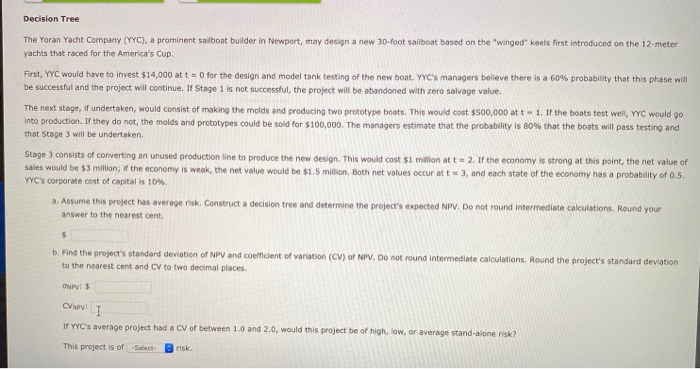

Decision Tree The Yoran Yacht Company (YYC), a prominent sailboat builder in Newport, may design a new 30-foot sailboat based on the 'winged" keels first introduced on the 12 meter yachts that raced for the America's Cup. First, YYC would have to invest $14,000 at t=0 for the design and model tank testing of the new boat. YYC's managers believe there is a 60% probability that this phase will be successful and the project will continue. If Stage 1 is not successful, the project will be abandoned with zero salvage value The next stage, if undertaken, would consist of making the molds and producing two prototype beats. This would cost $500,000 at 1. If the boats test well, YYC would go into production. If they do not, the molds and prototypes could be sold for $100,000. The managers estimate that the probability is 80% that the boats will pass testing and that Stage will be undertaken Stage 3 consists of converting an unused production line to produce the new design. This would cost $1 million att 2. If the economy is strong at this point, the net value of Sales would be $3 million; if the economy is weak, the net value would be $1.5 million. Both net values occur at t = 3, and each state of the economy has a probability of 0.5. YYC's corporate cost of capital is 10% a. Assume this project has average risk. Construct a decision tree and determine the project's expected NPV. Do not round intermediate calculations. Round your answer to the nearest cent. b. Find the project's standard deviation of NPV and coefficient of variation (CV) of NPV. Do not round Intermediate calculations. Round the project's standard deviation to the nearest cent and CV to two decimal places ONPVIS CI If YYC's average project had a CV of between 1.0 and 2.0, would this project be of high, low, or average stand-alone risk? This project is of Select Drisk. Decision Tree The Yoran Yacht Company (YYC), a prominent sailboat builder in Newport, may design a new 30-foot sailboat based on the 'winged" keels first introduced on the 12 meter yachts that raced for the America's Cup. First, YYC would have to invest $14,000 at t=0 for the design and model tank testing of the new boat. YYC's managers believe there is a 60% probability that this phase will be successful and the project will continue. If Stage 1 is not successful, the project will be abandoned with zero salvage value The next stage, if undertaken, would consist of making the molds and producing two prototype beats. This would cost $500,000 at 1. If the boats test well, YYC would go into production. If they do not, the molds and prototypes could be sold for $100,000. The managers estimate that the probability is 80% that the boats will pass testing and that Stage will be undertaken Stage 3 consists of converting an unused production line to produce the new design. This would cost $1 million att 2. If the economy is strong at this point, the net value of Sales would be $3 million; if the economy is weak, the net value would be $1.5 million. Both net values occur at t = 3, and each state of the economy has a probability of 0.5. YYC's corporate cost of capital is 10% a. Assume this project has average risk. Construct a decision tree and determine the project's expected NPV. Do not round intermediate calculations. Round your answer to the nearest cent. b. Find the project's standard deviation of NPV and coefficient of variation (CV) of NPV. Do not round Intermediate calculations. Round the project's standard deviation to the nearest cent and CV to two decimal places ONPVIS CI If YYC's average project had a CV of between 1.0 and 2.0, would this project be of high, low, or average stand-alone risk? This project is of Select Drisk