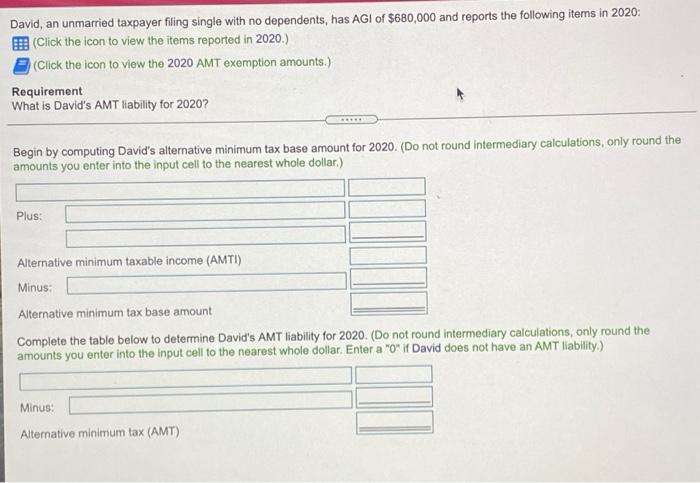

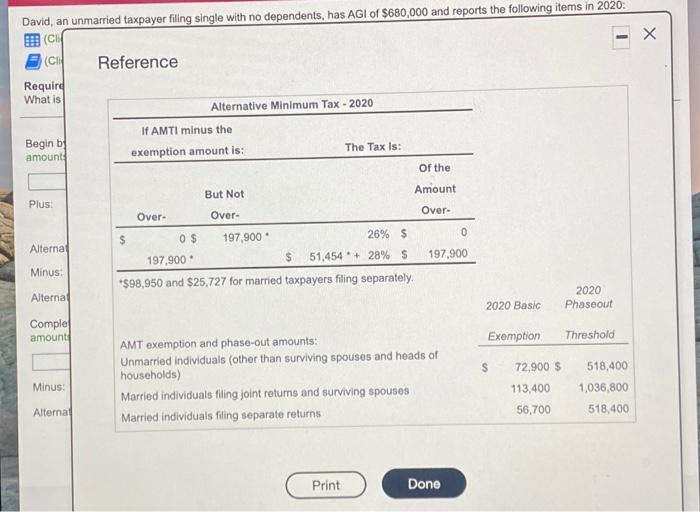

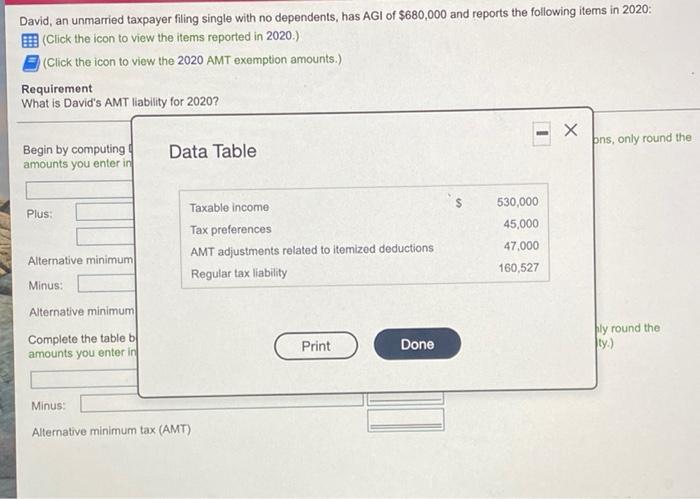

David, an unmarried taxpayer filing single with no dependents, has AGI of $680,000 and reports the following items in 2020: Click the icon to view the items reported in 2020.) (Click the icon to view the 2020 AMT exemption amounts.) Requirement What is David's AMT liability for 2020? Begin by computing David's alternative minimum tax base amount for 2020. (Do not round intermediary calculations, only round the amounts you enter into the input cell to the nearest whole dollar) Plus: Alternative minimum taxable income (AMTI) Minus: Alternative minimum tax base amount Complete the table below to determine David's AMT liability for 2020. (Do not round intermediary calculations, only round the amounts you enter into the input cell to the nearest whole dollar. Enter a "o" if David does not have an AMT liability.) Minus: Alternative minimum tax (AMT) - I 1 David, an unmarried taxpayer filing single with no dependents, has AGI of $680,000 and reports the following items in 2020 CH (CO Reference Require What is Alternative Minimum Tax - 2020 If AMTI minus the Begin bed amount exemption amount is: The Tax is: of the But Not Amount Plus Over- Over- Over- Alterna 0 197.900 $ 0$ 197,900 26% $ 197,900 $ 51,454 + 28% $ *$98,950 and $25,727 for married taxpayers filing separately. Minus: Alterna 2020 Phaseout 2020 Basic Comple amount Exemption Threshold $ Minus: AMT exemption and phase-out amounts: Unmarried individuals (other than surviving spouses and heads of households) Married individuals filing joint retums and surviving spouses Married individuals filing separate returns 72,900 $ 113.400 56,700 518,400 1,036,800 518,400 Alterna Print Done David, an unmarried taxpayer filing single with no dependents, has AGI of $680,000 and reports the following items in 2020: (Click the icon to view the items reported in 2020.) (Click the icon to view the 2020 AMT exemption amounts.) Requirement What is David's AMT liability for 2020? - x ns, only round the Begin by computing amounts you enter in Data Table $ Plus: Taxable income Tax preferences AMT adjustments related to itemized deductions Regular tax liability 530,000 45,000 47,000 160,527 Alternative minimum Minus: Alternative minimum Complete the table | amounts you enter in hly round the ty.) Print Done Minus Alternative minimum tax (AMT)