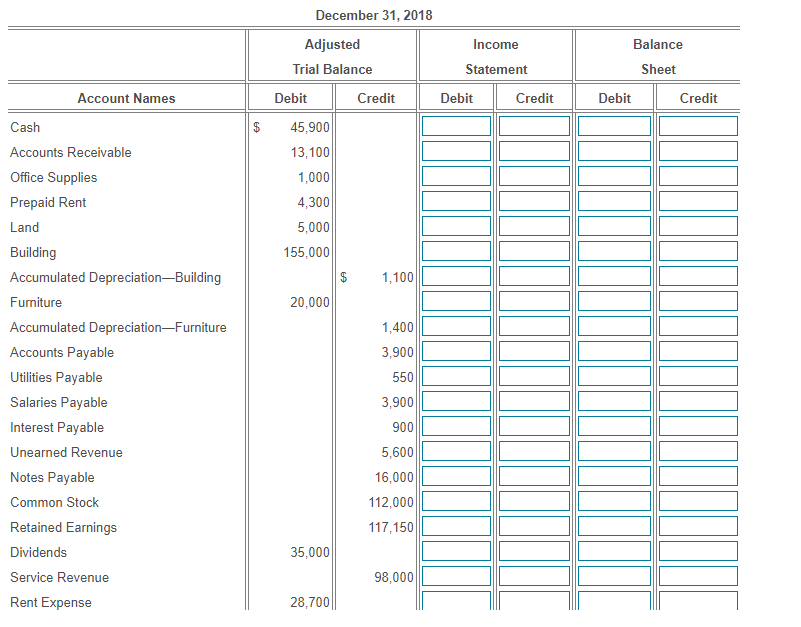

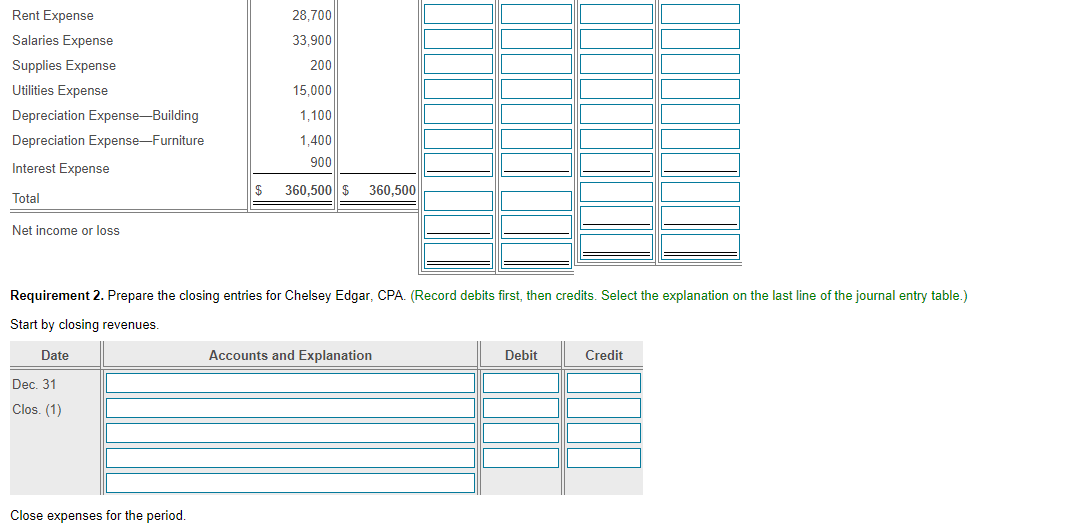

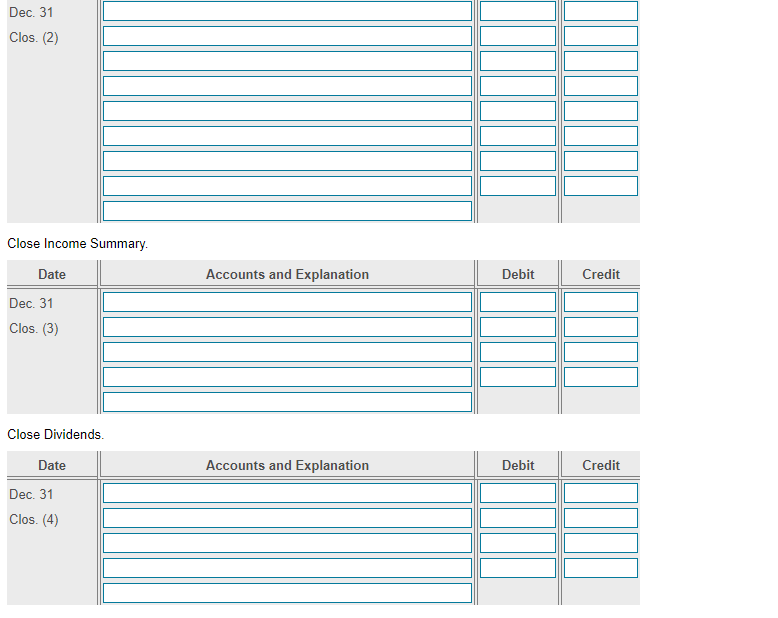

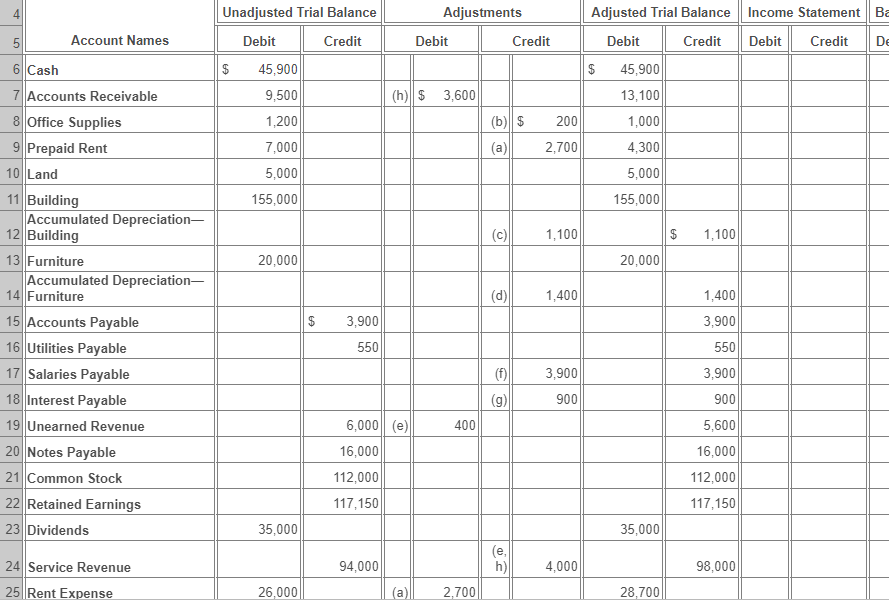

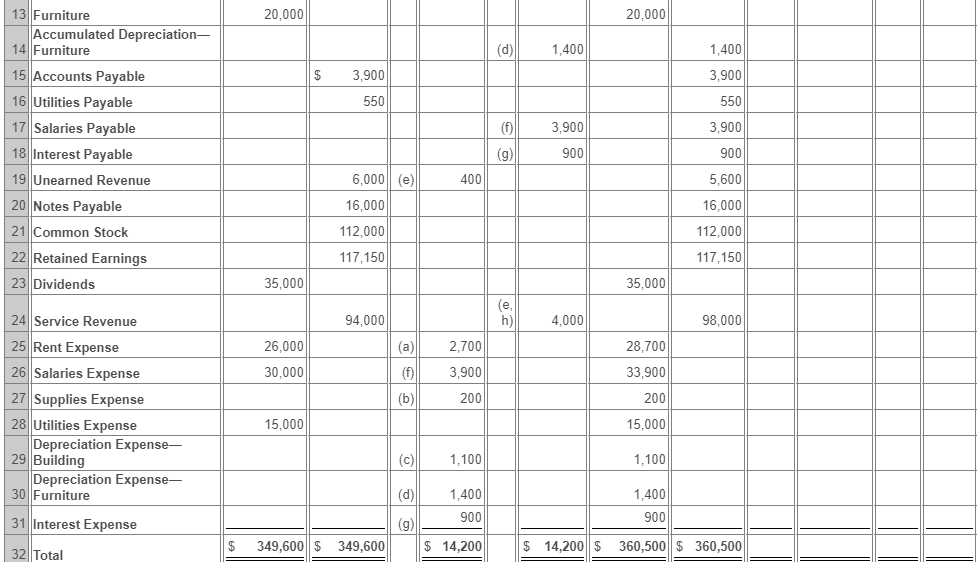

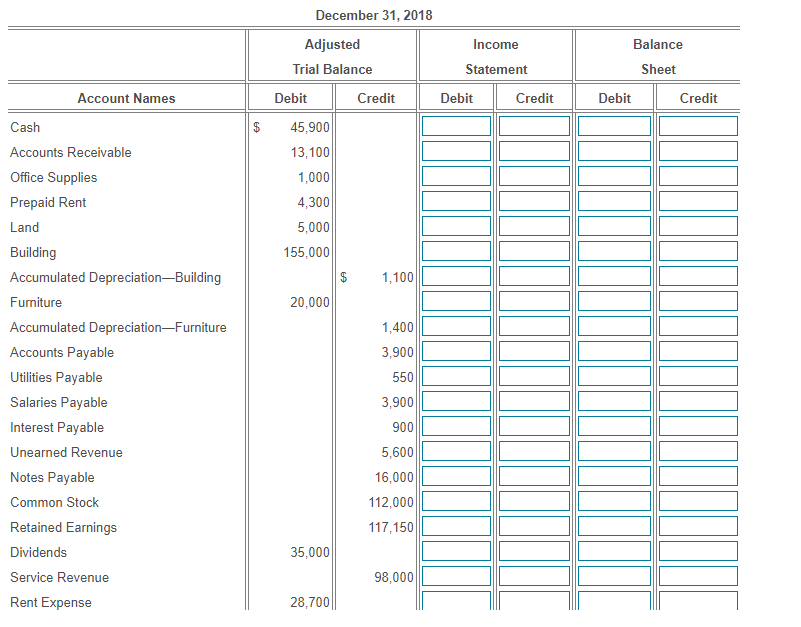

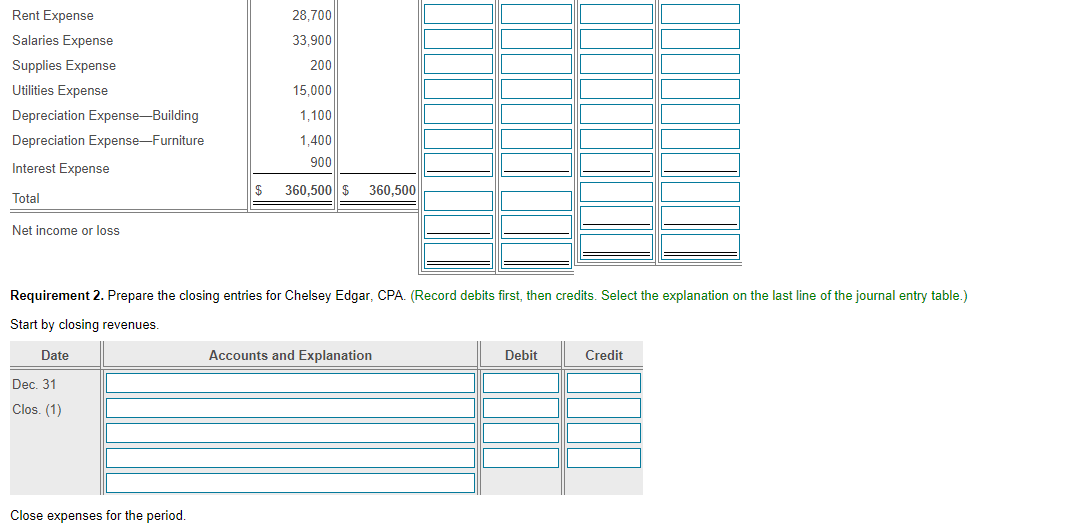

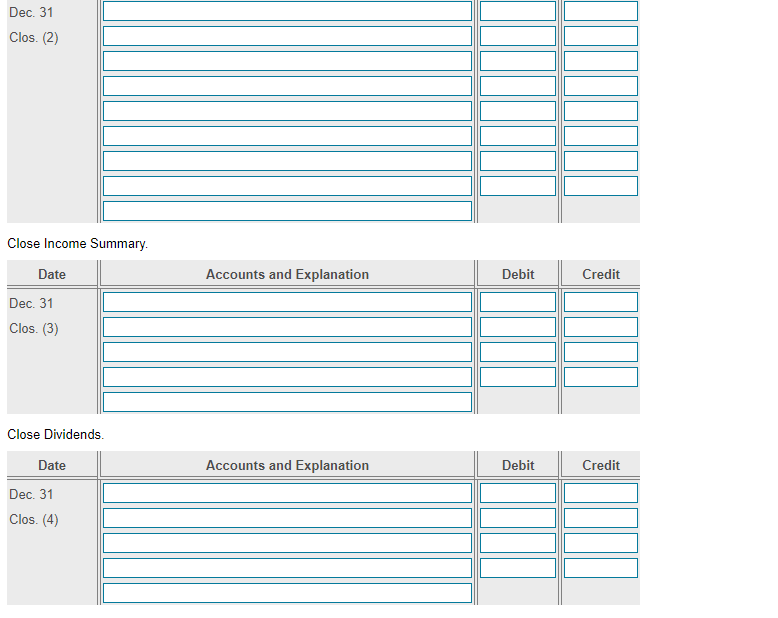

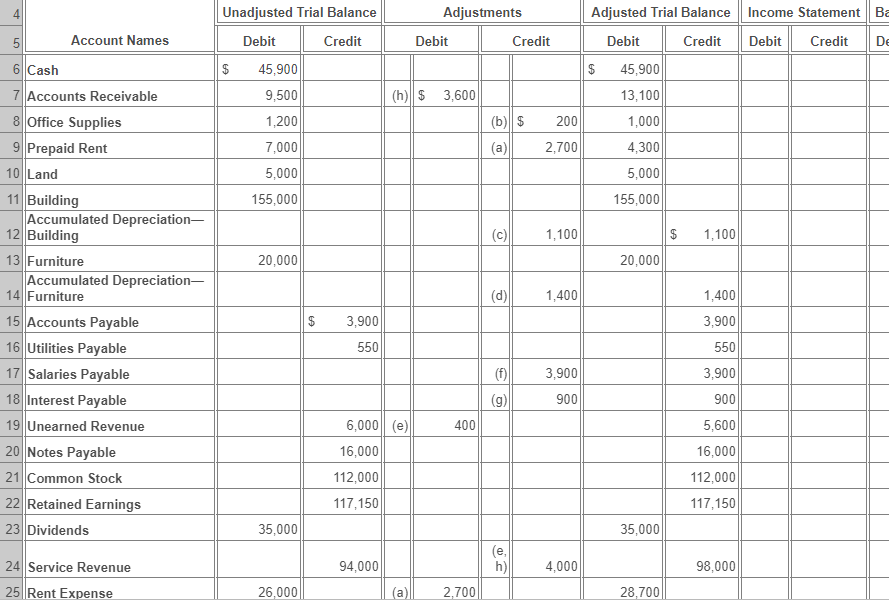

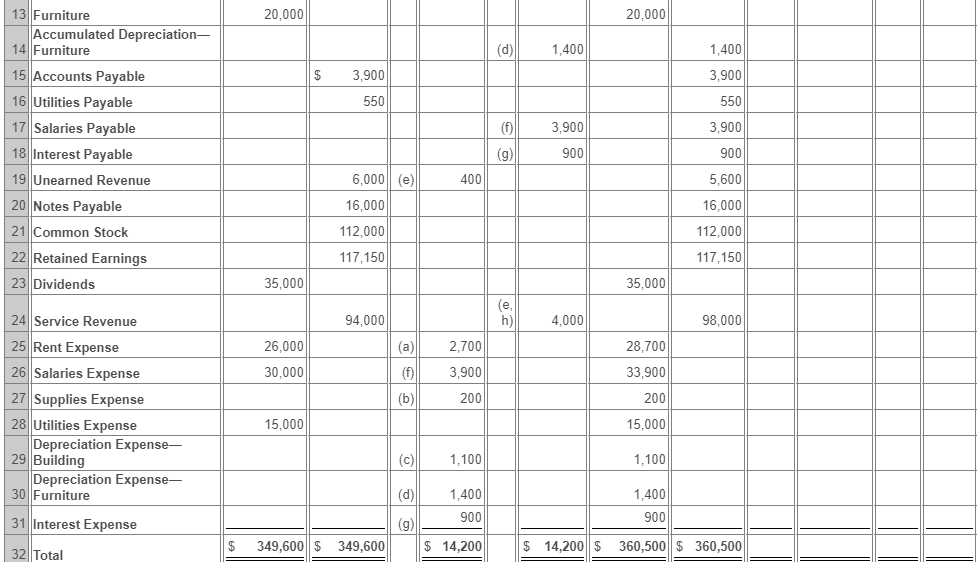

December 31, 2018 Adjusted Trial Balance Balance Income Statement Sheet Account Names Debit Credit Debit Credit Debit Credit $ 45,900 13,100 1,000 4,300 5,000 155,000 $ 1,100 20,000 Cash Accounts Receivable Office Supplies Prepaid Rent