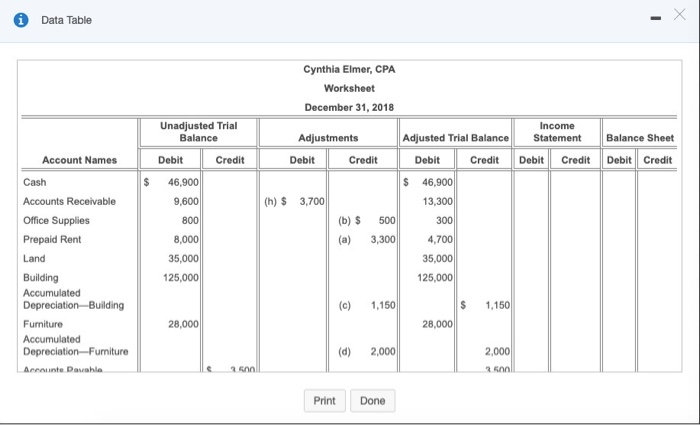

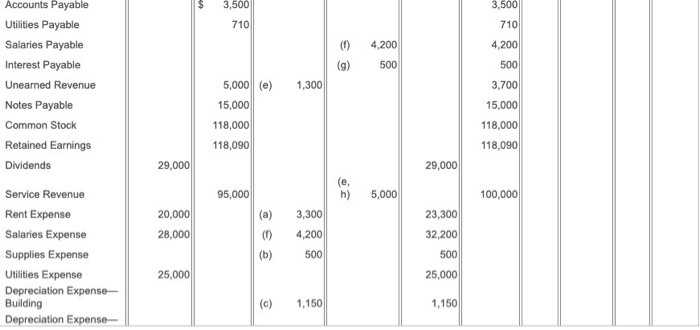

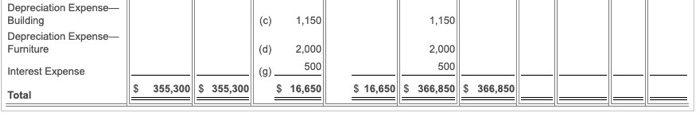

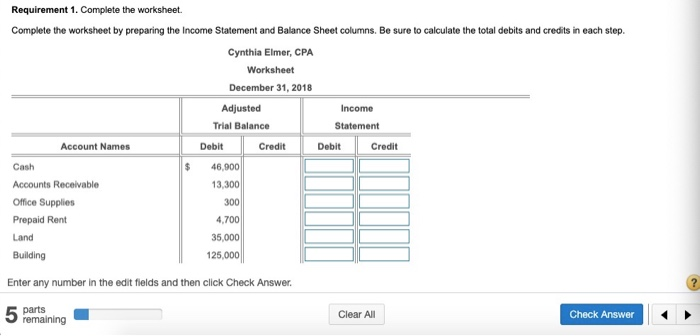

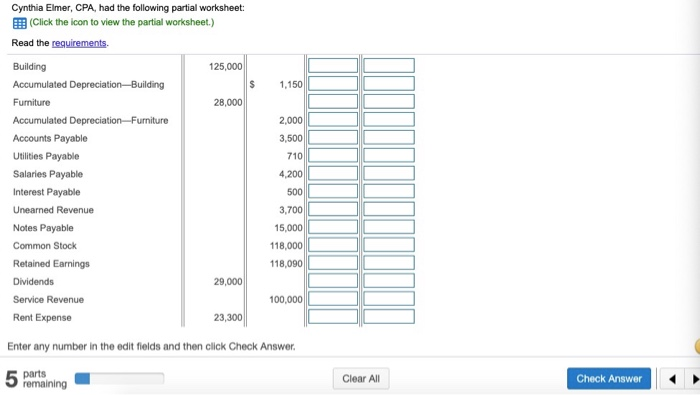

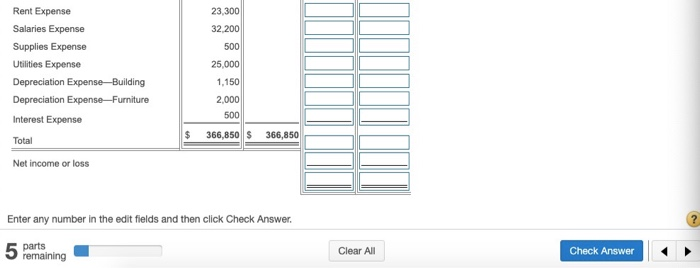

Data Table Unadjusted Trial Balance Debit Credit $ 46,900 9,600 Cynthia Elmer, CPA Worksheet December 31, 2018 Income Adjustments Adjusted Trial Balance Statement Balance Sheet Debit Credit Debit Credit Debit Credit Debit Credit $ 46,900 (h) 3,700 13,300 (b) $ 500 300 (a) 3,300 4,700 35,000 125,000 (c) 1,150 1,150 28,000 Account Names Cash Accounts Receivable Office Supplies Prepaid Rent Land Building Accumulated Depreciation-Building Furniture Accumulated Depreciation Furniture Account Davabla 800 8,000 35,000 125,000 28,000 (d) 2,000 2,000 20 250 | Print Done 3,500 3,500 710 710 (1) (9) 4,200 500 Accounts Payable Utilities Payable Salaries Payable Interest Payable Unearned Revenue Notes Payable Common Stock Retained Earnings Dividends 4,200 500 3,700 1,300 15,000 5,000 (e) 15,000 118,000 118,090 118,000 118,090 29,000 29,000 95,000 h) 5,000 100,000 3,300 20,000 28,000 (a) (1) Service Revenue Rent Expense Salaries Expense Supplies Expense Utilities Expense Depreciation Expense- Building Depreciation Expense- 4,200 500 23,300 32,200 500 25,000 25,000 (c) 1,150 1,150 (c) 1,150 1,150 Depreciation Expense- Building Depreciation Expense- Furniture Interest Expense Total (d) 2.000 2,000 500 500 (9) 355,300 $ 355,300 $ 16,650 $ 16,650 $ 366,850 $ 366,850 Requirement 1. Complete the worksheet. Complete the worksheet by preparing the Income Statement and Balance Sheet columns. Be sure to calculate the total debits and credits in each step. Cynthia Elmer, CPA Worksheet December 31, 2018 Adjusted Income Trial Balance Statement Account Names Debit Credit Debit Credit Cash $ 46.900 Accounts Receivable 13,300 Office Supplies 300 Prepaid Rent 4,700 Land 35,000 Building 125,000 Enter any number in the edit fields and then click Check Answer. 5 Permalining Clear All Check Answer $ Cynthia Elmer, CPA, had the following partial worksheet: Click the icon to view the partial worksheet.) Read the requirements Building 125,000 Accumulated Depreciation-Building $ 1,150 Furniture 28,000 Accumulated Depreciation Furniture 2,000 Accounts Payable 3,500 Utilities Payable 710 Salaries Payable 4,200 Interest Payable 500 Unearned Revenue 3,700 Notes Payable 15,000 Common Stock 118,000 Retained Earnings 118,090 Dividends 29,000 Service Revenue 100,000 Rent Expense 23,300 Enter any number in the edit fields and then click Check Answer. 5 Pemaining Clear All Check Answer 23,300 32 200 500 Rent Expense Salaries Expense Supplies Expense Utilities Expense Depreciation Expense-Building Depreciation Expense-Furniture Interest Expense Total 25,000 1,150 2,000 500 366,850 $ 366,850 Net income or loss Enter any number in the edit fields and then click Check Answer. 5 remaining Clear All Check