Answered step by step

Verified Expert Solution

Question

1 Approved Answer

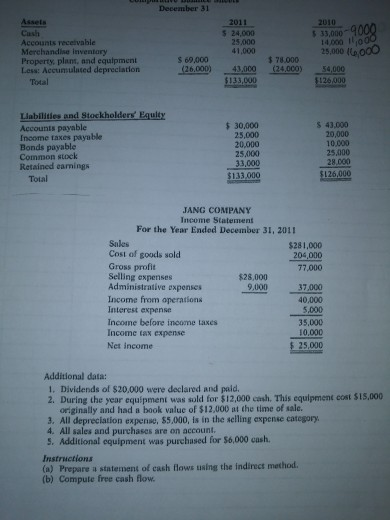

December 31 2011 5 24.000 2010 $ 33.000-9000 14.000 1.000 Assets Cash Accounts receivable Merchandise inventary Property, plant, and equipment Less: Accumulated depreciation Total 41.000

December 31 2011 5 24.000 2010 $ 33.000-9000 14.000 1.000 Assets Cash Accounts receivable Merchandise inventary Property, plant, and equipment Less: Accumulated depreciation Total 41.000 25,000 16,000 $ 69,000 (26,000) 78.000 124,000) 54,000 43.000 $133,000 3126.000 Llabilities and Stockholders Equity Accounts payable Income taxes payable Bonds payable Common stock Retained eaming Total $ 30,000 25.000 20.000 254100 33,000 $133.000 $43.000 20.000 10.000 25,000 28.000 $126,000 JANG COMPANY Income Statement For the Year Ended December 31, 2011 Sules $281,000 Cost of goods sold 204,000 Gross profit 77.000 Selling expenses $28.000 Administrative expenses 9,000 37,000 Income from operations 40.000 Interest expense 5.000 Incone before income taxes 35,000 Income tax expense 10,000 Net Income $ 25.000 Additional data: 1. Dividends of $20,000 were declared and paid. 4. During the year equipment was sold for $12,000 cash. This equipment Cost $15,000 originally and had a book value of $12,000 at the time of sale. 3. All depreciation expense, $5,000, is in the selling expense category. 4. All sales and purchases are on account. 5. Additional equipment was purchased for $6,000 cash. Instructions (a) Prepare a statement of cash flows using the indirect method. (b) Compute free cash flow

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started