Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Decision Cases LO 2 C 6 - 8 5 . ( Learning Objective 2 : Apply and compare various inventory methods, and assess the impact

Decision Cases

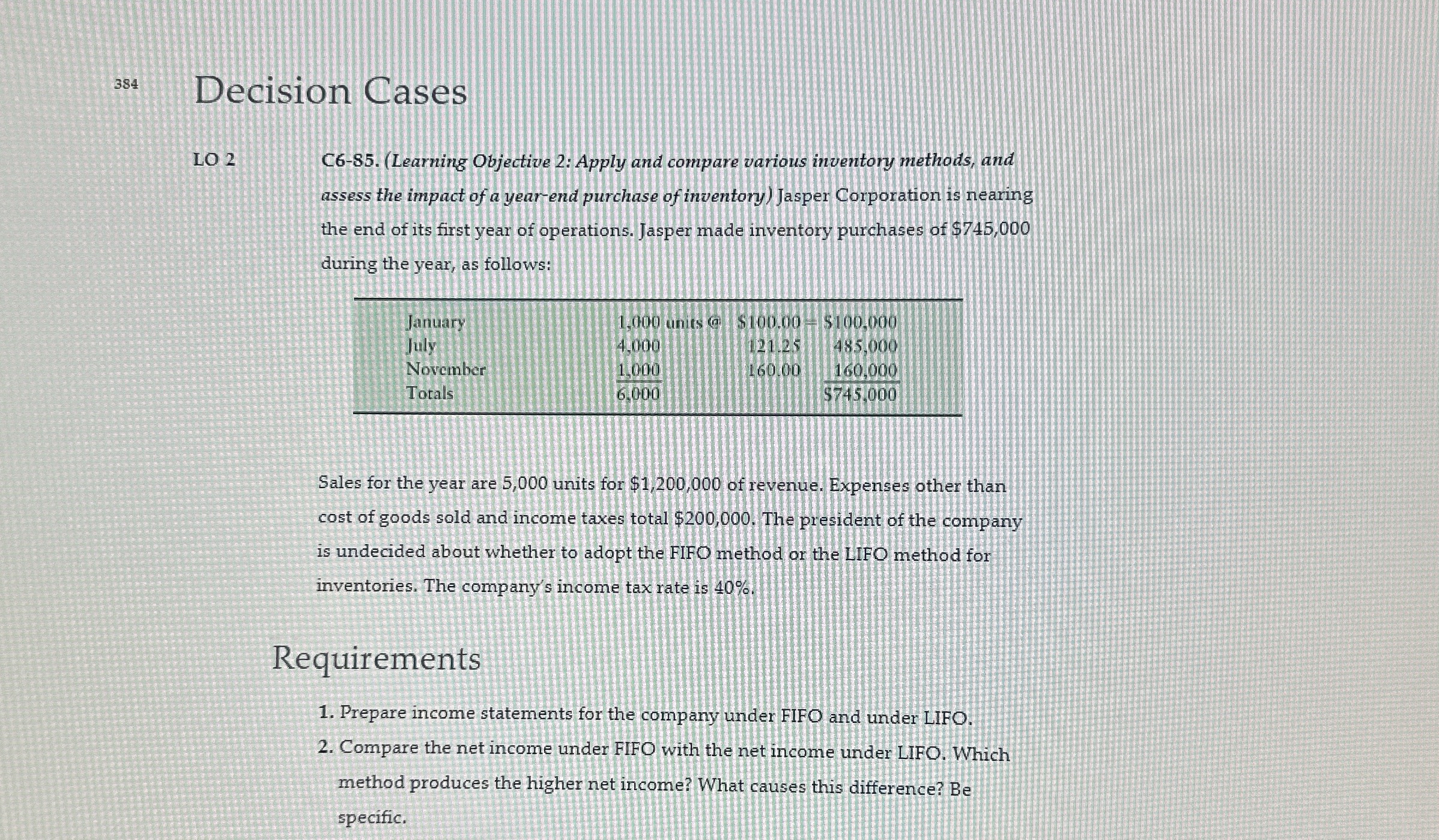

LO CLearning Objective : Apply and compare various inventory methods, and

assess the impact of a yearend purchase of inventony Jasper Corporation is nearing

the end of its first year of operations. Jasper made inventory purchases of $

during the year, as follows:

Sales for the year are units for $ of revenue. Expenses other than

cost of goods sold and income taxes total $ The president of the company

is undecided about whether to adopt the FIFO method or the LIFO method for

inventories. The company's income tax rate is

Requirements

Prepare income statements for the company under FIFO and under LIFO.

Compare the net income under FIFO with the net income under LIFO. Which

method produces the higher net income? What causes this difference? Be

specific.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started