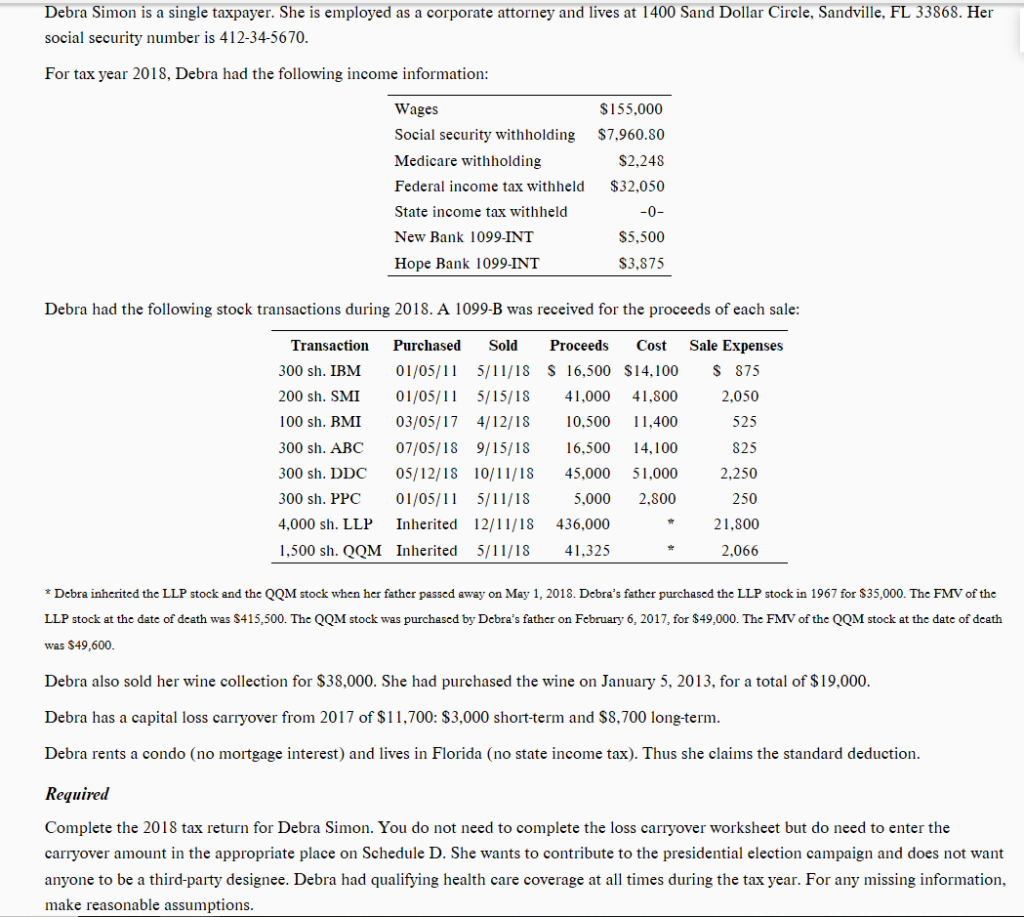

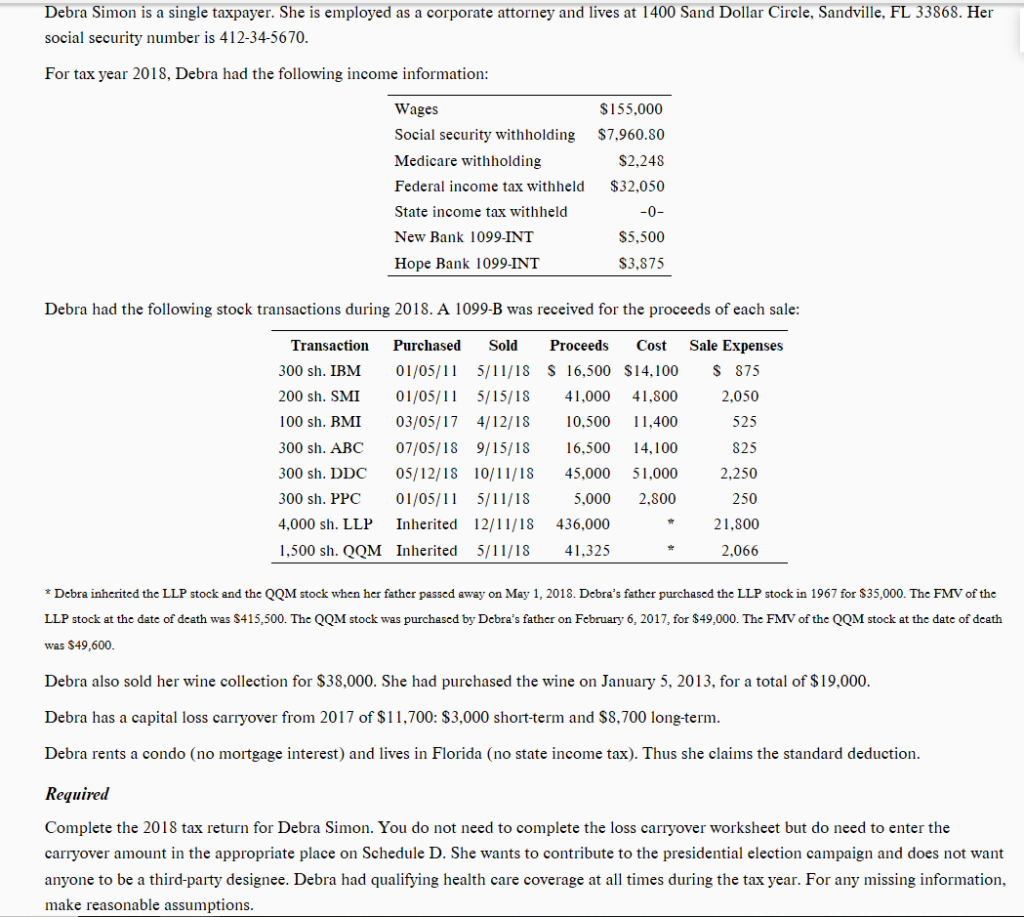

Debra Simon is a single taxpayer. She is employed as a corporate attorney and lives at 1400 Sand Dollar Circle, Sandville, FL 33868. Her social security number is 412-34-5670. For tax year 2018, Debra had the following income information: Wages Social security withholding Medicare withholding Federal income tax withheld State income tax withheld New Bank 1099-INT Hope Bank 1099-INT $ 155,000 $7,960.80 $2,248 $32,050 -0- $5,500 $3,875 Debra had the following stock transactions during 2018. A 1099-B was received for the proceeds of each sale: Transaction 300 sh. IBM 200 sh. SMI 100 sh. BMI 300 sh. ABC 300 sh. DDC 300 sh. PPC 4,000 sh. LLP 1,500 sh. QQM Purchased 01/05/11 01/05/11 03/05/17 07/05/18 05/12/18 01/05/11 Inherited Inherited Sold 5/11/18 5/15/18 4/12/18 9/15/18 10/11/18 5/11/18 12/11/18 5/11/18 Proceeds Cost $ 16,500 $14,100 41.000 41.800 10,500 11,400 16,500 14,100 45,000 51,000 5,000 2,800 436,000 41.325 Sale Expenses $ 875 2.050 525 825 2,250 250 21,800 2.066 * Debra inherited the LLP stock and the QQM stock when her father passed away on May 1, 2018. Debra's father purchased the LLP stock in 1967 for $35,000. The FMV of the LLP stock at the date of death was $415,500. The QQM stock was purchased by Debra's father on February 6, 2017, for $49,000. The FMV of the QQM stock at the date of death was $49,600 Debra also sold her wine collection for $38,000. She had purchased the wine on January 5, 2013, for a total of $19,000. Debra has a capital loss carryover from 2017 of $11,700: $3,000 short-term and $8,700 long-term. Debra rents a condo (no mortgage interest) and lives in Florida (no state income tax). Thus she claims the standard deduction. Required Complete the 2018 tax return for Debra Simon. You do not need to complete the loss carryover worksheet but do need to enter the carryover amount in the appropriate place on Schedule D. She wants to contribute to the presidential election campaign and does not want anyone to be a third-party designee. Debra had qualifying health care coverage at all times during the tax year. For any missing