Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dates the vhicl ws ued tof buinss; purpose of the trip; miles traveled for business; miles traveled for commuting; total miles the vehicle was driven

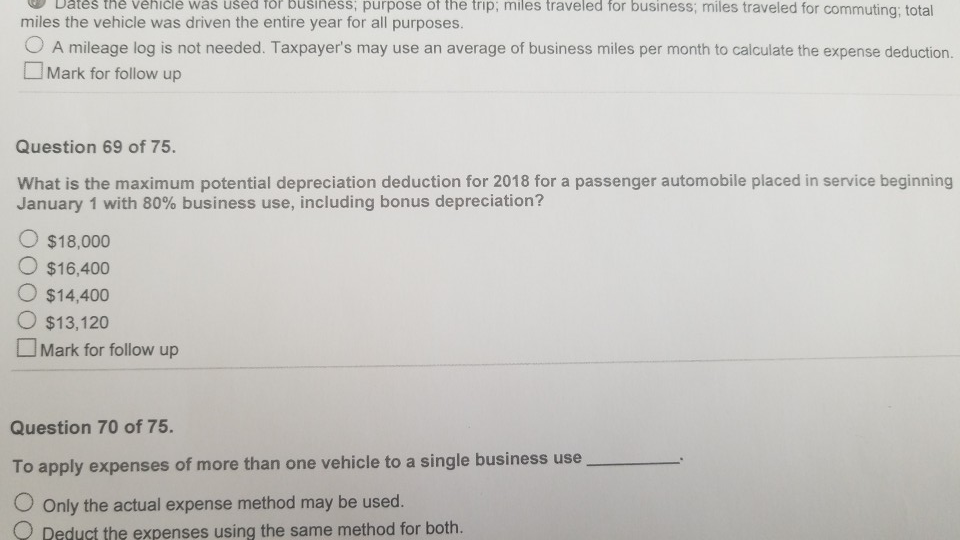

Dates the vhicl ws ued tof buinss; purpose of the trip; miles traveled for business; miles traveled for commuting; total miles the vehicle was driven the entire year for all purposes. 0 A mileage log is not needed. Taxpayer's may use an average of business miles per month to calculate the expense deduction. [] Mark for follow up Question 69 of 75 What is the maximum potential depreciation deduction for 2018 for a passenger automobile placed in service beginning January 1 with 80% business use, including bonus depreciation? O$18,000 O $16,400 O $14,400 $13,120 Mark for follow up Question 70 of 75. To apply expenses of more than one vehicle to a single business use O Only the actual expense method may be used. Reduct the expenses using the same method for both

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started