Answered step by step

Verified Expert Solution

Question

1 Approved Answer

December 2018: Section B Question 5 (c) In January 2014, Deodata Enterprise bought a second-hand 4D printing machine that costs RM55,000 with a useful

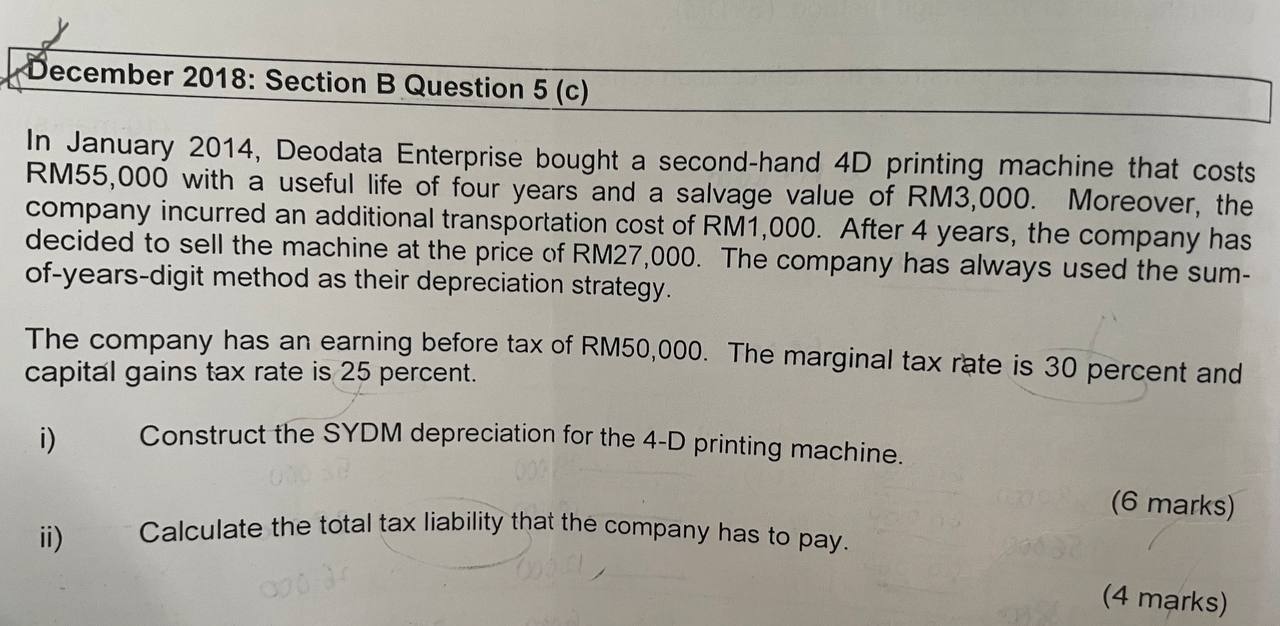

December 2018: Section B Question 5 (c) In January 2014, Deodata Enterprise bought a second-hand 4D printing machine that costs RM55,000 with a useful life of four years and a salvage value of RM3,000. Moreover, the company incurred an additional transportation cost of RM1,000. After 4 years, the company has decided to sell the machine at the price of RM27,000. The company has always used the sum- of-years-digit method as their depreciation strategy. The company has an earning before tax of RM50,000. The marginal tax rate is 30 percent and capital gains tax rate is 25 percent. i) Construct the SYDM depreciation for the 4-D printing machine. (6 marks) ii) Calculate the total tax liability that the company has to pay. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started