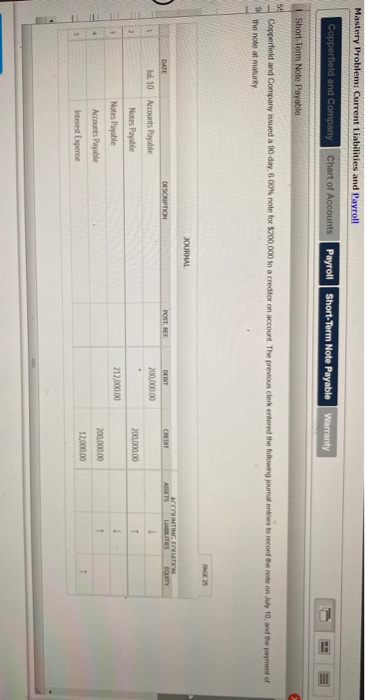

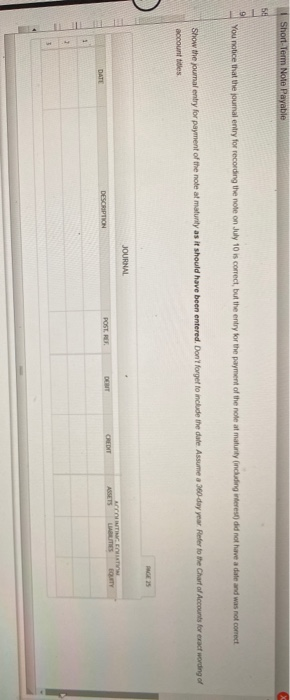

Answered step by step

Verified Expert Solution

Question

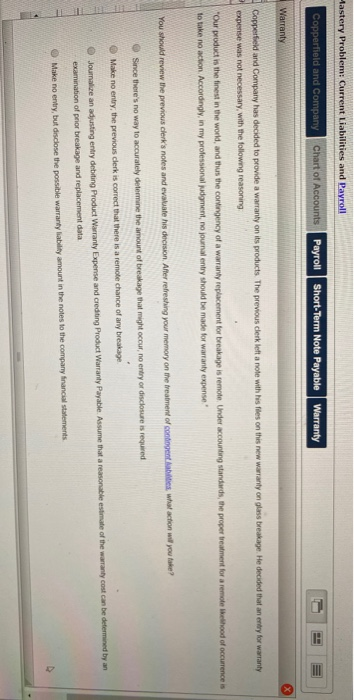

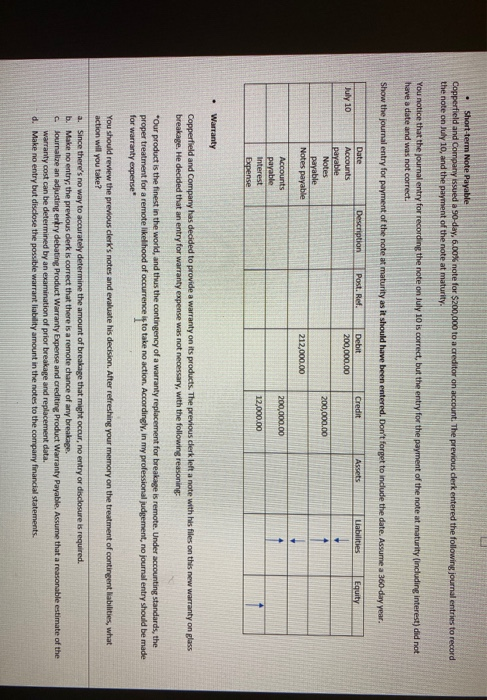

1 Approved Answer

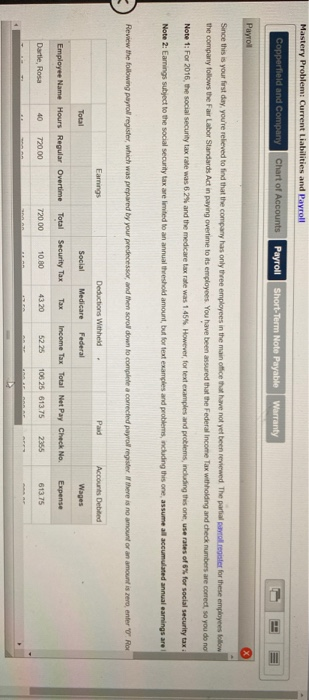

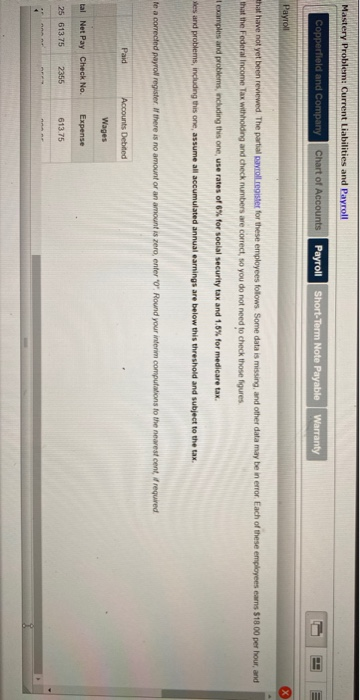

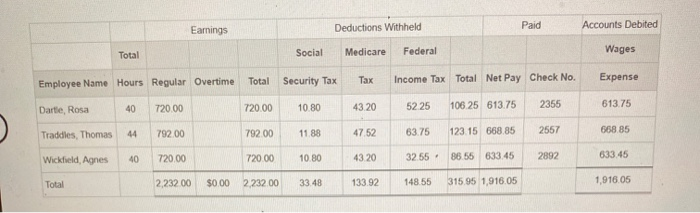

