Question

v) Management is considering replacing its labour-intensive production process with an automated production system. This would result in an increase of $58,630 annually in fixed

v) Management is considering replacing its labour-intensive production process with an automated production system. This would result in an increase of $58,630 annually in fixed manufacturing costs. The variable manufacturing costs would decrease by $25 per tonne. Calculate the new break-even volume in tonnes and in sales dollars. (5 marks)

(vi) Assume that management estimates that the selling price per tonne will decline by 10 percent next year. Variable costs will increase by $40 per tonne and fixed costs will not change. What level of sales (in dollars) would be required to earn a net profit of $94,500?

Part B

(i) Outline the challenges for organisations that seek to measure the future impact of their current activities on the environment and society. (5 marks)

(ii) An increasing number of companies are reporting their sustainability performance. Explain why organisations report their sustainability performance, particular when in many countries such reporting is voluntary. Does the increase in the number of companies reporting their sustainability performance necessarily means that these are more sustainable in their outlook and performance? Discuss. (5 marks)

(iii) Explain the concept of integrated reports and how they relate to sustainability reports.

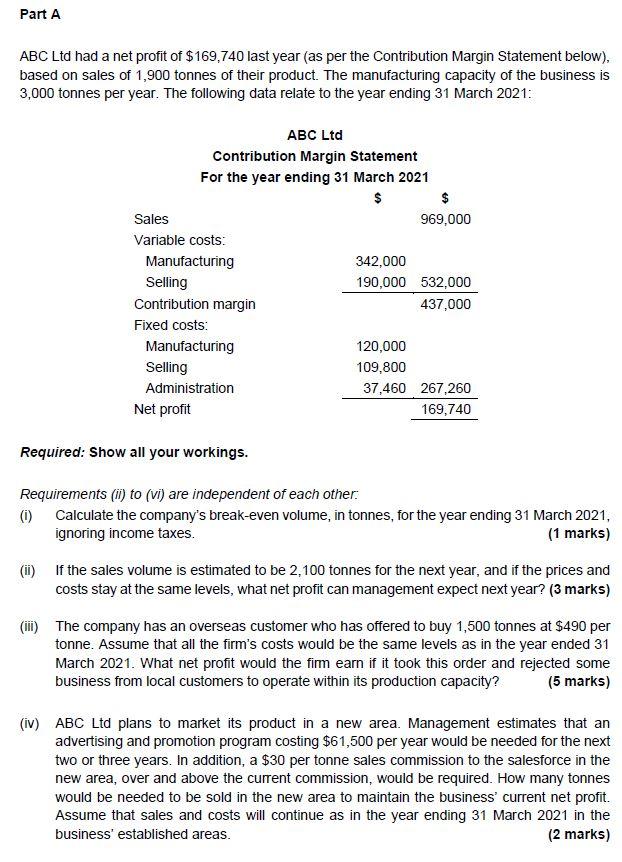

Part A ABC Ltd had a net profit of $169,740 last year (as per the Contribution Margin Statement below), based on sales of 1,900 tonnes of their product. The manufacturing capacity of the business is 3,000 tonnes per year. The following data relate to the year ending 31 March 2021: ABC Ltd Contribution Margin Statement For the year ending 31 March 2021 $ $ Sales 969,000 Variable costs: Manufacturing 342,000 Selling 190,000 532,000 Contribution margin 437,000 Fixed costs: Manufacturing 120,000 Selling 109,800 Administration 37,460 267,260 Net profit 169,740 Required: Show all your workings. Requirements (i) to (vi) are independent of each other. (0) Calculate the company's break-even volume, in tonnes, for the year ending 31 March 2021, ignoring income taxes. (1 marks) (i) If the sales volume is estimated to be 2,100 tonnes for the next year, and if the prices and costs stay at the same levels, what net profit can management expect next year? (3 marks) (iii) The company has an overseas customer who has offered to buy 1,500 tonnes at $490 per tonne. Assume that all the firm's costs would be the same levels as in the year ended 31 March 2021. What net profit would the firm earn if it took this order and rejected some business from local customers to operate within its production capacity? (5 marks) (iv) ABC Ltd plans to market its product in a new area. Management estimates that an advertising and promotion program costing $61,500 per year would be needed for the next two or three years. In addition, a $30 per tonne sales commission to the salesforce in the new area, over and above the current commission, would be required. How many tonnes would be needed to be sold in the new area to maintain the business' current net profit. Assume that sales and costs will continue as in the year ending 31 March 2021 in the business' established areas. (2 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started