Answered step by step

Verified Expert Solution

Question

1 Approved Answer

David Kweya started a business of selling children's clothes on 1 July 2016. He commenced the business with a capital of Sh. 14,000,000. He

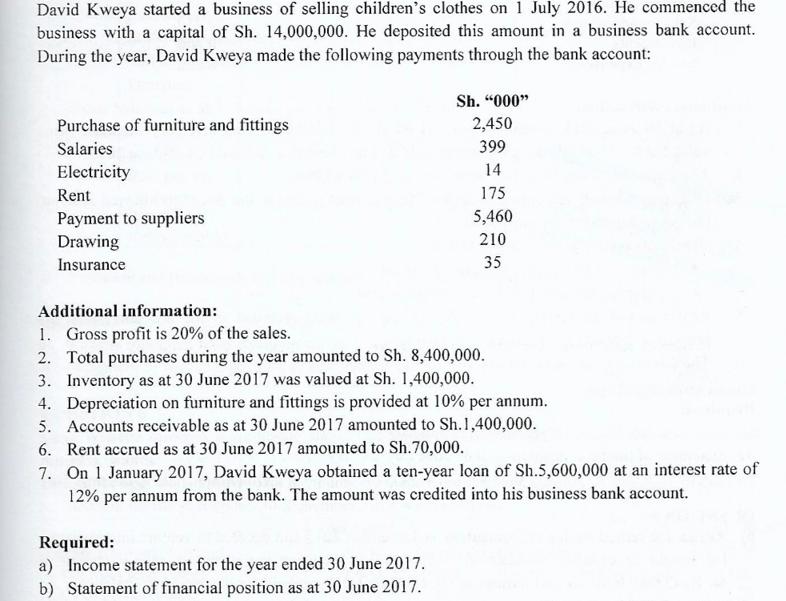

David Kweya started a business of selling children's clothes on 1 July 2016. He commenced the business with a capital of Sh. 14,000,000. He deposited this amount in a business bank account. During the year, David Kweya made the following payments through the bank account: Purchase of furniture and fittings Salaries Electricity Rent Payment to suppliers Drawing Insurance Sh. "000" 2,450 399 14 175 5,460 210 35 Additional information: 1. Gross profit is 20% of the sales. 2. Total purchases during the year amounted to Sh. 8,400,000. 3. Inventory as at 30 June 2017 was valued at Sh. 1,400,000. 4. Depreciation on furniture and fittings is provided at 10% per annum. 5. Accounts receivable as at 30 June 2017 amounted to Sh. 1,400,000. 6. Rent accrued as at 30 June 2017 amounted to Sh.70,000. 7. On 1 January 2017, David Kweya obtained a ten-year loan of Sh.5,600,000 at an interest rate of 12% per annum from the bank. The amount was credited into his business bank account. Required: a) Income statement for the year ended 30 June 2017. b) Statement of financial position as at 30 June 2017.

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Lets calculate the values Sales 20 8400000 1680000 Cost of Goods Sold 8400000 1680000 6720000 Gross ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started