Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Deduction from Gross Income 8. RRO Corporation is engaged in the sale of goods and services with net saleset revenue of P3,000,000 and P2,000,000 respectively.

Deduction from Gross Income

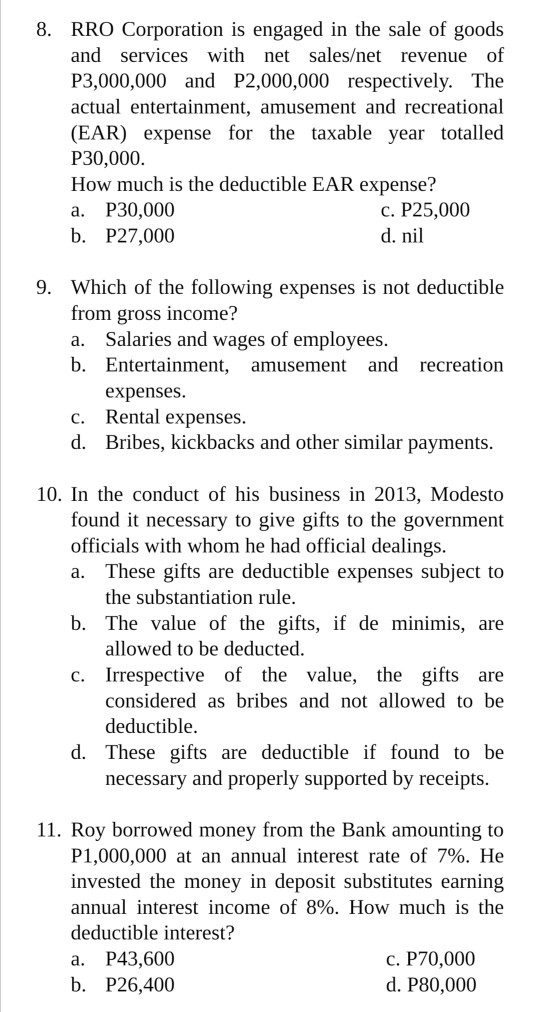

8. RRO Corporation is engaged in the sale of goods and services with net saleset revenue of P3,000,000 and P2,000,000 respectively. The actual entertainment, amusement and recreational (EAR) expense for the taxable year totalled P30,000. How much is the deductible EAR expense? a. P30,000 c. P25,000 b. P27,000 d. nil 9. Which of the following expenses is not deductible from gross income? a. Salaries and wages of employees. b. Entertainment, amusement and recreation expenses. C. Rental expenses. d. Bribes, kickbacks and other similar payments. 10. In the conduct of his business in 2013, Modesto found it necessary to give gifts to the government officials with whom he had official dealings. a. These gifts are deductible expenses subject to the substantiation rule. b. The value of the gifts, if de minimis, are allowed to be deducted. c. Irrespective of the value, the gifts are considered as bribes and not allowed to be deductible. d. These gifts are deductible if found to be necessary and properly supported by receipts. ad 11. Roy borrowed money from the Bank amounting to P1,000,000 at an annual interest rate of 7%. He invested the money in deposit substitutes earning annual interest income of 8%. How much is the deductible interest? a. P43,600 c. P70,000 b. P26,400 d. P80,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started