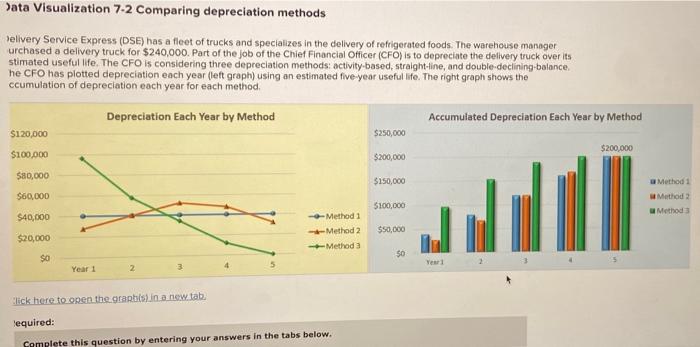

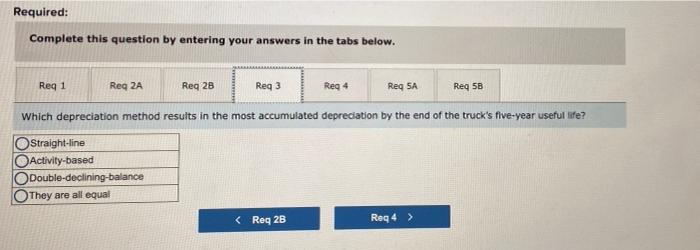

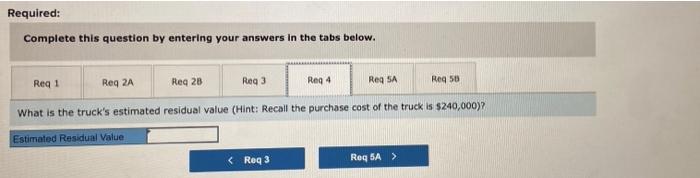

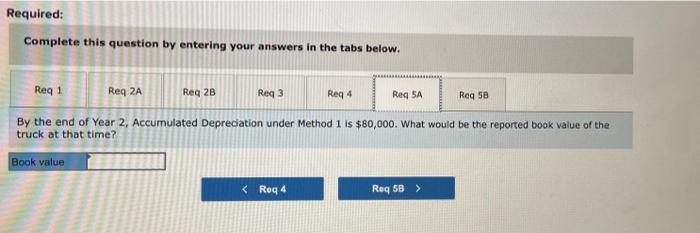

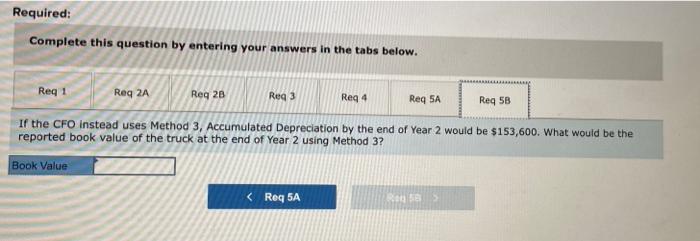

Data Visualization 7-2 Comparing depreciation methods Yelivery Service Express (DSE) has a fleet of trucks and specializes in the delivery of refrigerated foods. The warehouse manager urchased a delivery truck for $240,000. Part of the job of the Chief Financial Officer (CFO) is to depreciate the delivery truck over its stimated useful life. The CFO is considering three depreciation methods: activity based, straight-line, and double-declining balance he CFO has plotted depreciation each year (left graph) using an estimated five year useful life. The right graph shows the ccumulation of depreciation each year for each method Depreciation Each Year by Method Accumulated Depreciation Each Year by Method $120,000 $250,000 $100,000 $200,000 $200,000 $80,000 $150,000 $60,000 $100,000 $40,000 --Method 1 Method 2 $50,000 $20,000 Method a $0 50 Yeart Year 1 2 Method: Method Method Click here to open the graphis) in a new tab. Jequired: Complete this question by entering your answers in the tabs below. Required: Complete this question by entering your answers in the tabs below. Req 1 Reg 2A Reg 26 Req3 Req 4 Req SA Reg 58 Which method is depicted by each option: Method 1: Method 2: Method 3: Re Req 2A > Required: Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A Reg 28 Reg 3 Req 4 Req 5A Reg 58 Which depreciation method results in the most depreciation in the first year of the truck's five-year useful life? Straight-line Activity-based Double-declining balance They are all equal Req1 Req 2B > Required: Complete this question by entering your answers in the tabs below. Req 1 Reg 2A Reg 28 Req3 Reg 4 Reg SA Reg 58 Which depreciation method results in the same amount of depreciation each year? Straight-line Activity-based O Double-declining balance They are all equal Required: Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A Reg 28 Reg 3 Reg 4 Reg SA Reg 58 Which depreciation method results in the most accumulated depreciation by the end of the truck's five-year useful life? Straight-line Activity-based O Double-declining-balance They are all equal Required: Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A Reg 28 Reg 3 Reg 4 Reg SA Req 50 What is the truck's estimated residual value (Hint: Recall the purchase cost of the truck is $240,000) Estimated Residual Value Required: Complete this question by entering your answers in the tabs below. Reg 1 Req 2A Reg 28 Reg 3 Req 4 Reg SA Req SB By the end of Year 2, Accumulated Depreciation under Method 1 is $80,000. What would be the reported book value of the truck at that time? Book value Required: Complete this question by entering your answers in the tabs below. Req1 Req 2A Req 28 Reg 3 Reg 4 Req 5A Req 5B If the CFO instead uses Method 3, Accumulated Depreciation by the end of Year 2 would be $153,600. What would be the reported book value of the truck at the end of Year 2 using Method 3? Book Value