Answered step by step

Verified Expert Solution

Question

1 Approved Answer

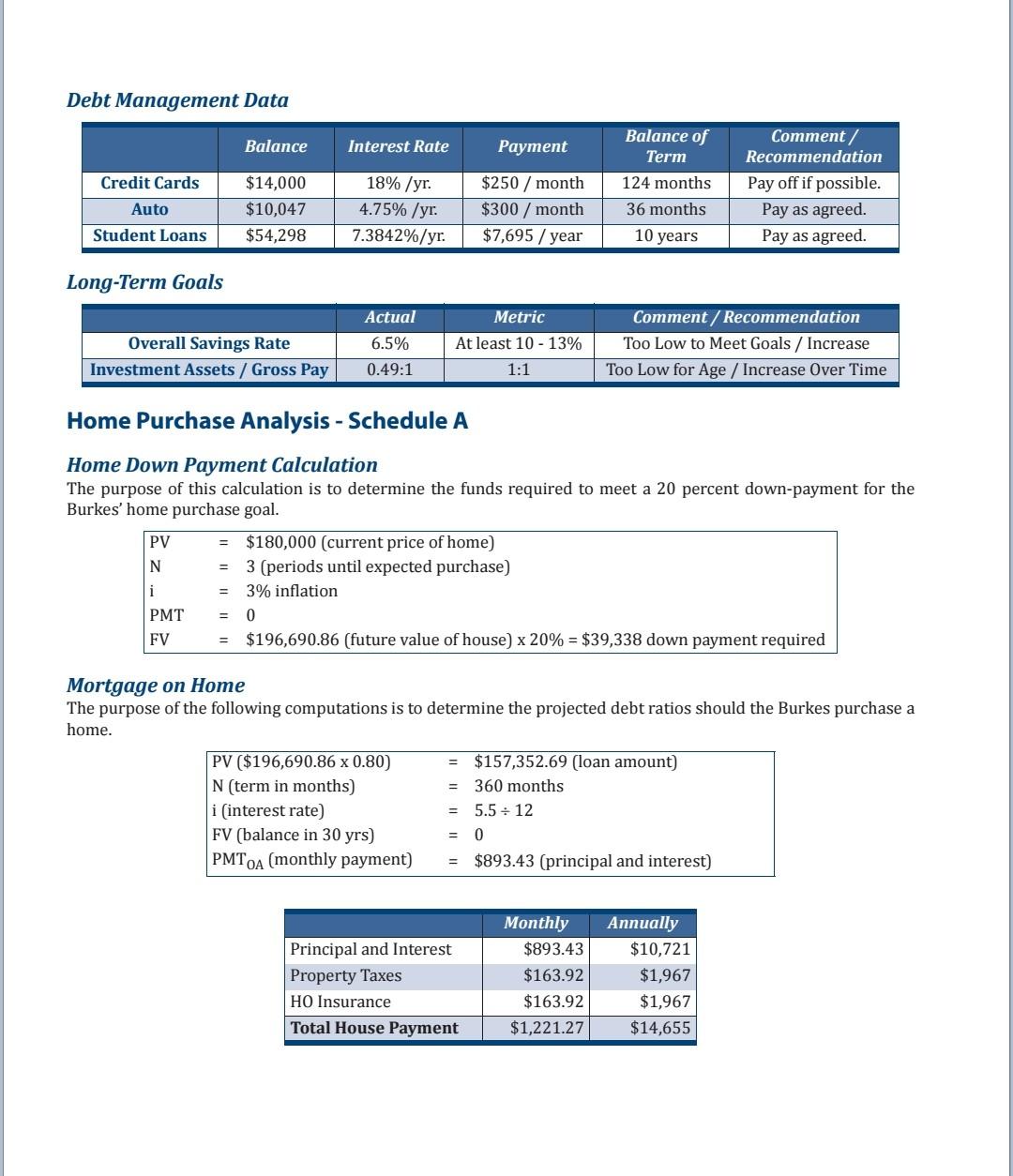

Debt Management Data Balance Interest Rate Payment Balance of Term 124 months 36 months Credit Cards Auto $14,000 $10,047 $54,298 18% /yr. 4.75% /yr. 7.3842%/yr.

