Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Deduction from Gross Income 12. Which of the following is not a requisite for taxes to be deductible? a. Must have been paid or incurred

Deduction from Gross Income

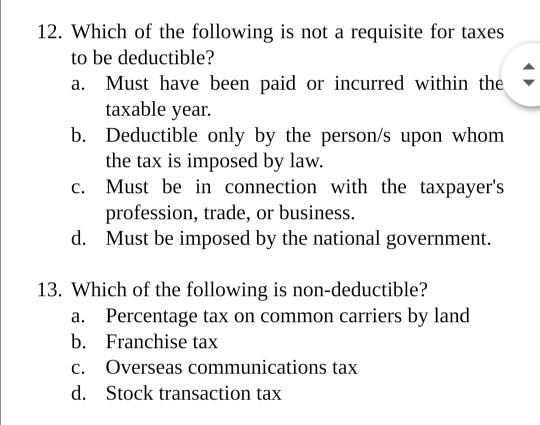

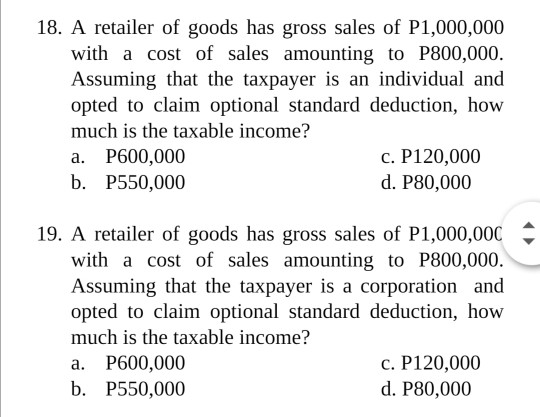

12. Which of the following is not a requisite for taxes to be deductible? a. Must have been paid or incurred within the taxable year. b. Deductible only by the person/s upon whom the tax is imposed by law. c. Must be in connection with the taxpayer's profession, trade, or business. d. Must be imposed by the national government. 13. Which of the following is non-deductible? a. Percentage tax on common carriers by land b. Franchise tax c. Overseas communications tax d. Stock transaction tax 18. A retailer of goods has gross sales of P1,000,000 with a cost of sales amounting to P800,000. Assuming that the taxpayer is an individual and opted to claim optional standard deduction, how much is the taxable income? a. P600,000 c. P120,000 b. P550,000 d. P80,000 19. A retailer of goods has gross sales of P1,000,000 - with a cost of sales amounting to P800,000. Assuming that the taxpayer is a corporation and opted to claim optional standard deduction, how much is the taxable income? a. P600,000 c. P120,000 b. P550,000 d. P80,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started