Answered step by step

Verified Expert Solution

Question

1 Approved Answer

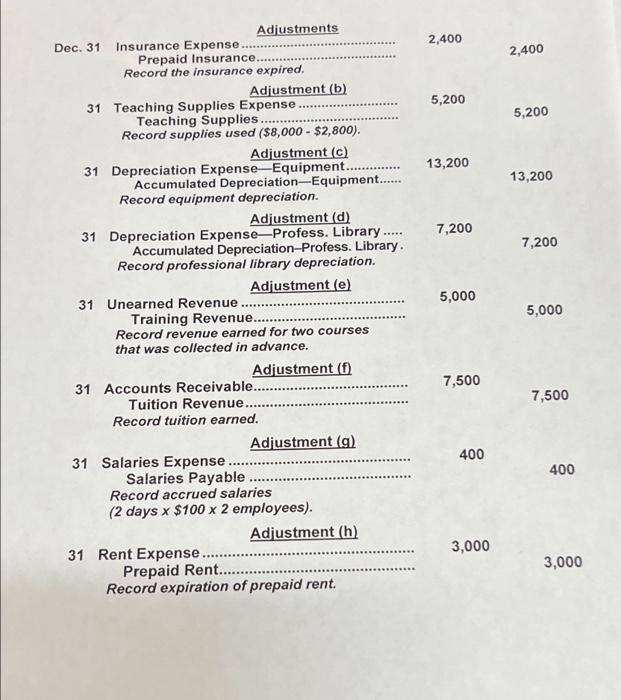

Dec. 31 Insurance Expense. Prepaid Insurance....... Record the insurance expired. Adjustments 31 Teaching Supplies Expense. Teaching Supplies ....... Adjustment (b) Record supplies used ($8,000 -

Dec. 31 Insurance Expense. Prepaid Insurance....... Record the insurance expired. Adjustments 31 Teaching Supplies Expense. Teaching Supplies ....... Adjustment (b) Record supplies used ($8,000 - $2,800). Adjustment (c) 31 Depreciation Expense-Equipment........... Accumulated Depreciation Equipment...... Record equipment depreciation. Adjustment (d) 31 Depreciation Expense-Profess. Library ..... Accumulated Depreciation-Profess. Library. Record professional library depreciation. Adjustment (e) 31 Unearned Revenue .... Training Revenue... Record revenue earned for two courses that was collected in advance. Adjustment (f) 31 Salaries Expense ... Salaries Payable 31 Accounts Receivable........ Tuition Revenue..... Record tuition earned. 31 Rent Expense Adjustment (g) Record accrued salaries (2 days x $100 x 2 employees). Adjustment (h) Prepaid Rent............. Record expiration of prepaid rent. 2,400 5,200 13,200 7,200 5,000 7,500 400 3,000 2,400 5,200 13,200 7,200 5,000 7,500 400 3,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started