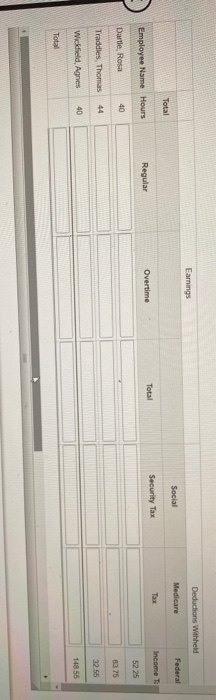

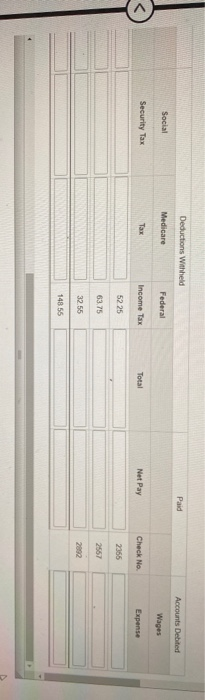

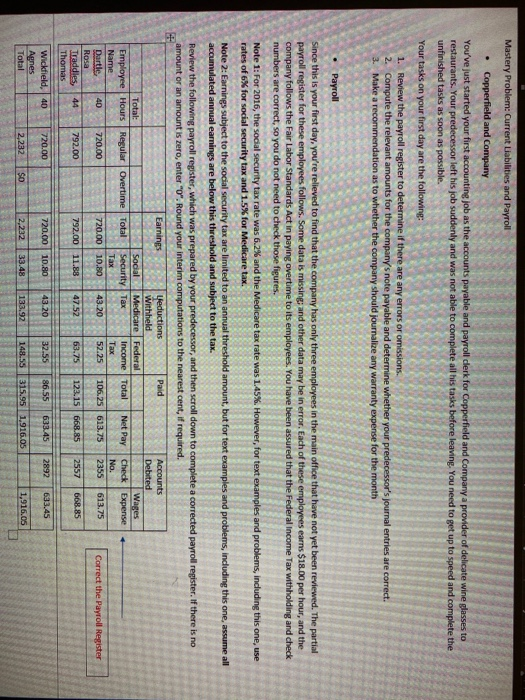

Deductions withheld Earnings Social Medicare Federal Total Security Tax Income to Total Overtime Employee Name Hours Regular 5225 Dartie Rosa 63.75 Traddles, Thomas 44 3255

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started