Answered step by step

Verified Expert Solution

Question

1 Approved Answer

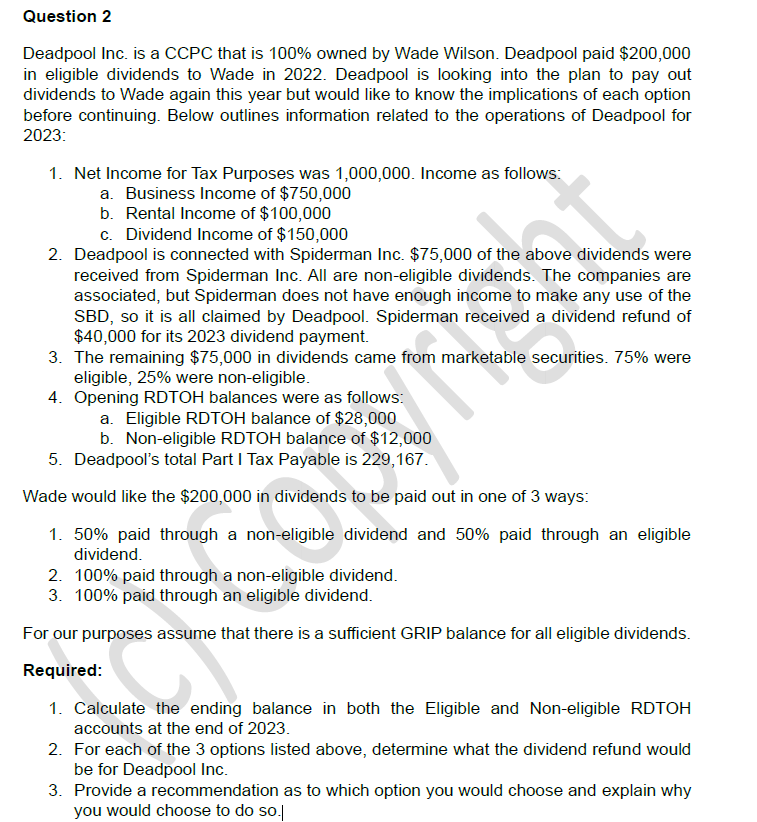

Deadpool Inc. is a CCPC that is 1 0 0 % owned by Wade Wilson. Deadpool paid $ 2 0 0 , 0 0 0

Deadpool Inc. is a CCPC that is owned by Wade Wilson. Deadpool paid $ in eligible dividends to Wade in Deadpool is looking into the plan to pay out dividends to Wade again this year but would like to know the implications of each option before continuing. Below outlines information related to the operations of Deadpool for : Question

Deadpool Inc. is a CCPC that is owned by Wade Wilson. Deadpool paid $

in eligible dividends to Wade in Deadpool is looking into the plan to pay out

dividends to Wade again this year but would like to know the implications of each option

before continuing. Below outlines information related to the operations of Deadpool for

:

Net Income for Tax Purposes was Income as follows:

a Business Income of $

b Rental Income of $

c Dividend Income of $

Deadpool is connected with Spiderman Inc. $ of the above dividends were

received from Spiderman Inc. All are noneligible dividends. The companies are

associated, but Spiderman does not have enough income to make any use of the

SBD so it is all claimed by Deadpool. Spiderman received a dividend refund of

$ for its dividend payment.

The remaining $ in dividends came from marketable securities were

eligible, were noneligible.

Opening RDTOH balances were as follows:

a Eligible RDTOH balance of $

b Noneligible RDTOH balance of $

Deadpool's total Part I Tax Payable is

Wade would like the $ in dividends to be paid out in one of ways:

paid through a noneligible dividend and paid through an eligible

dividend.

paid through a noneligible dividend.

paid through an eligible dividend.

For our purposes assume that there is a sufficient GRIP balance for all eligible dividends.

Required:

Calculate the ending balance in both the Eligible and Noneligible RDTOH

accounts at the end of

For each of the options listed above, determine what the dividend refund would

be for Deadpool Inc.

Provide a recommendation as to which option you would choose and explain why

you would choose to do so

Net Income for Tax Purposes was Income as follows:

a

Business Income of $

b

Rental Income of $

c

Dividend Income of $

Deadpool is connected with Spiderman Inc. $ of the above dividends were received from Spiderman Inc. All are noneligible dividends. The companies are associated, but Spiderman does not have enough income to make any use of the SBD so it is all claimed by Deadpool. Spiderman received a dividend refund of $ for its dividend payment.

The remaining $ in dividends came from marketable securities were eligible, were noneligible.

Opening RDTOH balances were as follows:

a

Eligible RDTOH balance of $

b

Noneligible RDTOH balance of $

Deadpools total Part I Tax Payable is

Wade would like the $ in dividends to be paid out in one of ways:

paid through a noneligible dividend and paid through an eligible dividend.

paid through a noneligible dividend.

paid through an eligible dividend.

For our purposes assume that there is a sufficient GRIP balance for all eligible dividends.

Required:

Calculate the ending balance in both the Eligible and Noneligible RDTOH accounts at the end of

For each of the options listed above, determine what the dividend refund would be for Deadpool Inc.

Provide a recommendation as to which option you would choose and explain why you would choose to do so

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started