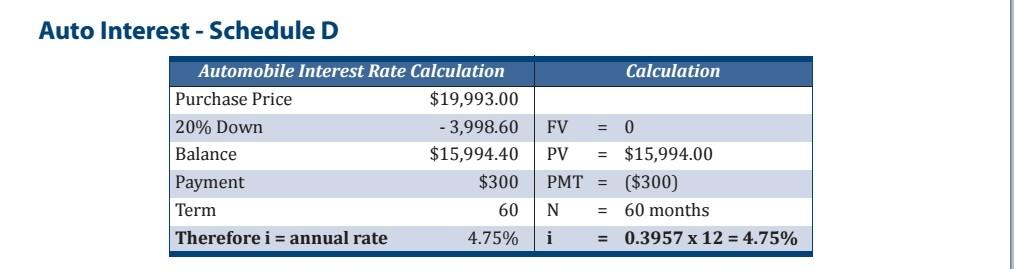

Debt Management Data Balance Interest Rate Payment Balance of Term 124 months 36 months Credit Cards Auto $14,000 $10,047 $54,298 18% /yr. 4.75% /yr. 7.3842%/yr. $250 / month $300 /month $7,695 / year Comment / Recommendation Pay off if possible. Pay as agreed. Pay as agreed. Student Loans 10 years Long-Term Goals Metric Actual 6.5% At least 10 - 13% Overall Savings Rate Investment Assets / Gross Pay Comment/Recommendation Too Low to Meet Goals / Increase Too Low for Age / Increase Over Time 0.49:1 1:1 Home Purchase Analysis - Schedule A Home Down Payment Calculation The purpose of this calculation is to determine the funds required to meet a 20 percent down-payment for the Burkes' home purchase goal. PV $180,000 (current price of home) N 3 (periods until expected purchase) 3% inflation PMT 0 FV $196,690.86 (future value of house) x 20% = $39,338 down payment required i Mortgage on Home The purpose of the following computations is to determine the projected debt ratios should the Burkes purchase a home. PV ($196,690.86 x 0.80) N term in months) i interest rate) FV (balance in 30 yrs) PMTOA (monthly payment) $157,352.69 (loan amount) = 360 months = 5.5 : 12 = 0 $893.43 (principal and interest) Principal and Interest Property Taxes HO Insurance Total House Payment Monthly $893.43 $163.92 $163.92 $1,221.27 Annually $10,721 $1,967 $1,967 $14,655 John & Mary Burke (Example comprehensive case) Assignment: 1. Do home purchase analysis- Schedule A (page 224) 2. Calculate auto interest - Schedule D (page 225) 3. Calculate PASS score table (page 228) 4. Calculate present value of all goals approach (page 229-230) 5. Do income tax analysis- Schedule D (page 234-235) Note: You must show all your calculation in excel. Auto Interest - Schedule D Calculation Automobile Interest Rate Calculation Purchase Price $19,993.00 20% Down - 3,998.60 Balance $15,994.40 Payment $300 Term 60 Therefore i = annual rate 4.75% FV PV PMT = 0 $15,994.00 ($300) 60 months 0.3957 x 12 = 4.75% N i Debt Management Data Balance Interest Rate Payment Balance of Term 124 months 36 months Credit Cards Auto $14,000 $10,047 $54,298 18% /yr. 4.75% /yr. 7.3842%/yr. $250 / month $300 /month $7,695 / year Comment / Recommendation Pay off if possible. Pay as agreed. Pay as agreed. Student Loans 10 years Long-Term Goals Metric Actual 6.5% At least 10 - 13% Overall Savings Rate Investment Assets / Gross Pay Comment/Recommendation Too Low to Meet Goals / Increase Too Low for Age / Increase Over Time 0.49:1 1:1 Home Purchase Analysis - Schedule A Home Down Payment Calculation The purpose of this calculation is to determine the funds required to meet a 20 percent down-payment for the Burkes' home purchase goal. PV $180,000 (current price of home) N 3 (periods until expected purchase) 3% inflation PMT 0 FV $196,690.86 (future value of house) x 20% = $39,338 down payment required i Mortgage on Home The purpose of the following computations is to determine the projected debt ratios should the Burkes purchase a home. PV ($196,690.86 x 0.80) N term in months) i interest rate) FV (balance in 30 yrs) PMTOA (monthly payment) $157,352.69 (loan amount) = 360 months = 5.5 : 12 = 0 $893.43 (principal and interest) Principal and Interest Property Taxes HO Insurance Total House Payment Monthly $893.43 $163.92 $163.92 $1,221.27 Annually $10,721 $1,967 $1,967 $14,655 John & Mary Burke (Example comprehensive case) Assignment: 1. Do home purchase analysis- Schedule A (page 224) 2. Calculate auto interest - Schedule D (page 225) 3. Calculate PASS score table (page 228) 4. Calculate present value of all goals approach (page 229-230) 5. Do income tax analysis- Schedule D (page 234-235) Note: You must show all your calculation in excel. Auto Interest - Schedule D Calculation Automobile Interest Rate Calculation Purchase Price $19,993.00 20% Down - 3,998.60 Balance $15,994.40 Payment $300 Term 60 Therefore i = annual rate 4.75% FV PV PMT = 0 $15,994.00 ($300) 60 months 0.3957 x 12 = 4.75% N

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started