Answered step by step

Verified Expert Solution

Question

1 Approved Answer

debtors information was not provided clothing chain Under Armour) TP3. LO 9.3 You are considering a $100,000 investment in one of two publicly traded companies

debtors information was not provided

clothing chain Under Armour)

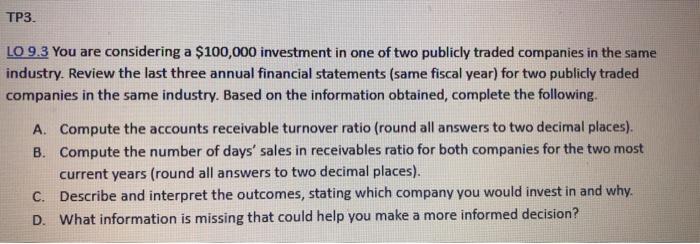

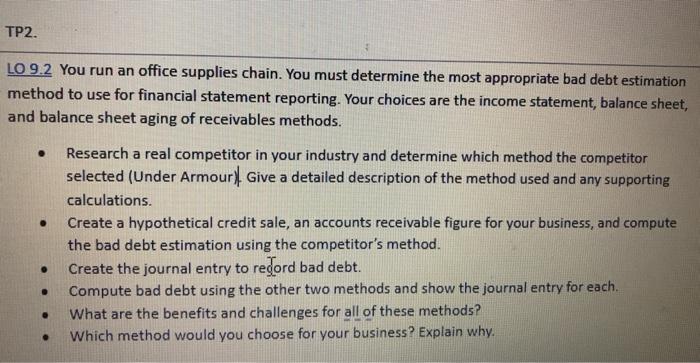

TP3. LO 9.3 You are considering a $100,000 investment in one of two publicly traded companies in the same industry. Review the last three annual financial statements (same fiscal year) for two publicly traded companies in the same industry. Based on the information obtained, complete the following. A. Compute the accounts receivable turnover ratio (round all answers to two decimal places). B. Compute the number of days' sales in receivables ratio for both companies for the two most current years (round all answers to two decimal places). C. Describe and interpret the outcomes, stating which company you would invest in and why. D. What information is missing that could help you make a more informed decision? TP2. LO 9.2 You run an office supplies chain. You must determine the most appropriate bad debt estimation method to use for financial statement reporting. Your choices are the income statement, balance sheet, and balance sheet aging of receivables methods. Research a real competitor in your industry and determine which method the competitor selected (Under Armour) Give a detailed description of the method used and any supporting calculations. Create a hypothetical credit sale, an accounts receivable figure for your business, and compute the bad debt estimation using the competitor's method. Create the journal entry to record bad debt. Compute bad debt using the other two methods and show the journal entry for each. What are the benefits and challenges for all of these methods? Which method would you choose for your business? Explain why. . . TP3. LO 9.3 You are considering a $100,000 investment in one of two publicly traded companies in the same industry. Review the last three annual financial statements (same fiscal year) for two publicly traded companies in the same industry. Based on the information obtained, complete the following. A. Compute the accounts receivable turnover ratio (round all answers to two decimal places). B. Compute the number of days' sales in receivables ratio for both companies for the two most current years (round all answers to two decimal places). C. Describe and interpret the outcomes, stating which company you would invest in and why. D. What information is missing that could help you make a more informed decision? TP2. LO 9.2 You run an office supplies chain. You must determine the most appropriate bad debt estimation method to use for financial statement reporting. Your choices are the income statement, balance sheet, and balance sheet aging of receivables methods. Research a real competitor in your industry and determine which method the competitor selected (Under Armour) Give a detailed description of the method used and any supporting calculations. Create a hypothetical credit sale, an accounts receivable figure for your business, and compute the bad debt estimation using the competitor's method. Create the journal entry to record bad debt. Compute bad debt using the other two methods and show the journal entry for each. What are the benefits and challenges for all of these methods? Which method would you choose for your business? Explain why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started