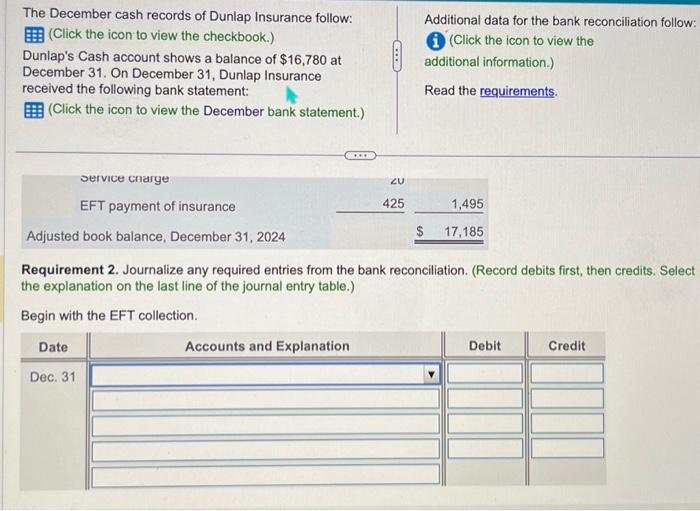

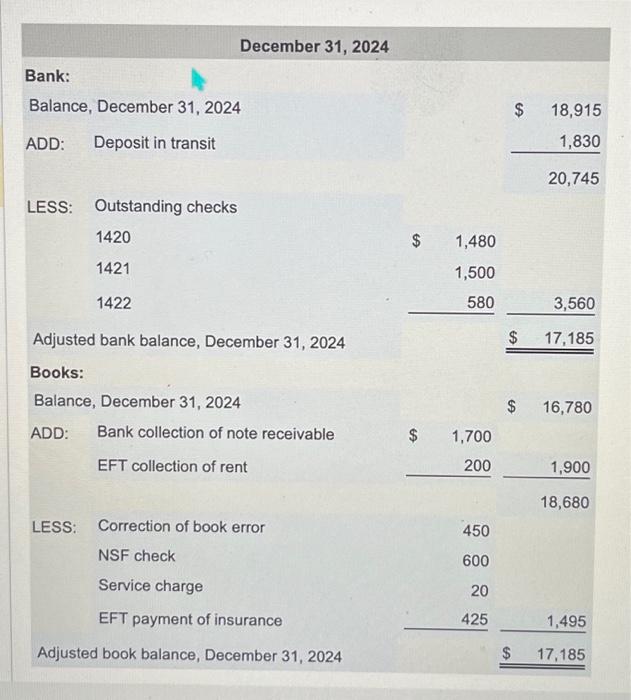

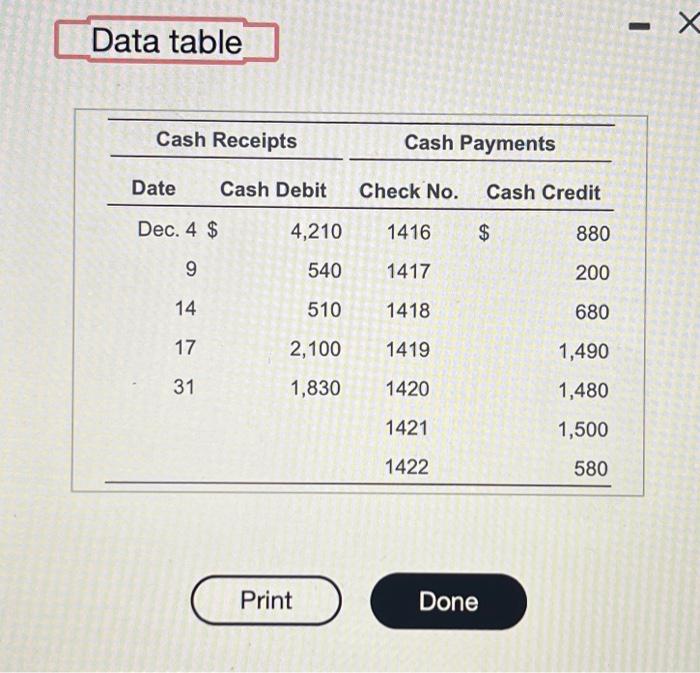

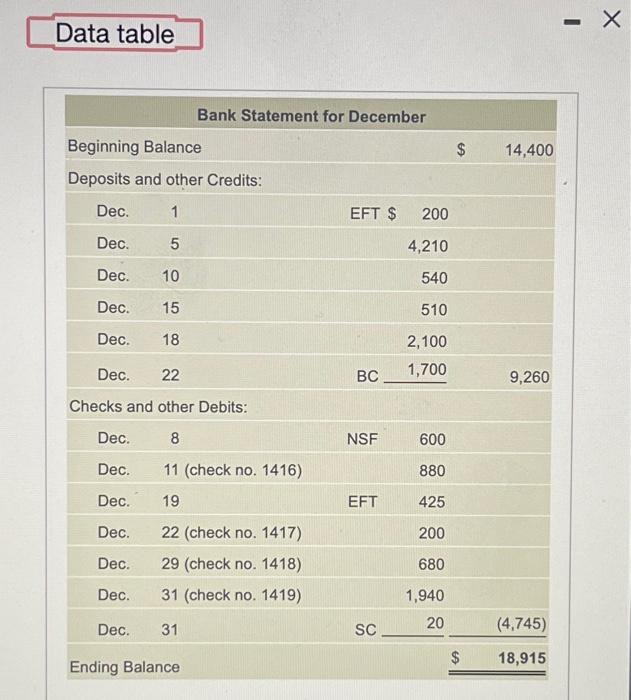

December 31, 2024 Bank: Balance, December 31, 2024 ADD: Deposit in transit LESS: Outstanding checks 1420 1421 1422 Adjusted bank balance, December 31, 2024 Books: Balance, December 31, 2024 ADD: Bank collection of note receivable EFT collection of rent LESS: Correction of book error NSF check Service charge EFT payment of insurance Adjusted book balance, December 31, 2024 \begin{tabular}{r} $18,915 \\ 1,830 \\ \hline 20,745 \end{tabular} \begin{tabular}{rr} 1,480 & \\ 1,500 & \\ 580 & 3,560 \\ \( {\$ \quad 17,185} \\ {\hline} \) \end{tabular} \$ 16,780 $1,700 20018,6801,900 450 600 20 425 1,495 $17,185 The December cash records of Dunlap Insurance follow: (Click the icon to view the checkbook.) Dunlap's Cash account shows a balance of $16,780 at December 31. On December 31, Dunlap Insurance received the following bank statement: (Click the icon to view the December bank statement.) Additional data for the bank reconciliation follow: (Click the icon to view the additional information.) Read the requirements. Requirement 2. Journalize any required entries from the bank reconciliation. