Answered step by step

Verified Expert Solution

Question

1 Approved Answer

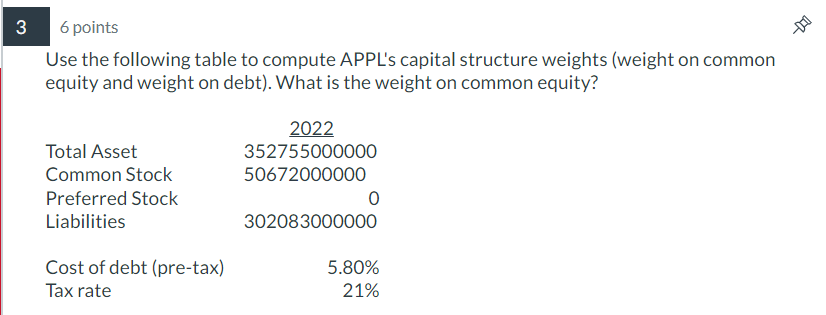

Date APPL SPY Capital structure and WACC 1/1/2018 39.80228 258.8217 2022 2/1/2018 42.34356 249.4108 Total Asset 352755000000 3/1/2018 40.0481 241.6068 Common Stock 50672000000 4/1/2018 39.44659

| Date | APPL | SPY | Capital structure and WACC | |||

| 1/1/2018 | 39.80228 | 258.8217 | 2022 | |||

| 2/1/2018 | 42.34356 | 249.4108 | Total Asset | 352755000000 | ||

| 3/1/2018 | 40.0481 | 241.6068 | Common Stock | 50672000000 | ||

| 4/1/2018 | 39.44659 | 243.8281 | Preferred Stock | 0 | ||

| 5/1/2018 | 44.60477 | 249.7553 | Liabilities | 302083000000 | ||

| 6/1/2018 | 44.35506 | 250.0687 | ||||

| 7/1/2018 | 45.59626 | 260.4974 | Cost of debt (pre-tax) | 5.80% | ||

| 8/1/2018 | 54.54347 | 268.8124 | Tax rate | 21% | ||

| 9/1/2018 | 54.2803 | 269.192 | ||||

| 10/1/2018 | 52.62597 | 251.7241 | ||||

| 11/1/2018 | 42.94046 | 256.3934 | ||||

| 12/1/2018 | 38.06171 | 232.4609 | FCFF and Firm Value | |||

| 1/1/2019 | 40.16097 | 252.5392 | 2021 | 2022 | ||

| 2/1/2019 | 41.78004 | 260.7255 | Total Current Assets | 134836000000 | 135405000000 | |

| 3/1/2019 | 46.03035 | 264.2806 | Total Current Liabilities | 125481000000 | 153982000000 | |

| 4/1/2019 | 48.62812 | 276.2887 | ||||

| 5/1/2019 | 42.42451 | 258.6695 | Capital spending | 22354000000 | ||

| 6/1/2019 | 48.14642 | 275.3303 | ||||

| 7/1/2019 | 51.82454 | 280.8525 | EBIT | 119437000000 | ||

| 8/1/2019 | 50.77851 | 276.1501 | Depreciation | 11104000000 | ||

| 9/1/2019 | 54.69039 | 280.2293 | Taxes | 19300000000 | ||

| 10/1/2019 | 60.74378 | 287.7464 | ||||

| 11/1/2019 | 65.25878 | 298.1623 | ||||

| 12/1/2019 | 71.92059 | 305.3244 | ||||

| 1/1/2020 | 75.80501 | 306.7016 | ||||

| 2/1/2020 | 66.95116 | 282.4214 | ||||

| 3/1/2020 | 62.42836 | 245.7101 | ||||

| 4/1/2020 | 72.12809 | 278.5396 | ||||

| 5/1/2020 | 78.05447 | 291.8107 | ||||

| 6/1/2020 | 89.80107 | 295.6846 | ||||

| 7/1/2020 | 104.6301 | 314.476 | ||||

| 8/1/2020 | 127.0606 | 336.4253 | ||||

| 9/1/2020 | 114.2392 | 322.5373 | ||||

| 10/1/2020 | 107.3834 | 315.7542 | ||||

| 11/1/2020 | 117.4352 | 350.1009 | ||||

| 12/1/2020 | 131.116 | 361.5305 | ||||

| 1/1/2021 | 130.3947 | 359.3717 | ||||

| 2/1/2021 | 119.8216 | 369.3642 | ||||

| 3/1/2021 | 120.8814 | 384.8726 | ||||

| 4/1/2021 | 130.0947 | 406.5636 | ||||

| 5/1/2021 | 123.3159 | 409.2331 | ||||

| 6/1/2021 | 135.7679 | 417.0468 | ||||

| 7/1/2021 | 144.5904 | 428.6256 | ||||

| 8/1/2021 | 150.5084 | 441.3815 | ||||

| 9/1/2021 | 140.4785 | 419.4669 | ||||

| 10/1/2021 | 148.7186 | 450.3362 | ||||

| 11/1/2021 | 164.1067 | 446.7179 | ||||

| 12/1/2021 | 176.5454 | 465.7413 | ||||

| 1/1/2022 | 173.7715 | 442.7275 | ||||

| 2/1/2022 | 164.1672 | 429.6595 | ||||

| 3/1/2022 | 173.8236 | 444.4299 | ||||

| 4/1/2022 | 156.94 | 406.6822 | ||||

| 5/1/2022 | 148.1697 | 407.6002 | ||||

| 6/1/2022 | 136.3042 | 372.3807 | ||||

| 7/1/2022 | 162.0158 | 408.429 | ||||

| 8/1/2022 | 156.7419 | 391.7643 | ||||

| 9/1/2022 | 137.9711 | 354.0927 | ||||

| 10/1/2022 | 153.086 | 384.4446 | ||||

| 11/1/2022 | 147.7849 | 405.8165 | ||||

| 12/1/2022 | 132.37 | 378.2829 | ||||

| 12/19/2022 | 132.37 | 380.02 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started