Land Building Accumulated Depreciation Building Furniture Accumulated Depreciation Furniture Accounts Payable Utilities Payable Salaries Payable Interest Payable Unearned Revenue Notes Payable Common Stock Retained Earnings Dividends Service Revenue Rent Expense 1,400 3,900 550 3,900 900 5,600 16,000 112,000 117,150 35,000 98,000 28,700 28,700 33,900 200 Rent Expense Salaries Expense Supplies Expense Utilities Expense Depreciation Expense-Building Depreciation ExpenseFurniture Interest Expense 15,000 1,100 1,400 900 $ 360,500 360,500 || Total Net income or loss Requirement 2. Prepare the closing entries for Chelsey Edgar, CPA (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Start by closing revenues. Date Accounts and Explanation Debit Credit Dec 31 Clos. (1) Close expenses for the period. Dec. 31 Clos. (2) Close Income Summary Accounts and Explanation Debit Credit Date Dec. 31 Clos. (3) Close Dividends. Date Accounts and Explanation Debit Credit Dec. 31 Clos. (4) Unadjusted Trial Balance Adjustments 6 5 Account Names Debit Credit Debit Credit 6 Cash $ 45,900 9,500 (h) $ 3,600 Adjusted Trial Balance Income Statement Ba Debit Credit Debit Credit De $ 45,900 13,100 1,000 4,300 5,000 155,000 (b) $ 200 (a) 2,700 1,200 7,000 5,000 155,000 (C) 1,100 $ CA 1,100 20,000 20,000 (d) 1,400 1,400 7 