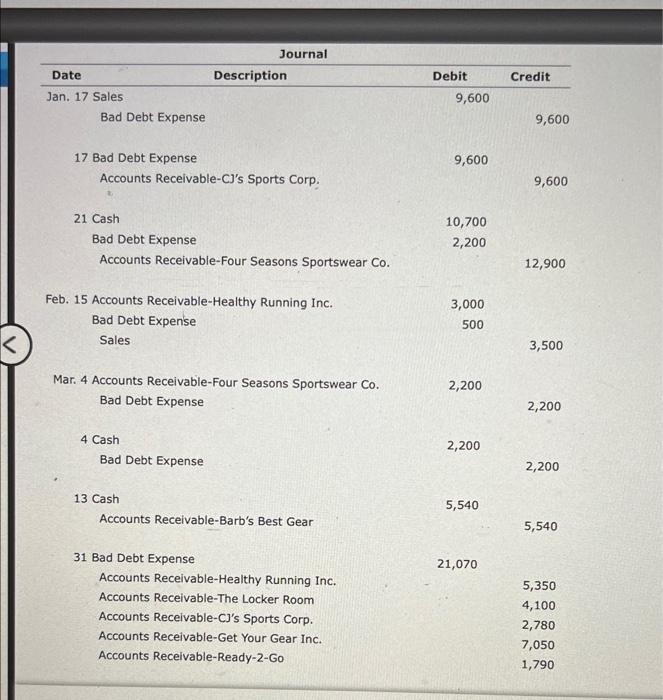

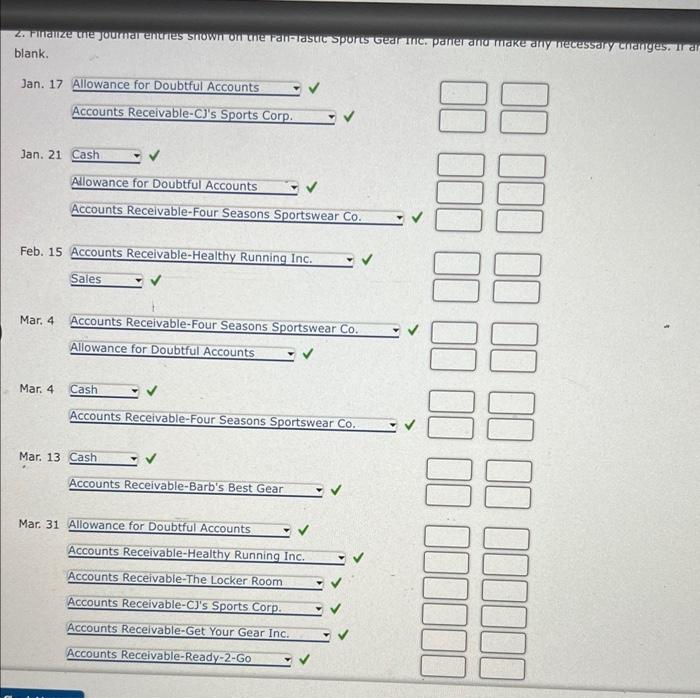

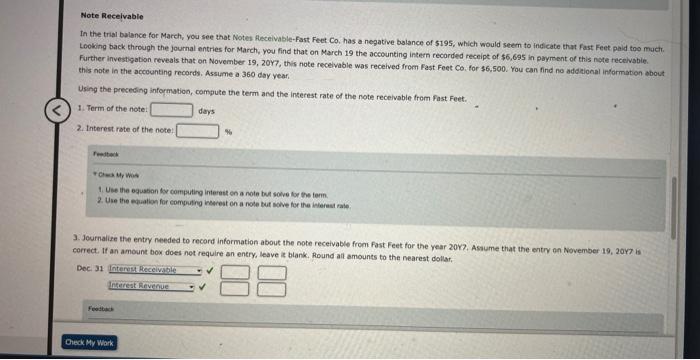

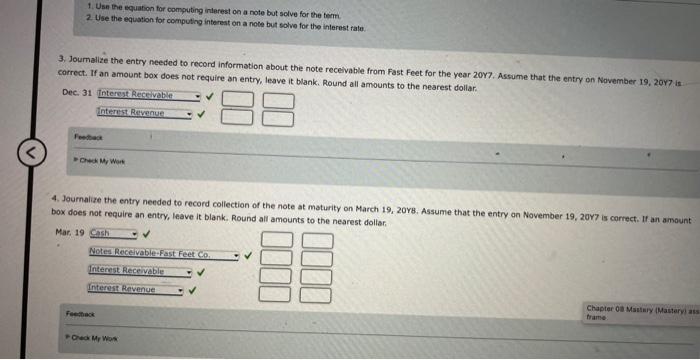

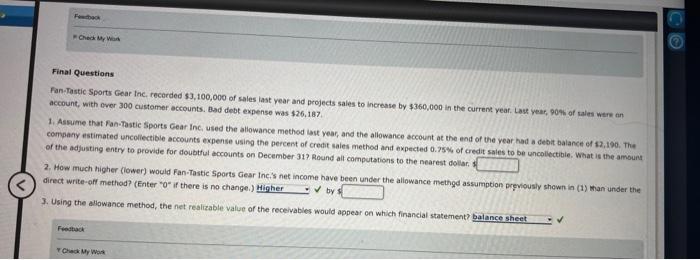

Date Jan. 17 Sales Bad Debt Expense 17 Bad Debt Expense Accounts Receivab 21 Cash Bad Debt Expense Accounts Receivab Feb. 15 Accounts Receivable Bad Debt Expense Sales Journal Mar. 4 Accounts Receivable-Four Seasons Sportswear Bad Debt Expense 4 Cash Bad Debt Expense 13 Cash Accounts Receivable-Barb's Best Gear 31 Bad Debt Expense Accounts Receivable-Healthy Running Inc. Accounts Receivable-The Locker Room Accounts Receivable-CJ's Sports Corp. Accounts Receivable-Get Your Gear Inc. Accounts Receivable-Ready-2-Go salynertainges. in a Note Recelvable In the trial balance for March, you see that Notes Pleceivable-Fast Feet Co, has a negative balance of 5195 , which would seem to indicate that Fast Feet paid too mach. Looking back through the journal entries for March, you find that on March 19 the accounting intern recorded receipt of $6,695 in payment of this note receivabie. Further investigabon reveals that on November 19, 20Y7, this note recelvable was recelved from Fast Feet Co. for 36,500 . You can find no addional information about this note in the accounting records. Assume a. 360 day year, Using the preceding information, compute the term and the inserest rate of the note recelvable from fast. Feet. 1. Term of the note: days 2. Interest rate of the note: Pestant + ciess Mr wos 1. Uee the equasion for computirg interett on a nole best sove for the ferm. 2. Use the equalion for computing inewrest on a note tut sove for the ieterast rale. 3. Jeurnalize the entey needed to record information about the note receivable from fast feet tor the year 20 y?. Assume that the entry on November 19, 20y7 is correct. If an