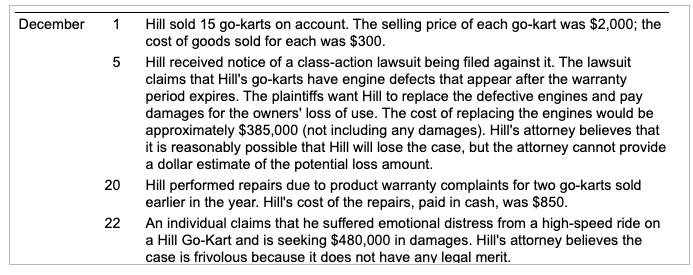

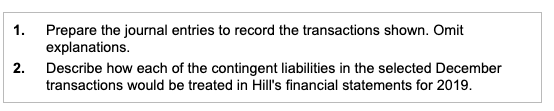

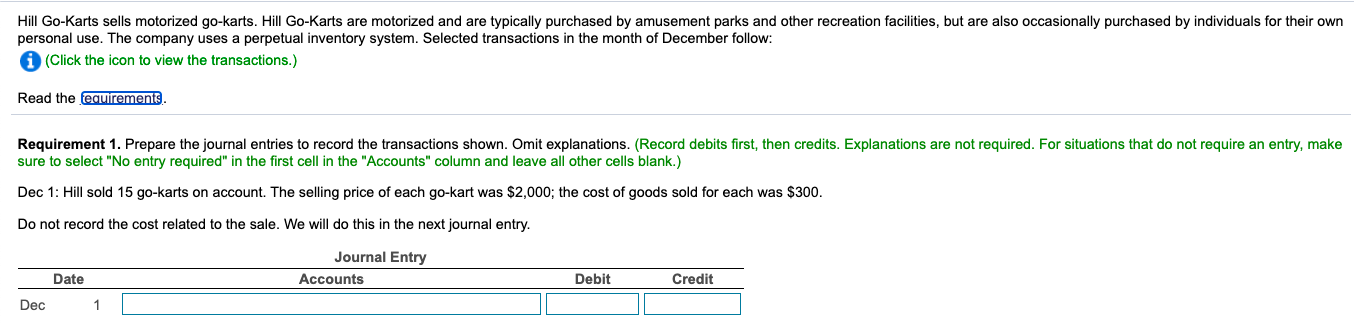

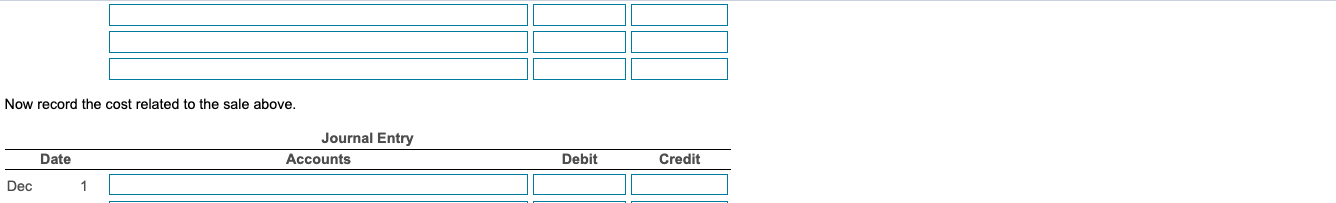

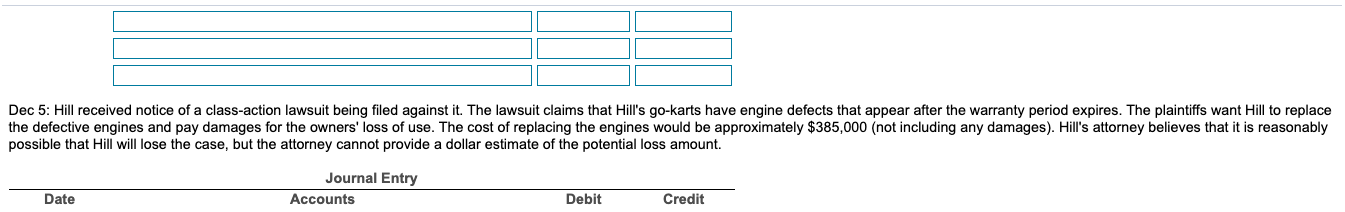

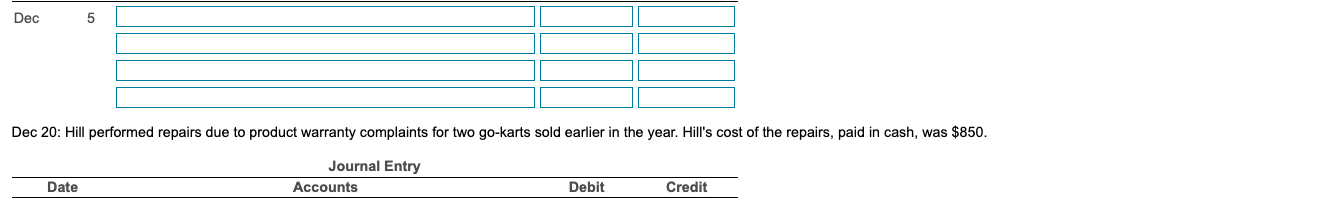

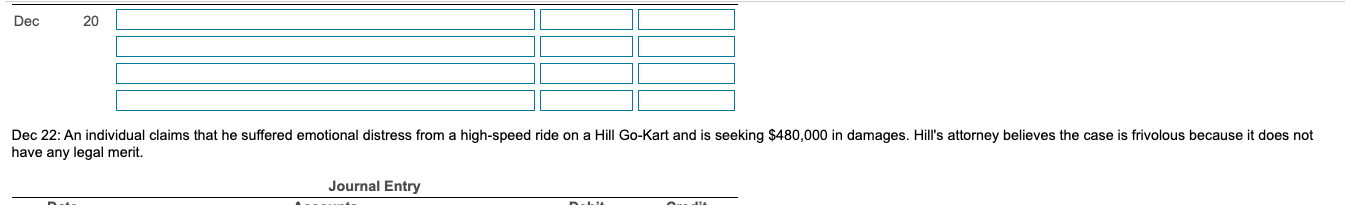

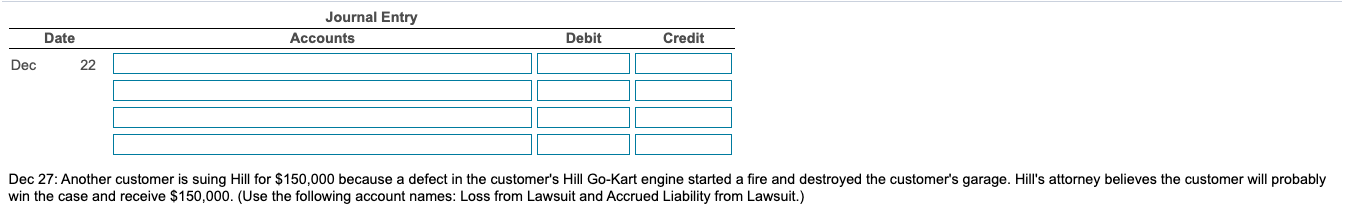

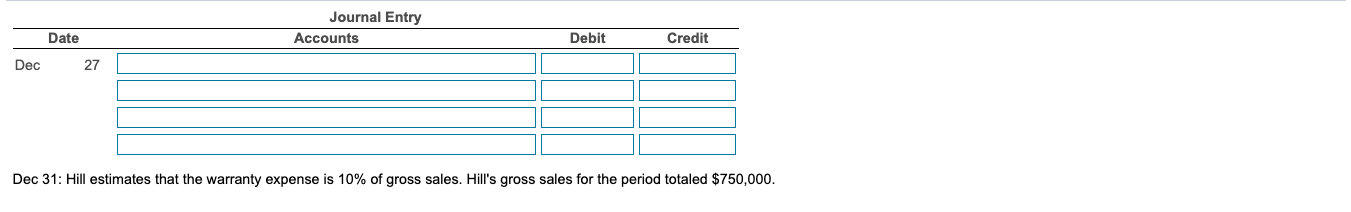

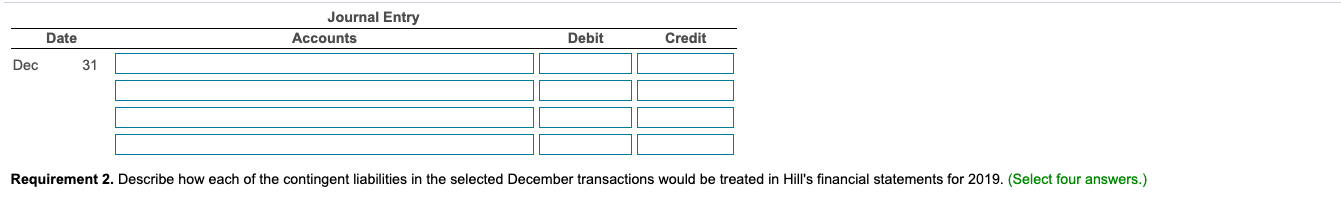

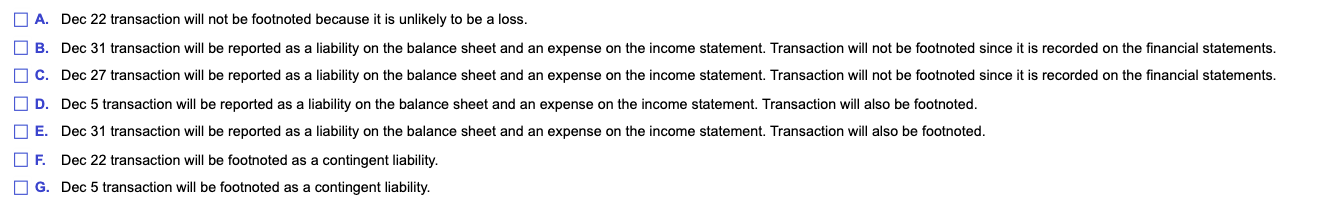

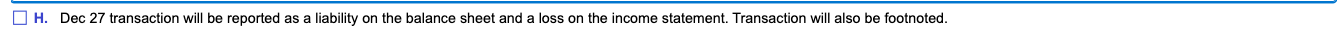

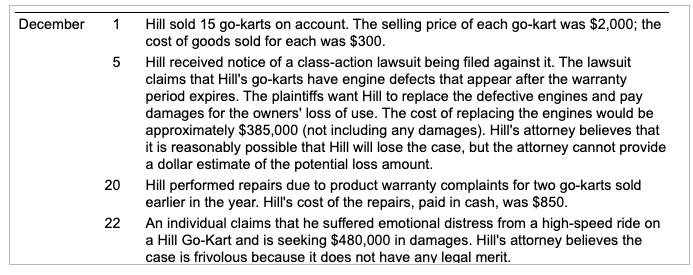

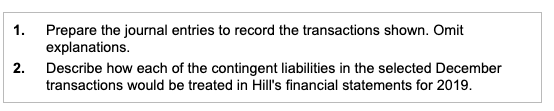

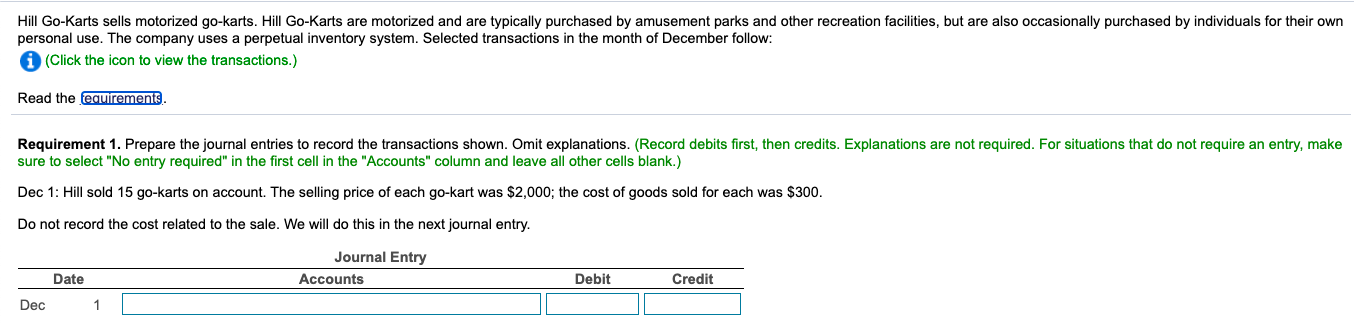

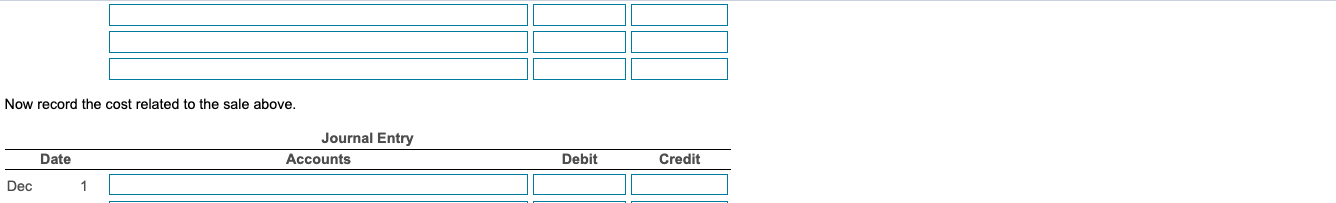

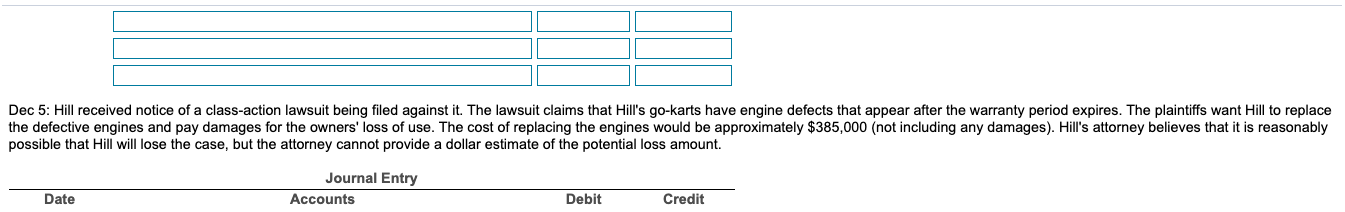

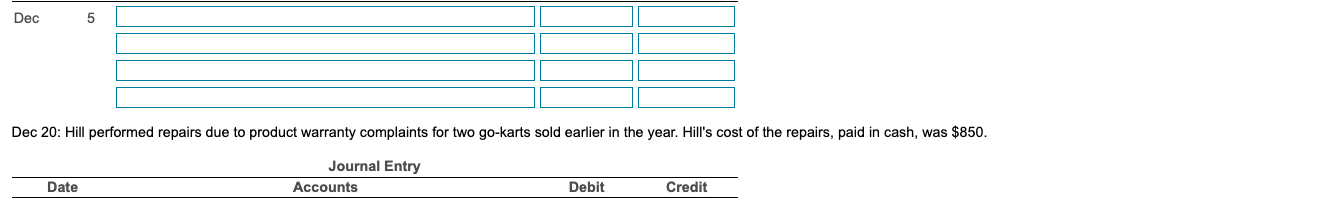

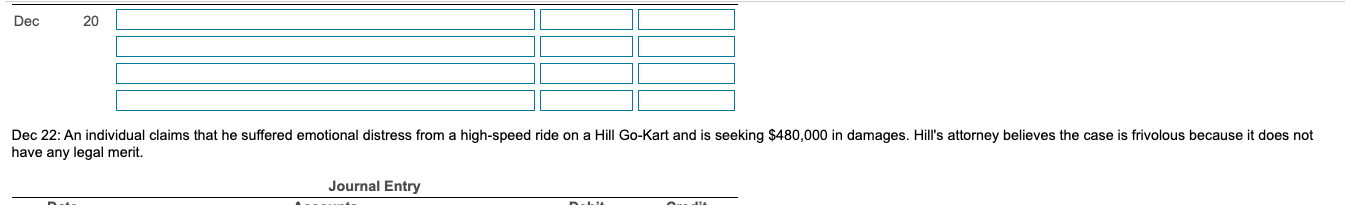

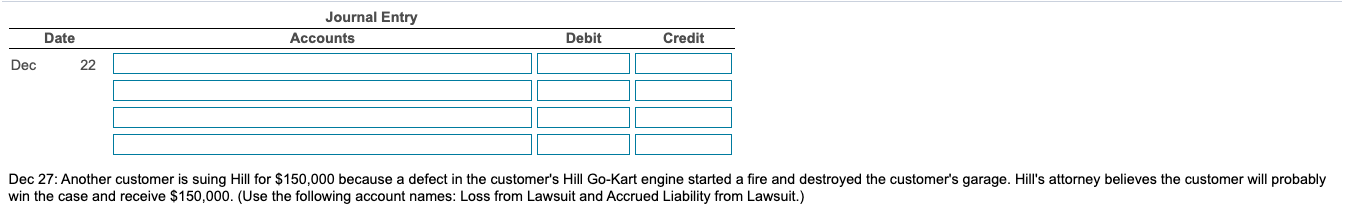

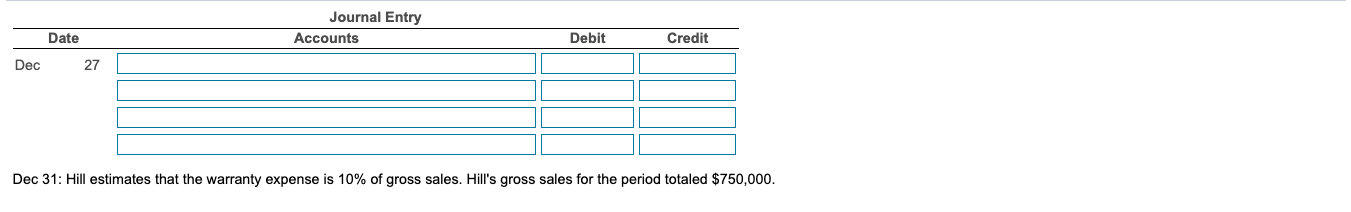

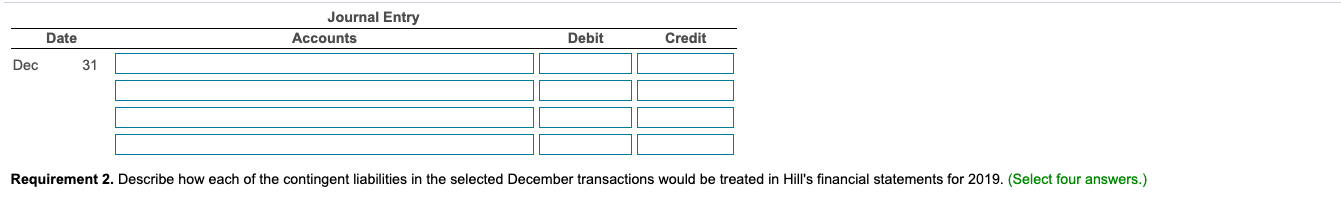

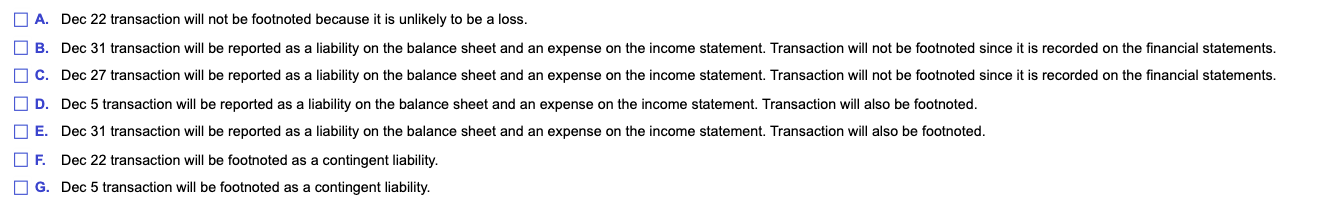

