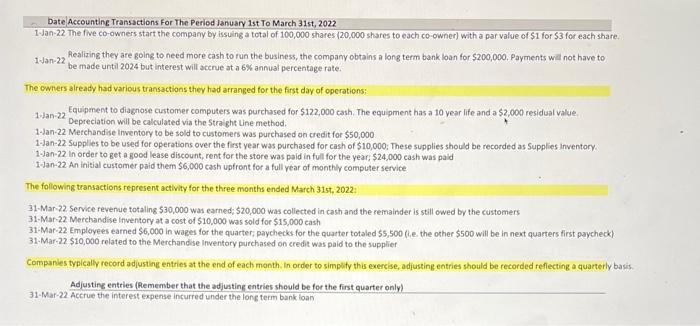

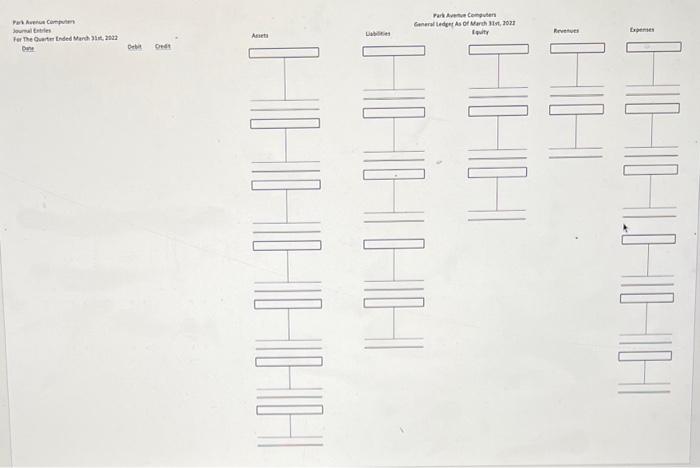

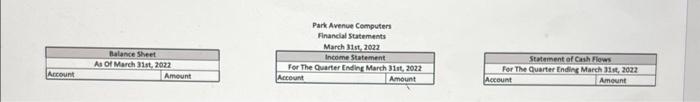

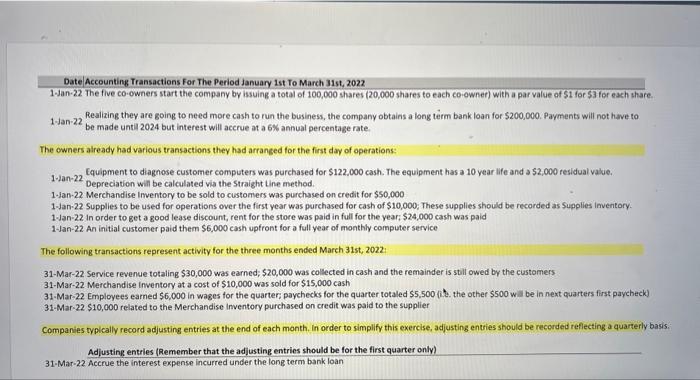

Date Accounting Transactions For The Period January 1st To March 315t,2022 1-Jan-22. The five co-owners start the company by issuling a total of 100,000 shares (20,000 shares to each co-owner) with a par value of $1 for $3 for each share. 1.Jan-22 Realizing they are going to need more cash to run the business, the company obtains a long term bank loan for $200,000. Payments will not have to 10 an-22 be made until 2024 but interest will accrue at a 6% annual percentage rate. The cwhers already had various transactions they had arranged for the first day of operations: 1.Jan-22 Equipment to diagnose customer computers was purchased for 5122,000 cash, The equipment has a 10 year life and a $2,000 residual value 17an-22 Depreciation will be calculated via the 5 traight line method. 1-lan-22 Merchandise inventory to be sold to customers was purchased on credit for $50,000 1-Jan-22 Supplies to be used for operations over the first year was purchased for cash of $10,000; These supplies should be recorded as Supplies inventory. 1-Jan-22 In order to get a good lease discount, rent for the store was paid in full for the year; $24,000 cash was paid 1-Jan-22 An initial customer paid them $6,000 cash upfront for a full year of monthly computer service The following transactions represent activity for the three months ended March 31st, 2022: 31-Mar-22 Service revenue totaling 530,000 was earned; 520,000 was collected in cash and the remainder is still owed by the customers 31-Mar-22. Merchandise ifventory at a cost of $10,000 was sold for $15,000 cash 31-Mar-22. Employees earned $6,000 in wages for the quarter; paychecks for the quarter totaled 55,500 (i.e the other $500 will be in next quarters first paycheck) 31-Mar-22 $10,000 related to the Merchandise inventory purchased on credit was paid to the supplier Companles typlcally record adjusting entries at the end of each month. In order to simplity this exereise, adjusting entries should be recorded reflecting a quarterly basis. 