amount box does not require an entry, leave it blank, Round alt amounts to the nearest dollar. Dec: 31 1. Use the equation for computing interest on a note but solve for the tem. 2. Use the equation for computing interest on a note but solve for the inlerest tale. 3. Joumalize the entry needed to record information about the note receivable from Fast Feet for the year 20y7. Assume that the entry on November 19, 20y7. is correct. If an amount box does not require an entry, leave it blank. Round all amounts to the nearest dollar. Dec. 31 Ches My wort 4. Journalize the entry needed to record collection of the note at maturity on March 19, 20Y8, Assume that the entry an November 19 , 20y7 is correct. If an amount box does not require an entry, leave it blank. Round all amounts to the nearest dollar. Final Questions Fan-Tastic Sports Gear Inc, recorded $3,100,000 of sales last year and projecis sales to increase by 3360,000 in the current year. Lase year, 904 of tales were tin account, with over 300 customer accounts. Bad debt expense was $26,187. 1. Assume that Fan-7astic Sports Cear Inc, used the allowance method last year, and the allowance account at the end of the year had a debit balance of 12 , 190. The company estimated uncoliectible accounts expense using the percent of credit sales method and expected 0.75% of credit sales to be uncollectible. What is the ambury of the adjusting entry to provide for doubtful accounts on December 31 ? Round alt computations to the nearest dollar, 1 2. How much higher (lower) would Fan-Tastic Sports Gear Incis net income have been under the allowance methgd assumption previously shewn in (1) than under the direct write-off method? (Enter 2Oif there is no change.) 3. Using the allowance method, the net realizable value of the receivables would appear on which financial statement? Feestuack