Answered step by step

Verified Expert Solution

Question

1 Approved Answer

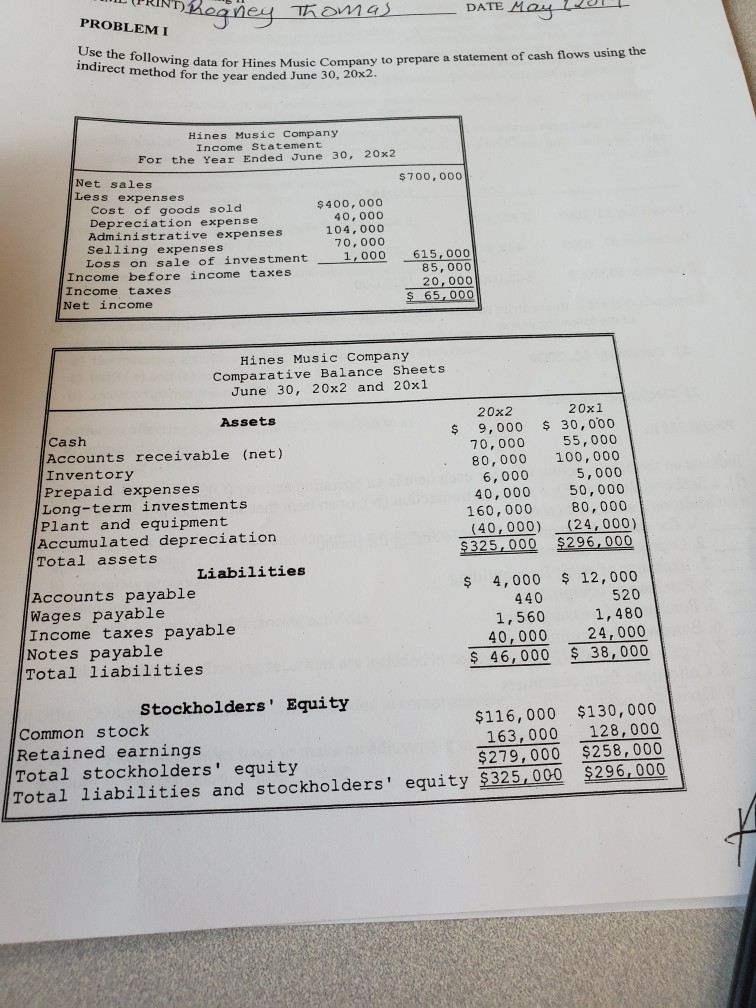

DATE MO PROBLEM I Use the following data Music indirect method for the year ended June 5 a for Hines Music Company to prepare a

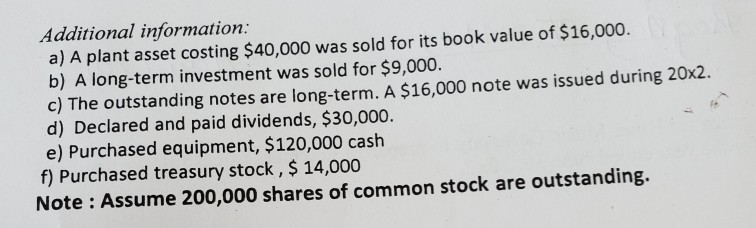

DATE MO PROBLEM I Use the following data Music indirect method for the year ended June 5 a for Hines Music Company to prepare a statement of cash flows using the 0, 20x2 Hines Music Company Income Statement For the Year Ended June 30, 20x2 Net sales Less expenses $700, 000 $400,000 40,000 104, 000 70,000 1,000 Cost of goods sold Depreciation expense Administrative expenses Selling expenses Loss on sale of investment 615,000 85,000 20, 000 Income before income taxes Income taxes Net income Hines Music Company Comparative Balance Sheets June 30, 20x2 and 20x1 20x1 20x2 Assets $ 9,000 30,000 Cash 70,000 55,000 80,000 100,000 6,000 5,000 40,000 50,000 Accounts receivable (net) Inventory Prepaid expenses Long-term investments Plant and equipment Accumulated depreciation Total assets 80,000 160,000 (40, 000) (24,000) $325,000 $296,000 Liabilities $ 4,000 12,000 Accounts payable Wages payable Income taxes payable Notes payable Total liabilities 520 1,480 24, 000 38, 000 440 1,560 40,000 46, 000 Stockholders' Equity $116,000 $130, 000 163,000 128,000 $279,000 $258,000 Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $325,000 $296 000 Additional information: a) A plant asset costing $40,000 was sold for its book value of $16,000. b) A long-term investment was sold for $9,000. c) The outstanding notes are long-term. A $16,000 note was issued during 20x2. d) Declared and paid dividends, $30,000. e) Purchased equipment, $120,000 cash f) Purchased treasury stock, $ 14,000 Note : Assume 200,000 shares of common stock are outstanding

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started