information, make reasonable assumptions. Debra Simon is a single taxpayer. She is employed as a corporate attorney and lives at 1400 Sand Dollar Circle, Sandville, FL 33868. Her social security number is 412-34-5670. For tax year 2018, Debra had the following income information: Wages Social security withholding Medicare withholding Federal income tax withheld State income tax withheld New Bank 1099-INT Hope Bank 1099-INT $ 155,000 $7,960.80 $2,248 $32,050 -0- $5,500 $3,875 Debra had the following stock transactions during 2018. A 1099-B was received for the proceeds of each sale: Transaction 300 sh. IBM 200 sh. SMI 100 sh. BMI 300 sh. ABC 300 sh. DDC 300 sh. PPC 4,000 sh. LLP 1,500 sh. QQM Purchased 01/05/11 01/05/11 03/05/17 07/05/18 05/12/18 01/05/11 Inherited Inherited Sold 5/11/18 5/15/18 4/12/18 9/15/18 10/11/18 5/11/18 12/11/18 5/11/18 Proceeds Cost $ 16,500 $14,100 41.000 41.800 10,500 11,400 16,500 14,100 45,000 51,000 5,000 2,800 436,000 41.325 Sale Expenses $ 875 2.050 525 825 2,250 250 21,800 2.066 * Debra inherited the LLP stock and the QQM stock when her father passed away on May 1, 2018. Debra's father purchased the LLP stock in 1967 for $35,000. The FMV of the LLP stock at the date of death was $415,500. The QQM stock was purchased by Debra's father on February 6, 2017, for $49,000. The FMV of the QQM stock at the date of death was $49,600 Debra also sold her wine collection for $38,000. She had purchased the wine on January 5, 2013, for a total of $19,000. Debra has a capital loss carryover from 2017 of $11,700: $3,000 short-term and $8,700 long-term. Debra rents a condo (no mortgage interest) and lives in Florida (no state income tax). Thus she claims the standard deduction. Required Complete the 2018 tax return for Debra Simon. You do not need to complete the loss carryover worksheet but do need to enter the carryover amount in the appropriate place on Schedule D. She wants to contribute to the presidential election campaign and does not want anyone to be a third-party designee. Debra had qualifying health care coverage at all times during the tax year. For any missing information, make reasonable assumptions