Question

Dec. 24 Paid workers for the previous two weeks work, $4,200 Dec 26 Paid $6,860 to KP Company for inventory purchased on December 15, the

Dec. 24 Paid workers for the previous two weeks work, $4,200

Dec 26 Paid $6,860 to KP Company for inventory purchased on December 15, the inventory had a list price of $7,000 and the terms were 2/15, n/30

Dec 28 Sold merchandise to MF Company for $8,000 cash. The merchandise cost $5,900.

Dec 29 Purchased $600 of office supplies for cash

Dec 29 Received payment from AW Company for sale of merchandise on December 16. The sales price was $2,500 and the terms were 2/10, n/30.

Dec 30 Sold merchandise to APC Company for $10,000 on account. The terms are 3/15, n/45. The merchandise cost $7,500.

Dec 30 Wrote off WHY Companys account as uncollectible. The sale to WHY occurred on June 20, 2022. The amount of the sale was $3,000 and the terms were n/30.

Dec 31 Purchased $9,000 of merchandise inventory from MSPC Company. The terms are 2/10, n/45.

NEED ADJUSTING ENTRIES BELOW

Information for year-end adjusting entries:

- On December 31, there are $800 of office supplies on hand

- JOHNSON borrowed the $120,000 on July 1, 2022. JOHNSON must make annual interest payments each September 30 and pay the full note on September 30, 2025. The interest rate on the note is 7%.

- Employees have earned $1,400 in wages for work done since the last payday (December 24)

- The prepaid rent was paid on April 1, 2022, and covers a one-year period starting on April 1, 2022.

- JOHNSON paid $2,100 for a one-year insurance policy on August 1, 2022. Coverage began on that date.

- The Building has a twenty-five year useful life and a $10,000 salvage value.

- The Equipment has an eight-year useful life and no salvage value.

- JOHNSON uses straight-line to depreciate its plant assets.

- December utilities are $480 and will be paid in January

- JOHNSON estimates its bad debts at 1% of its sales.

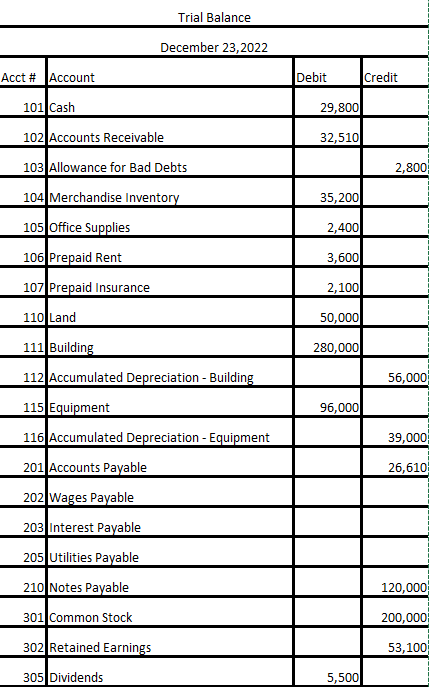

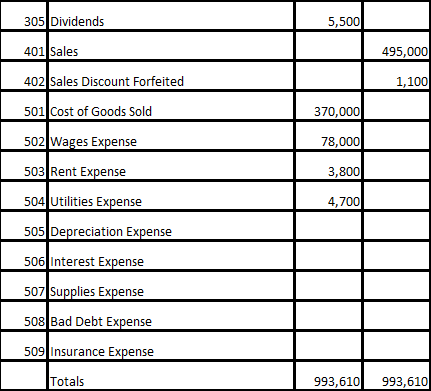

Here is the trial balance so far:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started