Label each increase or decrease and give its dollar amount. (Abbreviation used: Accum. Depr. = Accumulated Depreciation. Enter a Begin by completing the T-account for Property, Plant, and Equipment Property, Plant, and Equipment Next, complete the T-account for Accumulated Depreciation. Accumulated Depreciation Choose from any list or enter any number in the input fields and then continue to the next question. MacBook Pro esc 20 DOO F2 F3 000 F $7 @ A * # 3 $ 4 2 % 5 & 7 6 8 9 W E R T Y Finally, complete the T-account for Goodwill. Goodwill Requirement 4. Prepare the journal entry for the sale of property, plant, and equipment in 2018. (Record debits fire problem statement.) Journal Entry Accounts Date Debit Credit Millions Choose from any list or enter any number in the input fields and then continue to the next question. Journal Entry Date Accounts Debit Credit Millions Choose from any list or enter any number in the input fields and then continue to the next quest