Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dec. 2017/Jan. 2018 End Term Examination Max. Marks: 50 Max. Time: 3 Hours Date: 02/01/2018. MBA 1B/IBF/GLSCM (2017-19 Batch) Course: FINANCIAL MANAGEMENT Question 1 is

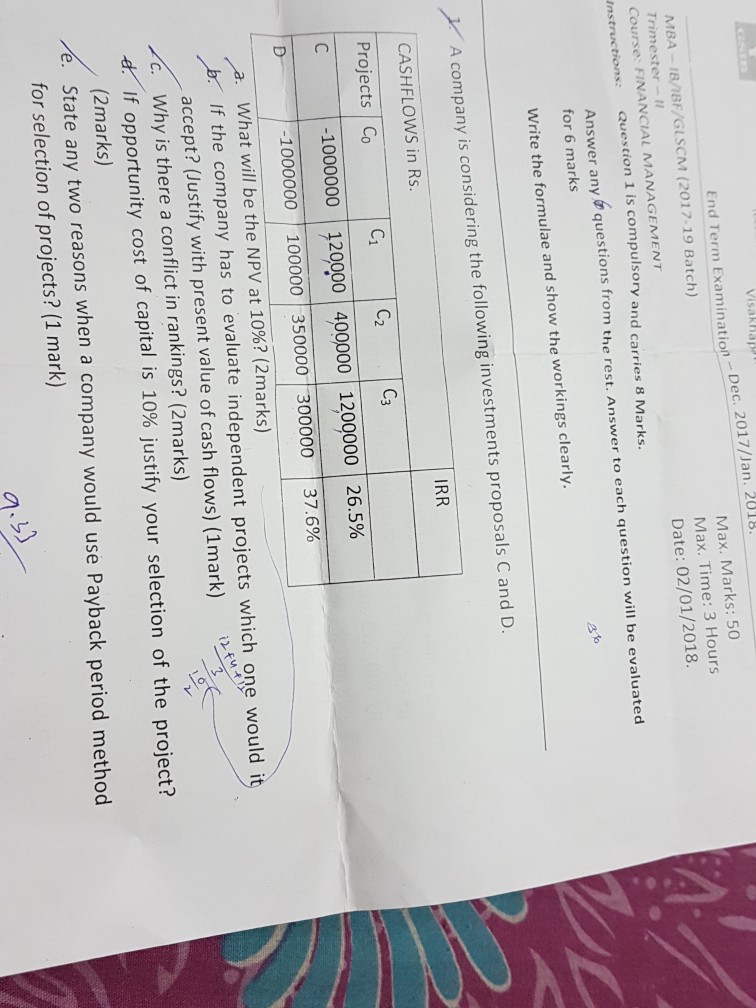

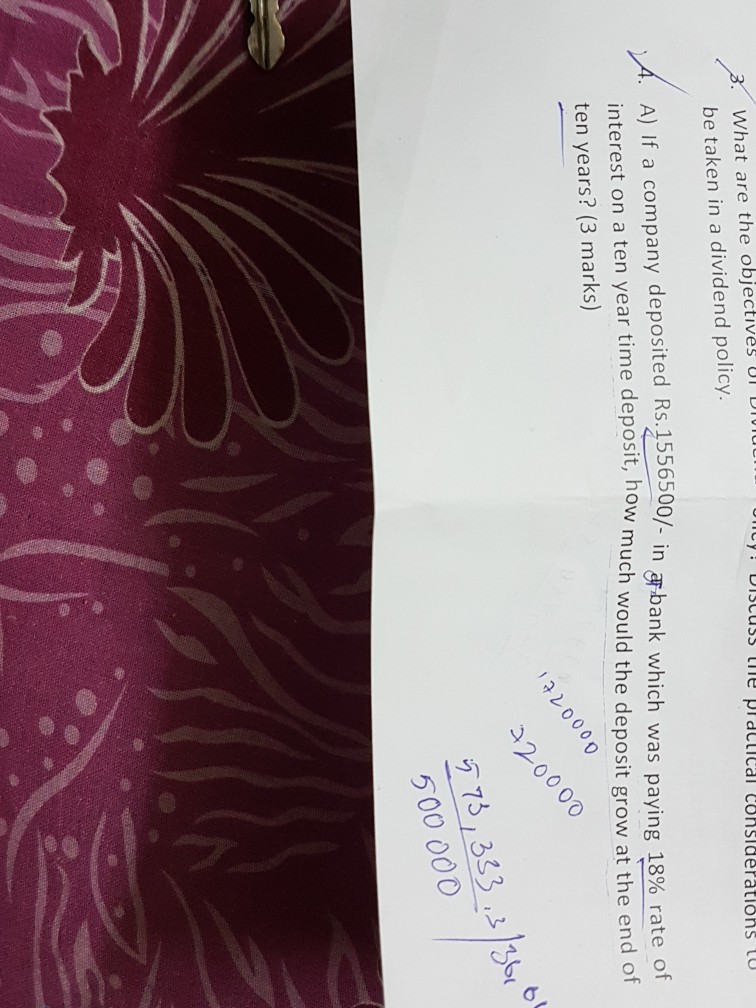

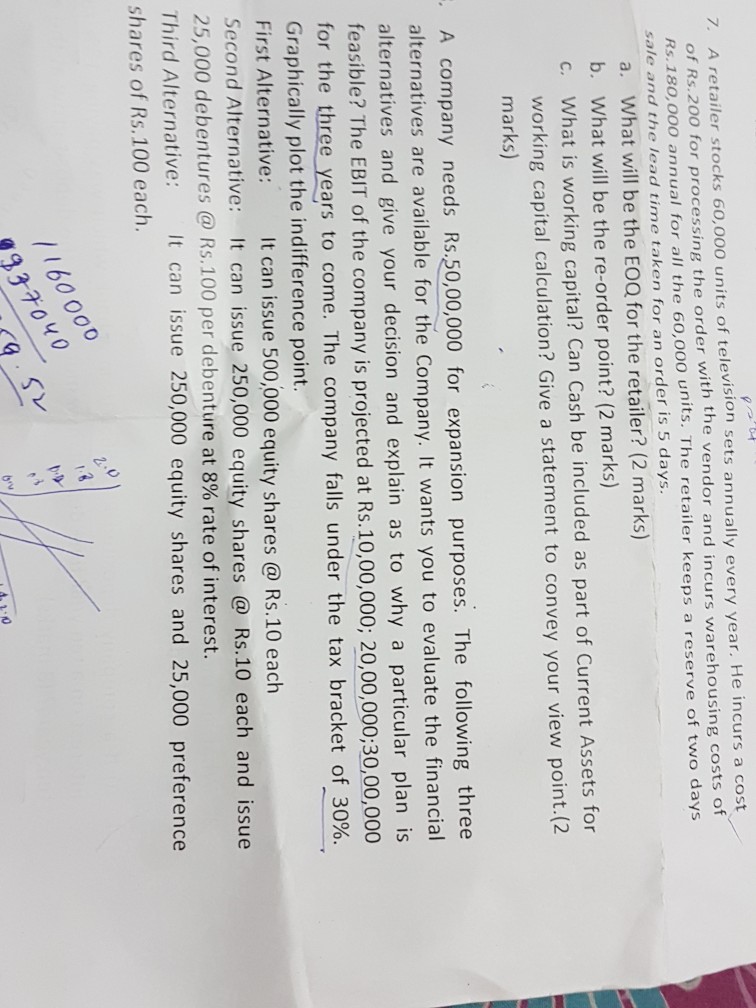

Dec. 2017/Jan. 2018 End Term Examination Max. Marks: 50 Max. Time: 3 Hours Date: 02/01/2018. MBA 1B/IBF/GLSCM (2017-19 Batch) Course: FINANCIAL MANAGEMENT Question 1 is compulsory and carries 8 Marks. Instructions: Answer any questions from the rest. Answer to each question will be evaluated for 6 marks fo Write the formulae and show the workings clearly. A company is considering the following investments proposals C and D IRR CASHFLOWS in Rs. Projects Co C1 C2 C3 -1000000 | 320000 | 400000 | 1200000 | 26.5% 1000000 100000 350000 300000 37.6% What will be the NPV at 10%? (2marks) If the company has to evaluate independent projects which one would i accept? (Justify with present value of cash flows) (1mark) C. Why is there a conflict in rankings? (2marks) d'If opportunity cost of capital is 10% justify your selection of the project? (2marks) e. State any two reasons when a company would use Payback period method for selection of projects? (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started