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Data table Bank Statement for December Beginning Balance $14,400 Deposits and other Credits: \begin{tabular}{|c|c|c|c|c|} \hline Dec. & 1 & EFT \$ & 200 & \\ \hline Dec. & 5 & & 4,210 & \\ \hline Dec. & 10 & & 540 & \\ \hline Dec. & 15 & & 510 & \\ \hline Dec. & 18 & & 2,100 & \\ \hline Dec. & 22 & BC & 1,700 & 9,260 \\ \hline \end{tabular} Checks and other Debits: \begin{tabular}{|c|c|c|c|c|} \hline Dec. & 8 & NSF & 600 & \\ \hline Dec. & 11 (check no. 1416) & & 880 & \\ \hline Dec. & 19 & EFT & 425 & \\ \hline Dec. & 22 (check no. 1417) & & 200 & \\ \hline Dec. & 29 (check no. 1418) & & 680 & \\ \hline Dec. & 31 (check no. 1419) & & 1,940 & \\ \hline Dec. & 31 & SC & 20 & (4,745) \\ \hline dingB & ince & & & 18,915 \\ \hline \end{tabular} Data table \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{2}{|c|}{ Cash Receipts } & \multicolumn{3}{|c|}{ Cash Payments } \\ \hline Date & Cash Debit & Check No. & & Gredit \\ \hline Dec. 4$ & 4,210 & 1416 & $ & 880 \\ \hline 9 & 540 & 1417 & & 200 \\ \hline 14 & 510 & 1418 & & 680 \\ \hline 17 & 2,100 & 1419 & & 1,490 \\ \hline 31 & 1,830 & 1420 & & 1,480 \\ \hline & & 1421 & & 1,500 \\ \hline & & 1422 & & 580 \\ \hline \end{tabular} Print Done