December 1 5 Hill sold 15 go-karts on account. The selling price of each go-kart was $2,000; the cost of goods sold for each was $300. Hill received notice of a class-action lawsuit being filed against it. The lawsuit claims that Hill's go-karts have engine defects that appear after the warranty period expires. The plaintiffs want Hill to replace the defective engines and pay damages for the owners' loss of use. The cost of replacing the engines would be approximately $385,000 (not including any damages). Hill's attorney believes that it is reasonably possible that Hill will lose the case, but the attorney cannot provide a dollar estimate of the potential loss amount. Hill performed repairs due to product warranty complaints for two go-karts sold earlier in the year. Hill's cost of the repairs, paid in cash, was $850. An individual claims that he suffered emotional distress from a high-speed ride on a Hill Go-Kart and is seeking $480,000 in damages. Hill's attorney believes the case is frivolous because it does not have any legal merit. 20 22 1. Prepare the journal entries to record the transactions shown. Omit explanations. Describe how each of the contingent liabilities in the selected December transactions would be treated in Hill's financial statements for 2019. 2. Hill Go-Karts sells motorized go-karts. Hill Go-Karts are motorized and are typically purchased by amusement parks and other recreation facilities, but are also occasionally purchased by individuals for their own personal use. The company uses a perpetual inventory system. Selected transactions in the month of December follow: (Click the icon to view the transactions.) Read the fequirements Requirement 1. Prepare the journal entries to record the transactions shown. Omit explanations. (Record debits first, then credits. Explanations are not required. For situations that do not require an entry, make sure to select "No entry required" in the first cell in the "Accounts" column and leave all other cells blank.) Dec 1: Hill sold 15 go-karts on account. The selling price of each go-kart was $2,000; the cost of goods sold for each was $300. Do not record