Question

Davis Company uses an absorption costing system based on standard costs. Total variable manufacturing costs, including direct material and labour costs, are $ 3 ?per

Davis Company uses an absorption costing system based on standard costs. Total variable manufacturing costs, including direct material and labour costs, are $ ?per unit. The standard production rate is ?units per machinehour.

Total budgeted and actual fixed manufacturing overhead costs are $

Fixed Manufacturing overhead was allocated at $ ?per machinehour. $ ?machinehours at denominator level

The selling price is $ ?per unit.

Variable marketing and administrative costs, which are driven by units sold, are $ ?per unit.

Fixed marketing and administrative costs are $

Beginning inventory in ?was ?units.

Ending inventory in ?is ?units.

Sales in ?are ?units.

So how many did we produce?

The same standard unit costs persisted throughout ?and

Variable overhead spending and efficiency variances total $ ?Unfavourable. No need to calculate these.

Fixed overhead spending variance will calculate to zero.

Calculate Fixed Denominator Production Volume ?variance, if applicable.

REQUIRED:

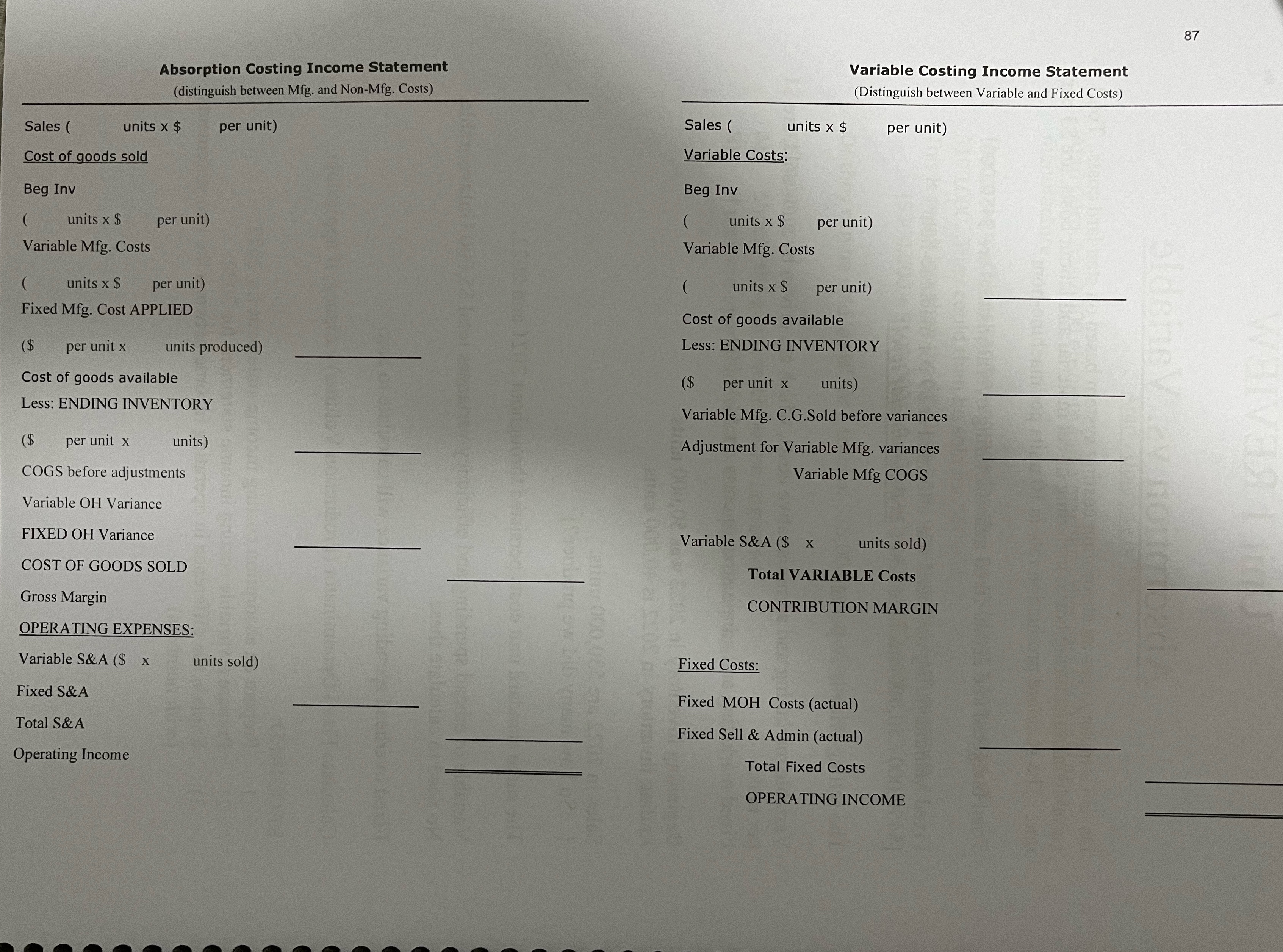

Prepare an absorption costing income statement for

Prepare a variable costing income statement for

Explain the difference in operating income between the two statements with numbers

Absorption Costing Income Statement (distinguish between Mfg. and Non-Mfg. Costs) units x $ per unit) Sales ( Cost of goods sold Beg Inv ) units x $ per unit) Variable Mfg. Costs ( units x $ per unit) Fixed Mfg. Cost APPLIED ($ per unit x units produced) Cost of goods available Less: ENDING INVENTORY ($ per unit x units) COGS before adjustments Variable OH Variance FIXED OH Variance COST OF GOODS SOLD Gross Margin OPERATING EXPENSES: Variable S&A ($ X units sold) e Fixed S&A Total S&A Operating Income ating 000.0825190 Tooning ew bib yasma? $500 bmx 1500 orqa bosing209 ser/ampronto bonibasqa besch Variable Costing Income Statement (Distinguish between Variable and Fixed Costs) Sales ( Variable Costs: units x $ per unit) Beg Inv ) units x $ per unit) Variable Mfg. Costs ( units x $ per unit) Cost of goods available Less: ENDING INVENTORY ($ per unit x units) Variable Mfg. C.G.Sold before variances Adjustment for Variable Mfg. variances Variable Mfg COGS Variable S&A (S X units sold) Total VARIABLE Costs CONTRIBUTION MARGIN Fixed Costs: Fixed MOH Costs (actual) Fixed Sell & Admin (actual) Total Fixed Costs OPERATING INCOME 87 22

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started