Accounts Receivable 8 Office Supplies 9 Prepaid Rent 10 Land 11 Building Accumulated Depreciation- 12 Building 13 Furniture Accumulated Depreciation- 14 Furniture 15 Accounts Payable 16 Utilities Payable 17 Salaries Payable 18 Interest Payable 19 Unearned Revenue 20 Notes Payable 21 Common Stock 22 Retained Earnings 23 Dividends $ 3,900 3,900 550 550 3,900 3,900 () (9) 900 900 400 6,000|| (e) 16,000 5,600 16,000 112,000 117,150 112,000 117,150 35,000 35,000 (e. h) 24 Service Revenue 94,000 4,000 98,000 25 Rent Expense 26,000 (a) 2.700 28,700 20,000 20.000 (d) 1,400 1,400 3,900 3,900 550 550 13 Furniture Accumulated Depreciation- 14 Furniture 15 Accounts Payable 16 Utilities Payable 17 Salaries Payable 18 Interest Payable 19 Unearned Revenue 20 Notes Payable 21 Common Stock 22 Retained Earnings (1) 3,900 3,900 900 (9) 900 5,600 6.000|| (e) 400 16,000 16,000 112.000 112,000 117,150 117,150 23 Dividends 35,000 35,000 24 Service Revenue 94,000 (e, h) 4,000 98,000 26,000 (a 2,700 28,700 30,000 3,900 33,900 (b 200 200 25 Rent Expense 26 Salaries Expense 27 Supplies Expense 28 Utilities Expense Depreciation Expense- 29 Building Depreciation Expense- 30 Furniture 15,000 15,000 (c) 1,100 1,100 (d) 1,400 900 (9) $ 14,200 1,400 900 31 Interest Expense 349,600 $ 349,600 $ 14,200 $ 360,500 $ 360,500 32 Total