the cost related to the sale. We will do this in the next journal entry. Journal Entry Accounts Date Debit Credit Dec 1 Now record the cost related to the sale above. Journal Entry Accounts Date Debit Credit Dec 1 Dec 5: Hill received notice of a class-action lawsuit being filed against it. The lawsuit claims that Hill's go-karts have engine defects that appear after the warranty period expires. The plaintiffs want Hill to replace the defective engines and pay damages for the owners' loss of use. The cost of replacing the engines would be approximately $385,000 (not including any damages). Hill's attorney believes that it is reasonably possible that Hill will lose the case, but the attorney cannot provide a dollar estimate of the potential loss amount. Journal Entry Accounts Date Debit Credit Dec 5 Dec 20: Hill performed repairs due to product warranty complaints for two go-karts sold earlier in the year. Hill's cost of the repairs, paid in cash, was $850. Journal Entry Accounts Date Debit Credit Dec 20 Dec 22: An individual claims that he suffered emotional distress from a high-speed ride on a Hill Go-Kart and is seeking $480,000 in damages. Hill's attorney believes the case is frivolous because it does not have any legal merit. Journal Entry Alta Journal Entry Accounts Date Debit Credit Dec 22 Dec 27: Another customer is suing Hill for $150,000 because defect in the customer's Hill Go-Kart engine started a fire and destroyed the customer's garage. Hill's attorney believes the customer will probably win the case and receive $150,000. (Use the following account names: Loss from Lawsuit and Accrued Liability from Lawsuit.) Journal Entry Accounts Date Debit Credit Dec 27 Dec 31: Hill estimates that the warranty expense is 10% of gross sales. Hill's gross sales for the period totaled $750,000. Journal Entry Accounts Date Debit Credit Dec 31 Requirement 2. Describe how each of the contingent liabilities in the selected December transactions would be treated in Hill's financial statements for 2019. (Select four answers.) A. Dec 22 transaction will not be footnoted because it is unlikely to be a loss. B. Dec 31 transaction will be reported as a liability on the balance sheet and an expense on the income statement Transaction will not be footnoted since it is recorded on the financial statements. C. Dec 27 transaction will be reported as a liability on the balance sheet and an expense on the income statement Transaction will not be footnoted since it is recorded on the financial statements. OD. Dec 5 transaction will be reported as a liability on the balance sheet and an expense on the income statement. Transaction will also be footnoted. O E. Dec 31 transaction will be reported as a liability on the balance sheet and an expense on the income statement Transaction will also be footnoted. DF. Dec 22 transaction will be footnoted as a contingent liability. O G. Dec 5 transaction will be footnoted as a contingent liability. H. Dec 27 transaction will be reported as a liability on the balance sheet and a loss on the income statement. Transaction will also be footnoted