Answered step by step

Verified Expert Solution

Question

1 Approved Answer

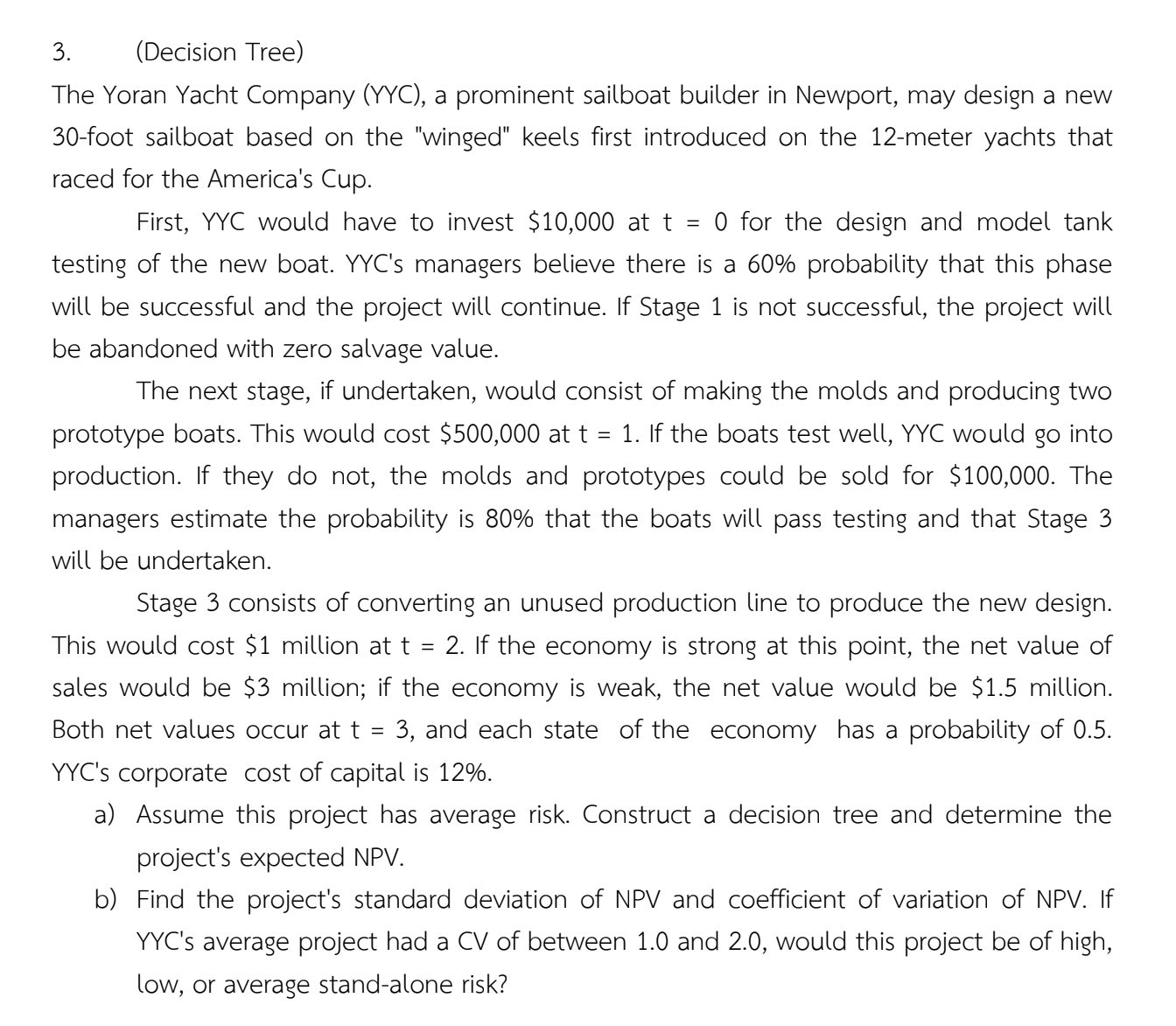

( Decision Tree ) The Yoran Yacht Company ( YYC ) , a prominent sailboat builder in Newport, may design a new 3 0 -

Decision Tree

The Yoran Yacht Company YYC a prominent sailboat builder in Newport, may design a new

foot sailboat based on the "winged" keels first introduced on the meter yachts that

raced for the America's Cup.

First, YYC would have to invest $ at for the design and model tank

testing of the new boat. YYCs managers believe there is a probability that this phase

will be successful and the project will continue. If Stage is not successful, the project will

be abandoned with zero salvage value.

The next stage, if undertaken, would consist of making the molds and producing two

prototype boats. This would cost $ at If the boats test well, YYC would go into

production. If they do not, the molds and prototypes could be sold for $ The

managers estimate the probability is that the boats will pass testing and that Stage

will be undertaken.

Stage consists of converting an unused production line to produce the new design.

This would cost $ million at If the economy is strong at this point, the net value of

sales would be $ million; if the economy is weak, the net value would be $ million.

Both net values occur at and each state of the economy has a probability of

YYCs corporate cost of capital is

a Assume this project has average risk. Construct a decision tree and determine the

project's expected NPV

b Find the project's standard deviation of NPV and coefficient of variation of NPV If

YYCs average project had a CV of between and would this project be of high,

low, or average standalone risk?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started