31-Nar-22 Adjusting entries (Remember that the adjusting entries should be for the first quarter only) 31-Mar-22 Accrue the interest expense incurred under the lone term bank loan Fet Auenut conputer Hounulitiles Fer pe Giate tnded Mant 3lit, 2ta2 \begin{tabular}{l} Asseta \\ \\ \hline \end{tabular} Punt. ' Crett Park Avenue Cemputers Financlal Statements \begin{tabular}{|l|c|} \hline \multicolumn{3}{|c|}{ Balance Sheet } \\ \hline Arrount & As of March 31st, 2022 \\ \hline \multicolumn{2}{|c|}{ Amount } \\ \hline \end{tabular} Date Accounting Transactions For The Period January 1st To March 31st, 2022 1-Jan-22. The five co-owners start the company by issuing a total of 100,000 shares (20,000 shares to each co-owner) with a par value of $1 for $3 for each share. 1-jan-22 Realizing they are going to need more cash to run the business, the company obtains a long term bank loan for $200,000. Payments will not have to 1-Jan-22 be made until 2024 but interest will accrue at a 6% annual percentage rate. The owners aiready had various transactions they had arranged for the first day of aperations: 1-2an-22 Cquipment to diagnose customer computers was purchased for $122,000 cash. The equipment has a 10 year life and a 52,000 residual vakue. 1.2an-22 Depreciation will be calculated via the Straight Line method. 1-Jan-22 Merchandise Imventory to be sold to customers was purchased on credit for $50,000 1-Jan-22 Supplies to be used for operations over the first year was purchased for cash of $10,000; These supplies should be recorded as Supplies inventory. 1-Jan-22 in order to get a good lease discount, rent for the store was paid in full for the year; $24,000 cash was paid 1-Jan-22 An initial customer paid them $6,000 cash upfront for a full year of monthly computer service The following transactions represent activity for the three months ended March 31st, 2022. 31-Mar-22. Service revenue totaling $30,000 was earned; $20,000 was collected in cash and the remainder is still owed by the customers 31-Mar-22 Merchandise inventory at a cost of $10,000 was sold for $15,000cash 31 -Mar-22 Employees earned $6,000 in wages for the quarter; paychecks for the quarter totaled $5,500 (i.t. the other $500 will be in next quarters first paycheck) 31Mar22$10,000 related to the Merchandise inventory purchased on credit was paid to the supplier Companies typically record adjusting entries at the end of each month, In order to simpilfy this exercise, adjusting entries should be recorded reflecting a quarterly basis. Adjusting entries (Remember that the adjusting entries should be for the first quarter only) 31 Mar-22 Accrue the interest expense incurred under the long term bank loan Park Avenue Computers Financial Statements \begin{tabular}{|l|l|} \hline \multicolumn{3}{|c|}{ Balance Sheet } \\ \hline \multicolumn{2}{|c|}{ As of March 31st, 202n } \\ \hline Aecpunt & Amosnt \\ \hline \end{tabular}