Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Data were collected from a random sample of 370 home sales from a community in 2003 . Let Price denote the selling price (in $1,000

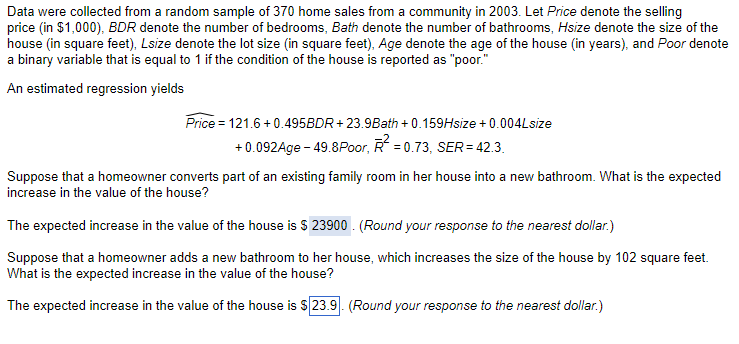

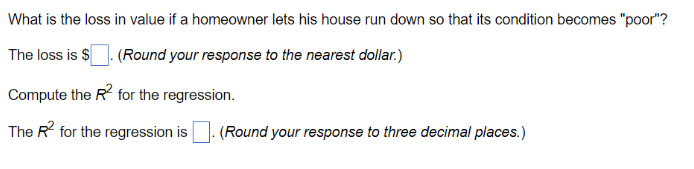

Data were collected from a random sample of 370 home sales from a community in 2003 . Let Price denote the selling price (in $1,000 ), BDR denote the number of bedrooms, Bath denote the number of bathrooms, Hsize denote the size of the house (in square feet), Lsize denote the lot size (in square feet), Age denote the age of the house (in years), and Poor denote a binary variable that is equal to 1 if the condition of the house is reported as "poor." An estimated regression yields Price=121.6+0.495BDR+23.9Bath+0.159Hsize+0.004Lsize+0.092Age49.8Poor,R2=0.73,SER=42.3. Suppose that a homeowner converts part of an existing family room in her house into a new bathroom. What is the expected increase in the value of the house? The expected increase in the value of the house is $ (Round your response to the nearest dollar.) Suppose that a homeowner adds a new bathroom to her house, which increases the size of the house by 102 square feet. What is the expected increase in the value of the house? The expected increase in the value of the house is $ (Round your response to the nearest dollar.) What is the loss in value if a homeowner lets his house run down so that its condition becomes "poor"? The loss is $ (Round your response to the nearest dollar.) Compute the R2 for the regression. The R2 for the regression is . (Round your response to three decimal places.)

Data were collected from a random sample of 370 home sales from a community in 2003 . Let Price denote the selling price (in $1,000 ), BDR denote the number of bedrooms, Bath denote the number of bathrooms, Hsize denote the size of the house (in square feet), Lsize denote the lot size (in square feet), Age denote the age of the house (in years), and Poor denote a binary variable that is equal to 1 if the condition of the house is reported as "poor." An estimated regression yields Price=121.6+0.495BDR+23.9Bath+0.159Hsize+0.004Lsize+0.092Age49.8Poor,R2=0.73,SER=42.3. Suppose that a homeowner converts part of an existing family room in her house into a new bathroom. What is the expected increase in the value of the house? The expected increase in the value of the house is $ (Round your response to the nearest dollar.) Suppose that a homeowner adds a new bathroom to her house, which increases the size of the house by 102 square feet. What is the expected increase in the value of the house? The expected increase in the value of the house is $ (Round your response to the nearest dollar.) What is the loss in value if a homeowner lets his house run down so that its condition becomes "poor"? The loss is $ (Round your response to the nearest dollar.) Compute the R2 for the regression. The R2 for the regression is . (Round your response to three decimal places.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started